A cancelled car insurance policy can be a major headache, especially since driving without car insurance is illegal in Canada. Understanding what causes a policy cancellation and what you can do to avoid it is crucial if you want to keep driving without issues.

Read on to learn everything you need to handle auto insurance cancellations in Ontario.

Why Do Policies Get Cancelled?

Insurance policies get cancelled for many reasons, but non-payment — or failure to make a payment on a policy — is among the most common causes. Some brokerages in Ontario have seen year-over-year increases in cancelled insurance policies for non-payment since 2019. This is likely due to the post-pandemic driving boom, which resulted in higher car insurance rates across the country.

Insurance providers typically notify policyholders that they have a set number of days to pay their outstanding balance. But often, all it takes to cancel a policy is just one missed premium.

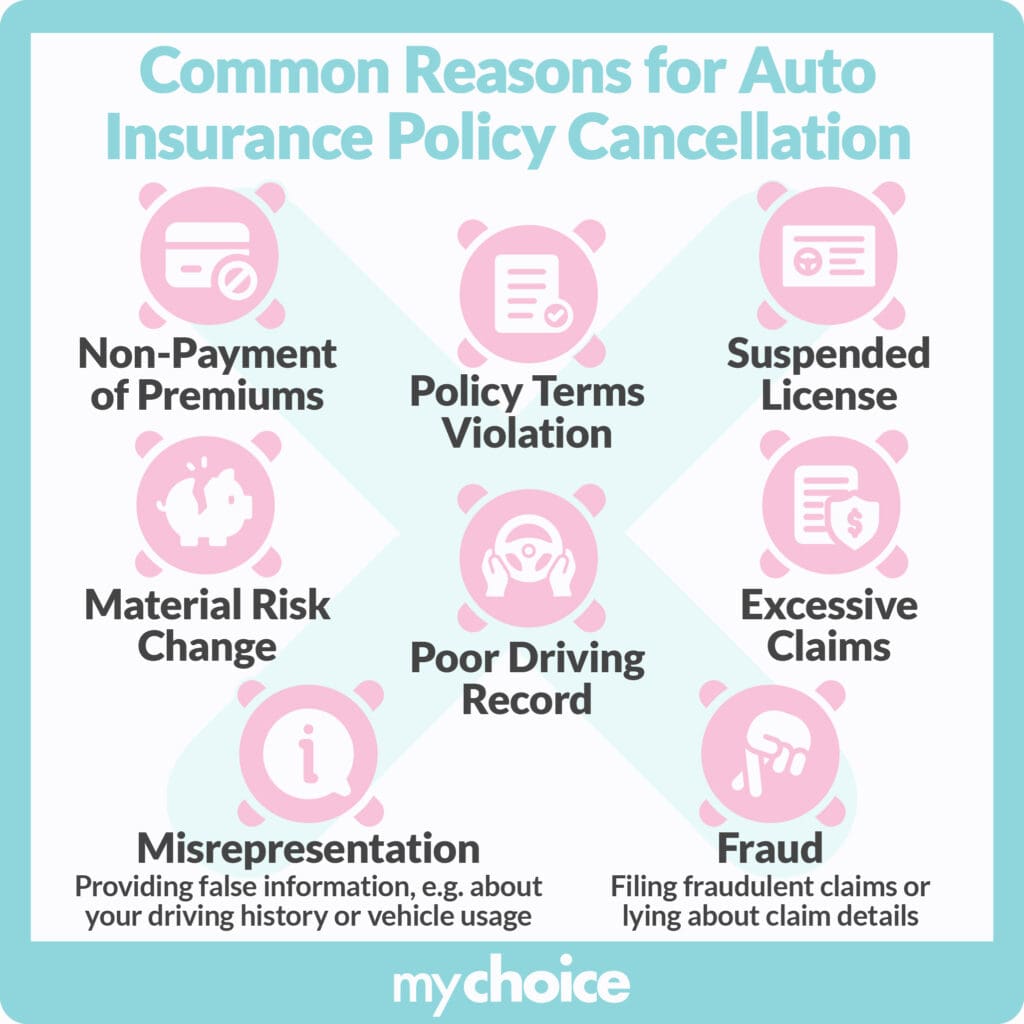

Aside from non-payment, here are some of the most common reasons providers cancel car insurance:

- Misrepresentation: This is when clients withhold key details or provide false information about their driving history or vehicle usage. For example, failing to mention that a vehicle will be used for both personal and commercial use.

