Gifting a car is probably one of the best gifts someone can receive, either for your partner as an anniversary gift or one of your children as a birthday or Christmas gift. It may also be that you’ve bought a new car for yourself and want to leave the old car to a relative instead of selling it to a third party.

Whatever the case may be, you just need to know the proper process for gifting or transferring ownership of a car in Ontario before rushing ahead with your decision. In the following article, we explain step by step what you should take into account.

Who Can I Gift a Car in Ontario to?

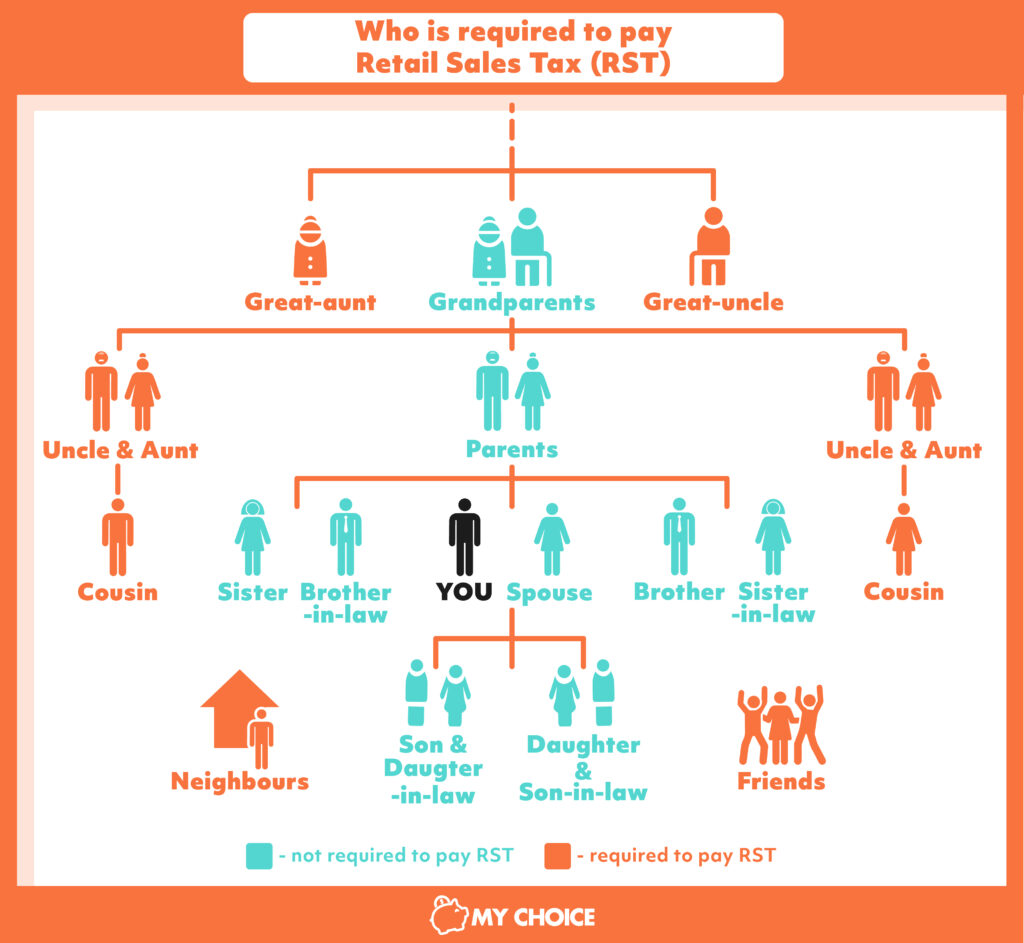

When you transfer ownership of your vehicle to an eligible family member, you will not have to pay the Retail Sales Tax. However, if the relative is a cousin, nephew, uncle, aunt or other relative outside of the following list, you will have to pay this tax at the time you transfer your car. Family members who are exempt from paying the RST are:

- Spouse (including a common-law spouse)

- Parent or step-parent

- Grandparent or step-grandparent

- Son or step-son

- Daughter or step-daughter

- Grandson or step-grandson

- Granddaughter or step-granddaughter

- Son-in-law

- Daughter-in-law

- Father-in-law

- Mother-in-law

- Sibling

- Half-siblings (siblings with a common parent)

- Adopted siblings (siblings with a common parent through adoption)

The Process of Gifting a Car to a Family Member

Unless you are Santa Claus or you have a generous heart and wallet, you’ll most likely be gifting your car to a family member or close relative. In the following process, we teach you to step by step what you should do and what documents you need.

