People with dental coverage are more likely to visit the dentist, but insurance can be out of reach for many lower-income Canadians. The Canadian government has rolled out a federal dental plan to reduce barriers to access and cover some – if not all – of the costs of a wide range of oral healthcare services.

In its commitment to building a healthier future for its citizens, the Canadian federal government rolled out several public healthcare initiatives in 2024, such as the recent Pharmacare Act. One of its biggest investments is the Canadian Dental Care Plan (CDCP), which aims to make dental healthcare more affordable for the 32% of Canadians who don’t have dental insurance. Read on to learn about the CDCP, its eligibility requirements, and the impact it could potentially have on life insurance in the long run.

How Does Canada’s Federal Dental Plan Work?

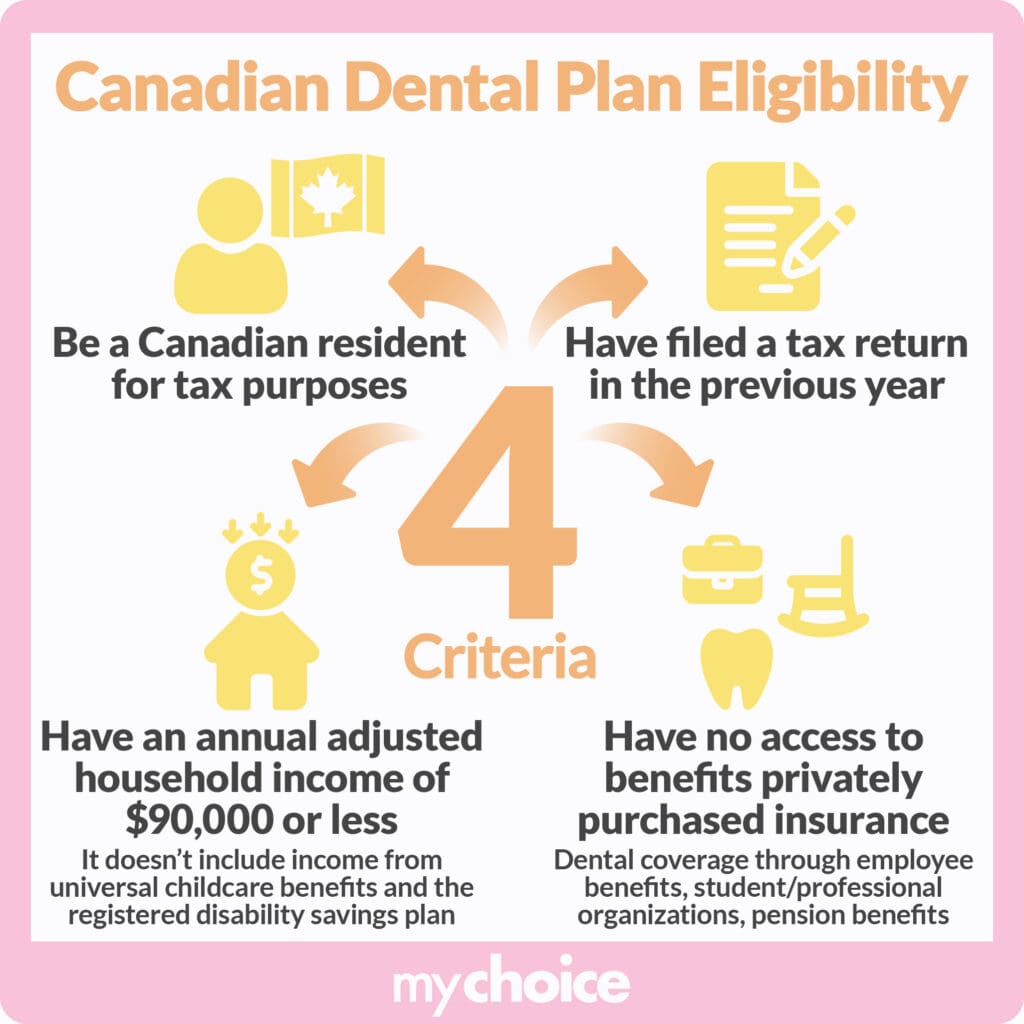

Managed by Health Canada and administered by Sun Life, the Canadian Dental Care Plan (CDCP) is a federal program that provides dental coverage for low- and middle-income Canadians without access to insurance. To be eligible for the program, you must meet all four criteria:

- Be a Canadian resident for tax purposes

- Have an annual adjusted household income of $90,000 or less

- Adjusted household income doesn’t include income from universal childcare benefits (UCCB) and the registered disability savings plan (RDSP).

- Have no access to dental coverage through employee benefits, student/professional organizations, pension benefits, or privately purchased insurance

- Have filed a tax return in the previous year

The CDCP is not designed to replace existing insurance but to extend coverage to those who don’t currently have access to dental insurance. If you’re eligible to receive dental coverage through you or your spouse’s employment benefits, you can’t apply to the CDCP — even if you decide not to take advantage of those benefits.