- Change in situation: Also known as material change in risk, this is when significant life changes, such as a new medical diagnosis that can make driving dangerous, prompt providers to reconsider whether the policy is right for the client.

- Fraud: This includes filing fraudulent claims, lying about claim details, or being dishonest about the circumstances of a loss.

- Excessive claims: A client that files many claims too often and/or within a short time frame can be flagged as a high-risk driver and may need to increase their premium rate or change their policy altogether.

- Policy terms violation: Your policy can be cancelled if you use your vehicle for unauthorized purposes that go against your policy’s terms.

- License suspension: Drivers who get their licenses suspended are often flagged as high-risk drivers, prompting insurers to change or cancel the policy.

- Poor driving record: If you incur multiple violations or get into too many accidents in a year, you’ll also be flagged as a high-risk driver.

What Can You Do if You Receive a Car Insurance Cancellation Notice?

Insurers are required to notify their clients that they’ll be cancelling their insurance. Often, the provider will provide a reason for the cancellation and give a timeframe for when it’ll take effect.

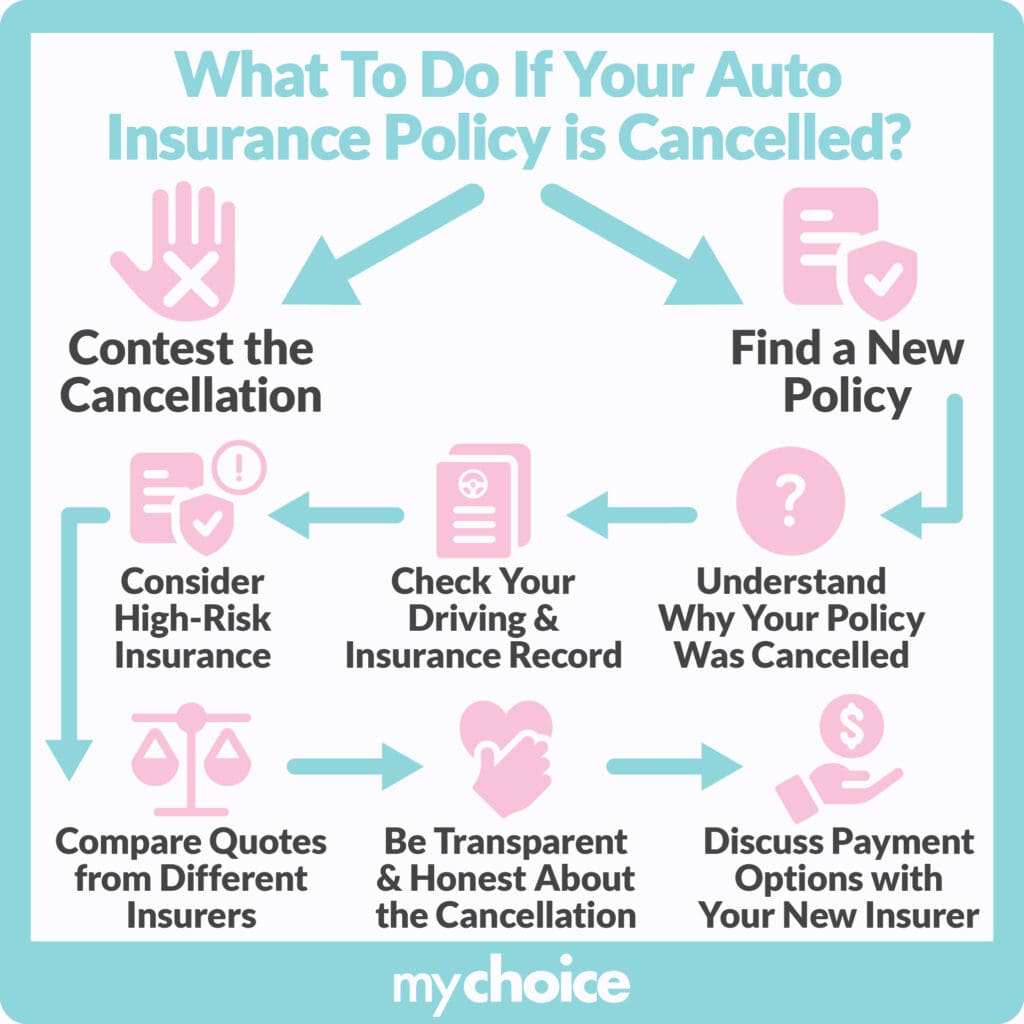

If you receive a notice that your car insurance will be cancelled, you have two choices of action:

What If You Can’t Afford a Car Insurance Payment?

