Running a business from home provides plenty of perks, such as flexible hours, no lengthy commute, and the comfort of working in your own space. However, transforming your living room into a partial home office and your garage into inventory begs the question: do you need home-based business insurance?

While regular home insurance can cover some business activities, it won’t be enough to mitigate the risks of running an online store or providing consulting services. This article will discuss why business insurance matters, what coverage is available, and what considerations to make.

Do I Need Insurance for My Home-Based Business?

Yes, you need insurance for your home-based business. Here’s what it covers:

- Sole proprietors

- Self-employed individuals

- Businesses with up to two employees operating out of their home

But what encompasses a home-based business? You’ll need coverage whether you have customers or clients who visit your home, inventory stored in your dwelling, or equipment to run your business. Even side businesses can face significant risks, as there are entities to protect, like handmade goods or computers. Note that insurance for working from home is different from home-based business insurance.

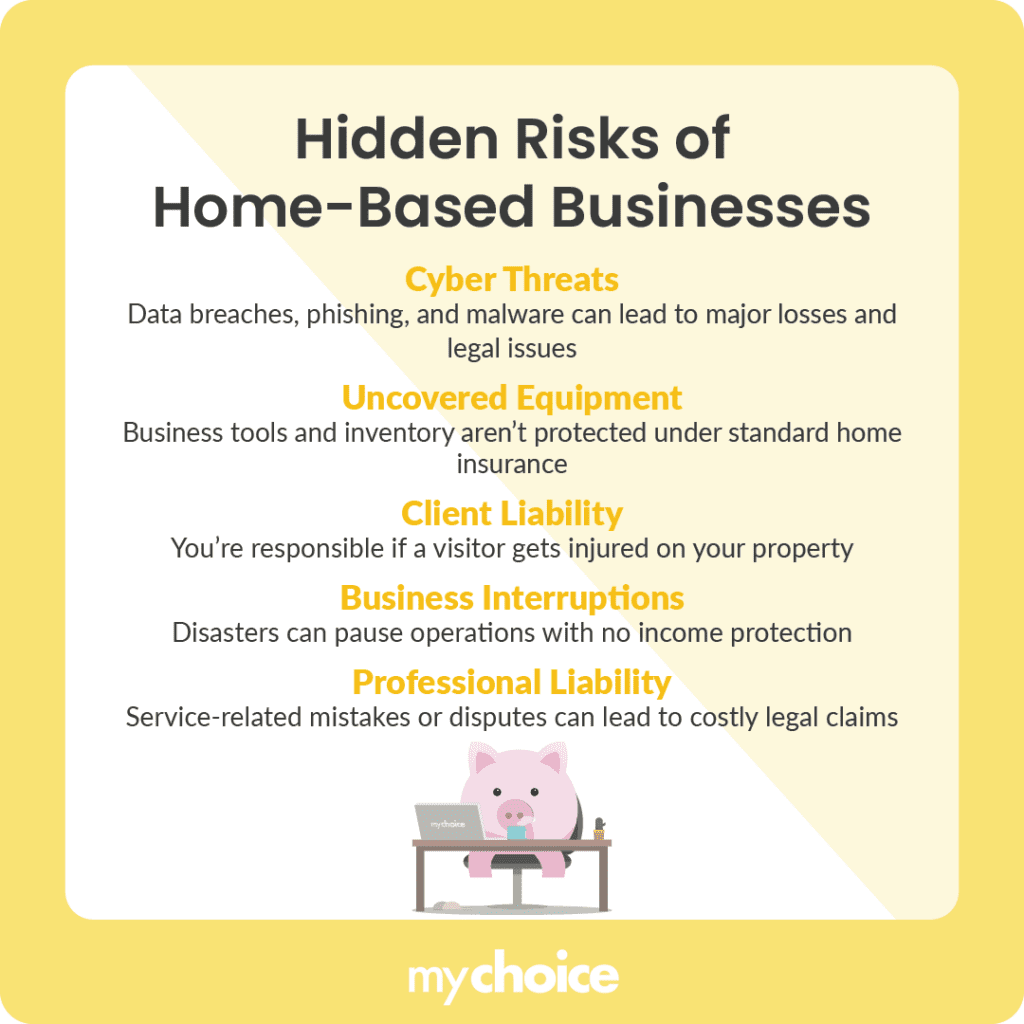

Unique Risks for Modern Home-Based Businesses

Thanks to technology and evolving work models, more Canadians are running businesses from home with ease and flexibility. In 2022, there were 1.19 million small businesses in Canada, many of which operated out of a home base. Still, you might not anticipate certain risks, including the following.

What is the Best Insurance for a Home-Based Business?

Ultimately, the best insurance for a home-based business will depend on what you do. While there isn’t a single suitable policy for every business, there are flexible options you can customize to your services, including the following.

What’s Covered By My Home Vs. Business Insurance Policy?

Many independent Canadian business owners mistakenly assume that their home insurance covers business activities. The reality is that home insurance can only cover personal belongings, structural damage, and personal liabilities involving guests, not clients.

With a business insurance policy, you’ll get coverage for day-to-day risks like:

- Lost income due to a covered event like a fire or natural disaster

- Product liability if something you sell causes harm or damage

- Data breaches, hacking, and digital threats

- Damage to business equipment like computers, tools, and products

- Professional liability for errors, omissions, or negligence

Let’s review an example of how home and business insurance differ to get more perspective. Suppose you use a personal laptop to run secondary business tasks like recording inventory, and it gets stolen or damaged. Your home insurance won’t provide coverage for this incident.

Then, say a client sues you for a service error because of setbacks resulting from your laptop problem. Only business liability insurance will cover legal costs.

Key Advice from MyChoice

- Get the right level of insurance for your home-based business. If you don’t have a business-registered vehicle, you won’t need a policy covering business fleets.

- Seek professional advice from a commercial insurance broker who can help you decide what policy best suits your operations.

- Consider adding a rider to your existing home plan if you’re in the early stages of growing your business. It’ll provide the appropriate amount of coverage for lower-risk operations.