That said, if you get dental coverage through another local, provincial, or federal dental program (e.g., Healthy Smiles Ontario, Ontario Disability Support Program), you can still be eligible for coverage under the CDCP. Benefits are coordinated between programs to prevent duplicate coverage and gaps.

How Much Does the CDCP Cover?

Under this program, the government covers up to 100% of the cost of eligible oral healthcare services, depending on income:

| Adjusted annual family income | How much you pay | How much the CDCP pays |

|---|---|---|

| < $70,000 | 0% | 100% |

| $70,000 – $79,999 | 40% | 60% |

| $80,000 – $89,999 | 60% | 40% |

Aside from these potential co-payments, patients—including those with 100% coverage—may also have to pay additional charges if:

- The cost of eligible services exceeds what the CDCP will reimburse

- Treatment includes services or fees that aren’t covered by the CDCP

Oral healthcare providers (i.e., dentists, dental hygienists, dental specialists, and denturists) who participate in the federal program are encouraged to follow the rates set by the CDCP. That said, dentists can still bill higher fees. Make sure to confirm any costs that won’t be covered by the CDCP before receiving treatment to prevent unexpected out-of-pocket expenses.

Unlike private dental insurance, you can’t pay for services upfront and get reimbursed later. Oral healthcare providers submit claims to Sun Life and are reimbursed directly, so make sure you go to a participating dentist.

What Services Are Covered by the CDCP?

The CDCP provides the same set of benefits for all qualified Canadians. Covered services include but aren’t limited to:

- Diagnostic and preventive services (e.g., dental exams, cleaning/scaling, sealants, fluoride applications, x-rays)

- Restorative services (e.g., temporary and permanent fillings, posts, crowns, and cores)

- Endodontic services (e.g, root canals)

- Periodontal services (e.g., gum line cleaning, abscess treatments, post-surgical evaluations)

- Removable prosthodontics (e.g, dentures)

- Oral surgeries (e.g., tooth extraction, draining, broken jaw bone treatment)

- Anesthesia (e.g., minimal, moderate, deep, and general)

Orthodontics, such as braces and retainers, will be covered by the federal program starting in 2025. You can check out the Government of Canada website for a comprehensive list of services covered by the Canadian Dental Care Plan.

Some of these services, as well as any services beyond established frequency limits, will require pre-authorization before your treatment will be covered. This means that your oral healthcare provider needs to submit a treatment recommendation based on your medical history and existing conditions, subject to approval by the CDCP. Services requiring pre-approval will be available starting November 2024.

Keep in mind that the CDCP only covers services booked on or after the start date listed in your membership package.

Applying to the Federal Dental Plan

As of August 2024, the following individuals can apply for CDCP coverage online:

- Seniors over 65

- Children under 18

- Persons with a valid Disability Tax Credit certificate

All other remaining eligible Canadians can apply online in 2025.

You can also apply through the following channels and request alternative formats, such as large print, e-text, Braille, audio/video, and DAISY:

- Phone: 1-833-537-43-42

- TTY: 1-833-677-6262

If you are eligible for the CDCP, you will receive a welcome package with your membership card, co-pay information, and start date within 3 months of application.

You must renew your membership, meeting all of the eligibility criteria, every year. More information on this will be available later.

Impact of the Federal Dental Plan on the Insurance Market

As it targets the uninsured, the CDCP doesn’t directly affect anyone who currently has private dental insurance. However, it could make health and life insurance more affordable by promoting better oral health outcomes and reducing the load on the public health system.

Oral health is very much tied to overall health. For example, individuals with gum disease are up to three times more likely to die of a heart attack or stroke. Issues like tooth decay, oral thrush, and dry mouth can also signify something more serious, like diabetes.

In 2021, the health insurance sector paid $9.5 billion for dental care, making up a third of total health insurance claims. Additionally, most uninsured individuals go to the emergency room for non-urgent dental concerns, which cost the system $1.8 billion in 2017.

Frequent, accessible dental care can prevent these costly visits and claims. Plus, people who care for their teeth are more likely to live healthier and longer — potentially reducing life insurance payouts and, thus, premiums.

Key Advice From MyChoice

- You can’t take advantage of the Canadian Dental Coverage Plan if you already have access to dental insurance through your employer, even if you opt out of those benefits. However, you can still apply if you get oral healthcare coverage through a municipal, regional, or federal government program.

- Before receiving treatment, confirm with your dentist or dental specialist if they participate in the CDCP, which services are covered, and if there will be additional charges on top of your co-pay.

- If you want your dental services to be covered by the CDCP, do not pay for any treatments up front. Your oral healthcare provider should file a claim and get reimbursed directly.