What Documents are Necessary to Transfer the Ownership of a Car Ontario to a Family Member?

This is a checklist containing the forms and documents you’ll need to bring with you to a ServiceOntario location when you’re gifting a car to a family member:

- Driver’s license

- Proof of car insurance policy in the recipient’s name

- Completed sworn statement for family gift form (signed by both you and new owner in front of a lawyer or notary public)

- The transfer portion of your Vehicle Ownership Permit

- Safety Standards Certificate (or spousal declaration form)

- Completed plate transfer declaration

Now let’s take a look at the step-by-step process.

Make Sure The Car Loan Debt Is Paid

If you have just been given a car, congratulations! The first thing we recommend you do is to check that the car is paid in full and that you don’t have an outstanding loan debt with any car dealer on the vehicle.

This is necessary because in nice words no one can give away something they owe, so before registering your car make sure that the generous person who gave you their car has proof that the car is fully paid for. The proof can be the title of the car, your name or the statement that reflects a balance of $0.

Get a Sworn Statement for a Family Gift Form and Sign it

During the gifting process, both the driver and the recipient of the vehicle must sign a Sworn Statement for a Family Gift Form in front of an attorney or notary public. Signing this document certifies the Ontario government that the recipient of the vehicle is an eligible family member and that the car is a gift. You can obtain a copy of the “Sworn Statement for a Family Gift Form” at your local ServiceOntario or their website here.

Make Sure You Have Your Vehicle Ownership Permit

This document is a green piece of paper that you get when your vehicle is registered with ServiceOntario and it is proof that you are the registered vehicle owner. Make sure you have this document before going to your local ServiceOntario to transfer the vehicle, most people keep it in the glove box or center console in their car.

You need this permit to legally transfer ownership of your car to a family member.

Get A Safety Standards Certificate Or A Spousal Declaration Form

A safety standards certificate confirms that your vehicle met the minimum safety standards.

You can buy and register a vehicle without a safety standards certificate, but cannot put plates on a vehicle without one.

To get a certificate, your vehicle must pass an inspection by the Ministry of Transportation. You do not need a safety standards inspection and certificate if you are transferring the vehicle to your spouse.

Buying Car Insurance for a Gifted Car

As we already know, driving in Ontario or any other Canadian province without insurance is illegal. Therefore, when you give your car to a family member, you must ensure that the new owner purchases car insurance. If they already have some, they have 14 days to register the vehicle with their insurance provider.

If it is the first car you receive, we recommended that you consider having comprehensive coverage, this will give you greater coverage if you do get into an accident. Car insurance rates for young or new drivers are usually very expensive so make sure you compare the rates of several insurance providers.

Transfer Or Purchase A Licence Plate

When you give a car as a gift, you can transfer your license plate to your spouse, parents or children. If it is someone different, the new owner must buy a new license plate.

What Taxes Should You Pay When You Receive a Gifted Car?

If you get a used car as a gift and you are not an eligible family member as mentioned above. You will need to pay the RST for this vehicle at the time you transfer this vehicle to a ServiceOntario. Remember that if you are a family member exempt from paying this tax, you must present one of the following documents as proof.

- A completed Sworn Statement for the Transfer of a Used Motor Vehicle in the Province of Ontario

- Separation agreement

- Divorce agreement

- Other similar court document

The Cost of Owning a Vehicle

In any case, owning a vehicle means that you must have a sufficient budget each month for all things like gas, maintenance, insurance, and any repairs that may occur, all these are some of the most common expenses with owning a car.

It is important to understand that in addition to a car being a luxury, it is also a responsibility, therefore make sure that the person to whom you want to give the car is aware of these costs before surprising him/her with such a gift. The cost of owning a vehicle can be hefty if not prepared financially.