If you’re worried about meeting the deadline for your premium payment, there are some steps you can take to avoid immediate policy cancellation.

Firstly, if your payment is due soon, you must notify your insurer that you can’t make the payment ASAP. Your insurer may help you set up a new payment plan or extend your deadline temporarily to give you more time to figure out how to make the payment.

If you’ve already missed the deadline, call your provider as soon as you can. If it’s your first time to miss a payment, your provider may give a grace period and just charge a late fee. However, if you make a habit of paying your premiums late, your insurer may cancel your policy temporarily.

How Long Does Cancelled Insurance Stay On Record?

Cancelled insurance for non-payment can stay on your record for up to three years. Cancellations due to other reasons, such as fraud or policy term violations, can stay on record for as long as 10 years.

Note that cancelled insurance can affect your ability to get good premium rates even when you change providers. So, always strive to make your payments and maintain a good relationship with your insurance provider.

How Does a Cancelled Insurance Policy Affect You?

Aside from staying on your record and impacting your future premium rates, cancelled auto insurance can affect you in the following ways:

- License suspension: Since car insurance is mandatory in Canada, getting your policy cancelled can lead to an automatic driver’s license suspension. This means that you won’t be able to drive until you obtain a new policy.

- Vehicle repossession: Most lenders require drivers to have full coverage on financed or leased vehicles. So, if your insurance policy is cancelled by your provider, the lender could repossess your vehicle.

- Lower credit score: Given that car insurance cancellation goes on your driving record, it can also affect your credit score. On the flip side, if you pay your premiums on time and maintain a clean driving record, you’re likely to see a boost in your credit score.

Applying for Car Insurance After Cancellation

If you have no other option but to find a new insurance policy, follow these steps for smooth, worry-free policy-hunting:

- Evaluate your situation: Identify what caused your policy to be cancelled. This will help you understand what steps you have to take to contest your cancellation or apply for a new policy.

- Review your driving record: Get a copy of your driving record so you understand what insurers will take into account when considering your case.

- Compare quotes: Shop around to compare quotes across different insurance companies. Some providers may be more lenient than others regarding high-risk driving status.

- Be transparent about your situation: Be honest about your prior cancellation. This will help build trust with your new insurance provider and avoid any issues in the future.

- Find payment options you can handle: If you had trouble paying your premiums in the past, ask your insurer if they offer flexible payment terms to avoid future cancellations.

Navigating Policy Cancellation for High-Risk Drivers

Insurance providers are always considering the risks involved with insuring a client. The higher the risk, the more expensive it will be for the provider. Therefore, insurance companies usually charge much higher rates to high-risk drivers. In some cases, providers will even flat-out refuse to insure a high-risk driver.

If you find yourself in this tricky situation, you can apply for insurance from the Facility Association, an entity established by the automobile insurance industry to ensure that car insurance is available to all car owners and licensed drivers who are unable to get car insurance from an individual insurance provider.

Facility Association doesn’t issue policies but rather works with certain companies that do and collects premiums and handles claims on their behalf.

This is often considered the last resort for drivers, as it’s far more expensive than your typical policy. There are a few providers — including Coachman, Echelon, Economical, Jevco, and Pafco — that provide insurance for high-risk drivers that’s usually cheaper than the policies you can find at the Facility Association. But if you still have trouble getting coverage from these companies, you may need to get facility insurance to drive your car again.

Eligibility Criteria for Facility Insurance

Here’s the criteria you have to meet to be eligible for Facility insurance:

- Have a valid driver’s license

- Have a registered vehicle with valid license plates

- Live in Alberta, New Brunswick, Newfoundland and Labrador, the Northwest Territories, Nova Scotia, Nunavut, Ontario, Prince Edward Island, and Yukon.

Key Advice From My Choice

- You can get a sizable discount on your premiums by paying annually rather than monthly.

- To remember when your due date is up, set a reminder on your calendar or phone.

- Set up automatic payments from your bank account or credit card so you don’t have to think about when you have to make payments.

- If your premium rate is too high, shop around for better rates. Visit MyChoice to compare car insurance quotes today.