In Canada, auto insurance claims totalled approximately $16.3 billion in 2022, highlighting the high frequency of accidents each year. With so many incidents occurring, you have to ask yourself: if you ever get into a car accident, should you report it to your insurer or handle it yourself? This decision requires careful consideration, as it can influence your future premiums and overall financial planning.

Deciding whether to file a claim or cover the cost yourself can feel like a bit of a gamble. While auto insurance is there to help with unexpected expenses, it may not always be the more financially sound choice. Let’s take a closer look at the factors you should consider before coming to a decision.

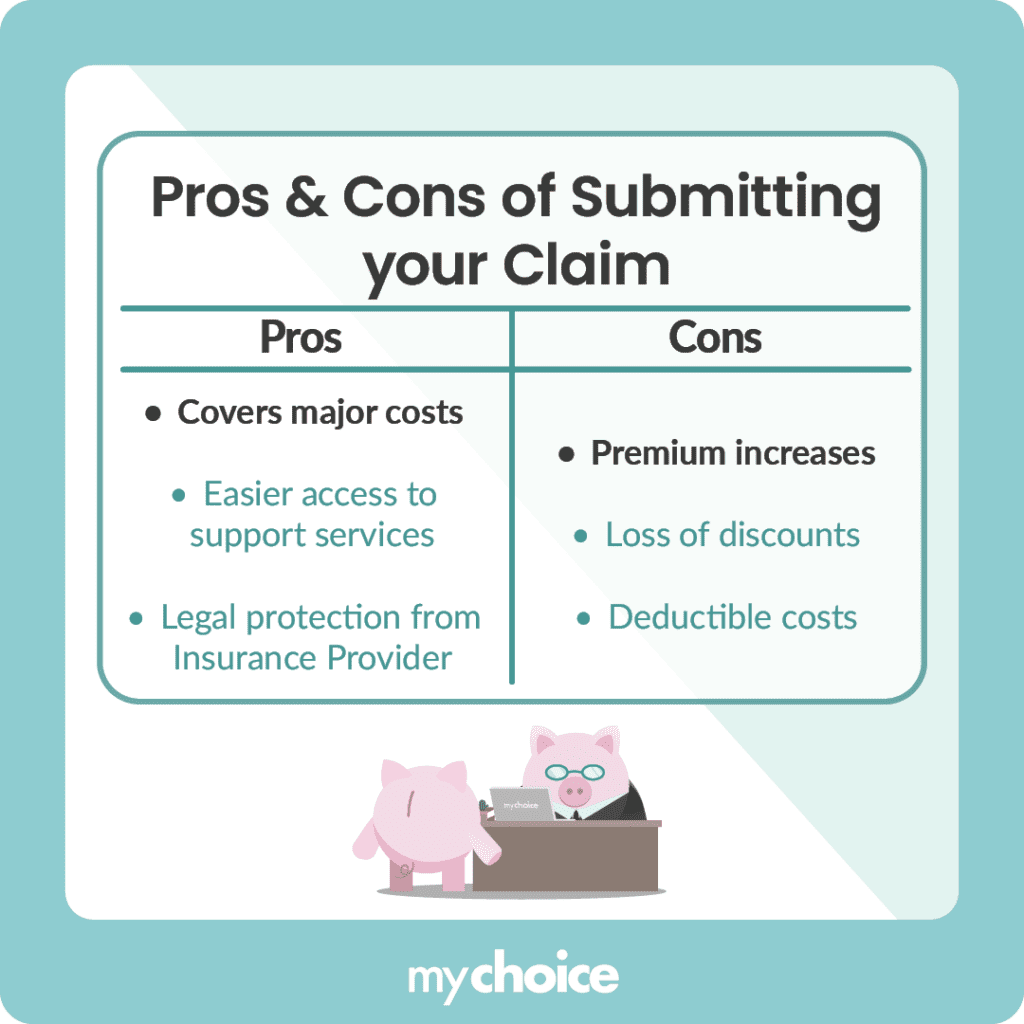

Pros & Cons of Filing a Car Insurance Claim

Claiming your insurance can be a financial lifesaver when dealing with hefty repair bills for issues like engine failure or rear-end damage. However, keep in mind that filing a claim might lead to higher premiums down the road, and there’s always a chance of your claim being denied if it doesn’t meet the policy requirement.

