Canada has long been vocal about its commitment to reducing greenhouse gas emissions and meeting global climate targets. One of the most significant steps in this direction has been the effort to electrify the nation’s vehicles, with the federal government unveiling various initiatives to push the country toward cleaner transportation.

While Canada is pushing for electric vehicles (EVs) to become the norm by 2035, many drivers wonder how this will affect them. Will you still be able to gasoline-powered cars after 2035? How will this shift affect insurance premiums? Read on to find out how the transition to electric vehicles will impact the auto insurance industry.

Immediate Implications for Canadian Drivers

The shift to EVs comes with immediate implications for the average Canadian driver. The types of vehicles on the market, the availability of charging infrastructure, and the price of insurance will be major concerns going forward.

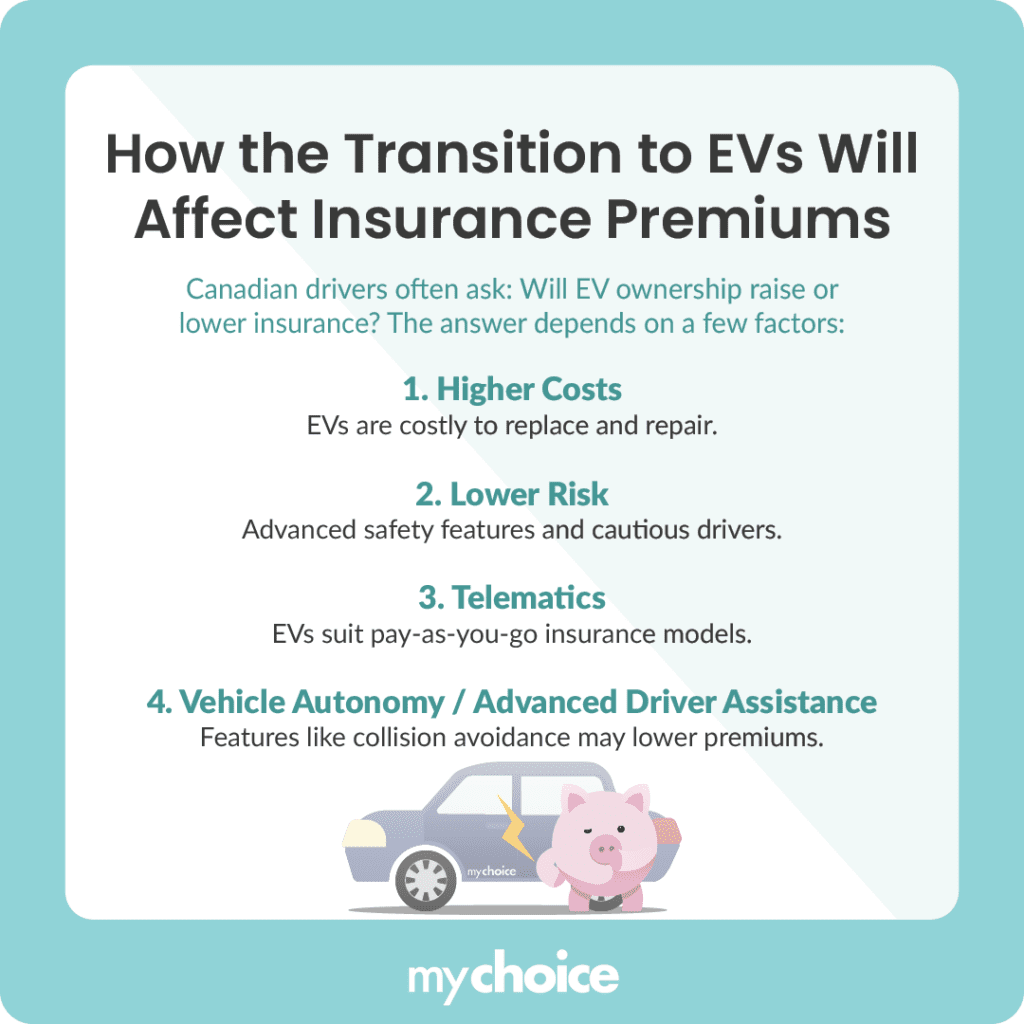

How the Transition to EVs Will Affect Insurance Premiums

One of the most pressing questions for Canadian drivers considering an EV purchase is: will my insurance go up or down if I make the switch? Unfortunately, this is not a simple yes-or-no question. A variety of factors governs the relationship between EV ownership and insurance premiums:

Insurance Impact in Different Provinces

Auto insurance systems can vary significantly from province to province. Public insurance plays a major role in British Columbia, Saskatchewan, and Manitoba, while private insurers are the norm in provinces such as Ontario and Alberta.

Because of these differing frameworks, Canadians will likely experience varying insurance outcomes depending on which province they call home. However, as EV adoption accelerates, more standardized insurance practices can be expected nationwide.

Insurance Industry Response to Quebec’s New Regulations

According to a recent report from Morningstar DBRS, as more claims data for EVs become available, insurers will need to adjust their pricing models accordingly, which may lead to higher costs for EV owners. The report highlights that repairs and replacement parts for EVs are significantly more expensive than those for traditional vehicles, leading some insurers to total damaged EVs rather than repair them. However, the highly regulated nature of auto insurance in Canada could help mitigate the pace of potential rate increases.

Insurers might begin offering coverage riders or specialized policies to address EV-specific concerns. For instance, battery degradation is one of the top worries for prospective buyers, so some insurers could incorporate coverage that protects policyholders in the event of a sudden battery failure. There might also be riders that cover damage to home-charging equipment or even provide liability coverage if a charging station malfunctions and causes damage to a house or neighbouring property.

Key Advice from MyChoice

- Transitioning from a gas-powered car to an EV can come with rebates that lower the initial cost.

- Some insurers will lower premiums for drivers transitioning to EVs, while others will raise premiums to match the increased cost to repair or replace them.

- Insurance changes due to EV adoption will vary from province to province due to the differing forms of available auto insurance.