Here’s a straightforward breakdown to help you weigh your choices:

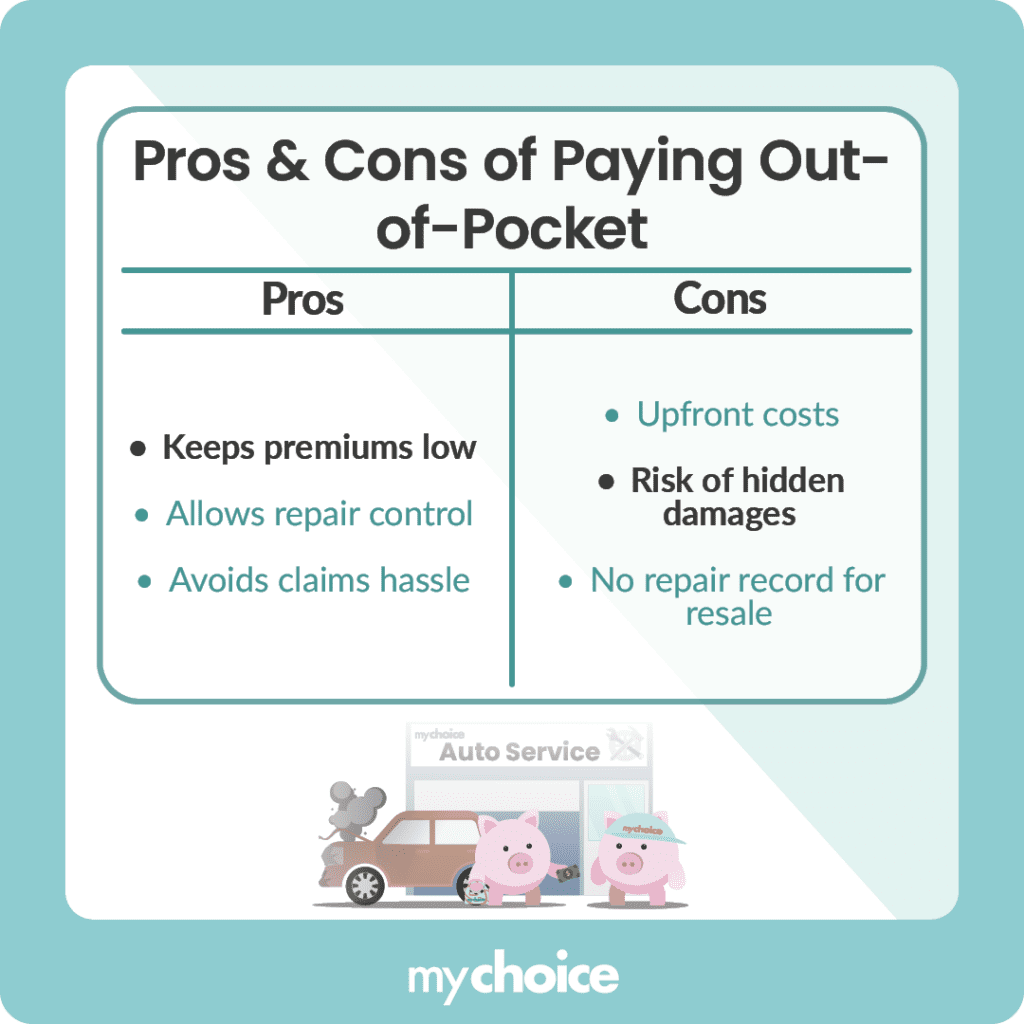

Pros & Cons of Paying Out Of Pocket

The Hidden Financial Ripples Of A Claim

Filing a claim might seem like the easiest solution at the moment, but it can set off a domino effect on your finances. Below is a list of major problems that you will face if you choose this path:

Scenario Deep Dive: When Out-Of-Pocket Makes Sense

Auto insurance exists to cover unexpected car trouble, but it’s not always obvious when it’s smarter to pay for repairs yourself. Understanding your options can help you make an informed decision.

Here are some obvious scenarios where you might choose to bypass your policy:

When Should You File A Claim?

While digging into your wallet is the best decision for minor incidents, you should flip the script when you face serious accidents. Below is a list of possible scenarios that could mean it’s time to file an auto insurance claim:

Key Advice From MyChoice

- Balance out your short-term savings with long-term costs – sometimes, a smaller out-of-pocket bill can save you from major premium hikes later.

- You should know your deductible. If it’s high, the best decision is to handle the expense yourself.

- Always know your no-claims status. Do the math before filing because a single claim can erase valuable discounts.

- Following legal requirements is a must. Major accidents should be reported to both the police (when required) and your insurer.