Renting property can be a complicated venture – with unclear rules about who covers what, renter insurance policies, and ensuring you keep the rented property in tip-top shape throughout your stay. However, that can be difficult with just the regular wear-and-tear of living or if there’s an accident that causes damage to the property – like water damage from a flood or burst pipe.

So, does your tenant insurance cover water damage? What types of incidents qualify for a claim? Keep reading as we break down the specifics of what you can expect when dealing with water damage as a renter.

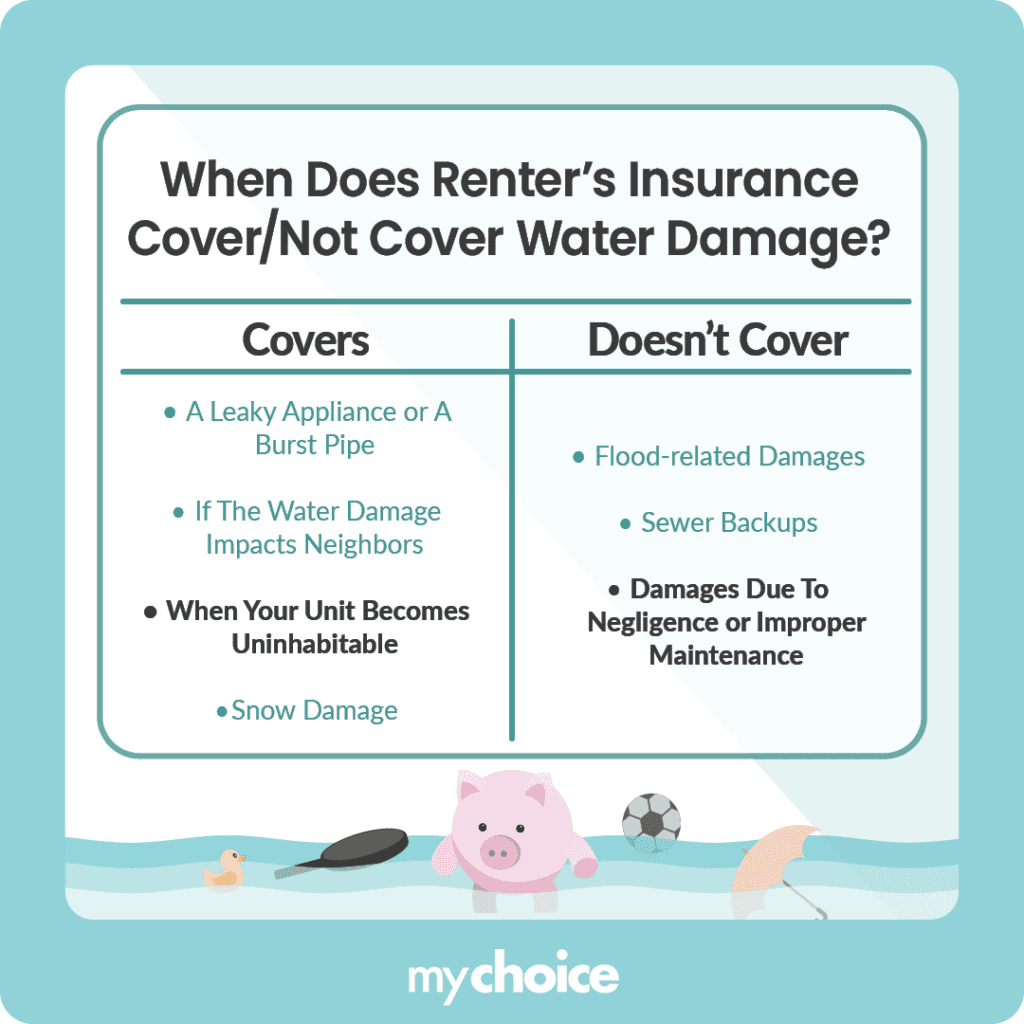

When Does Renter’s Insurance Cover Water Damage?

Water damage is one of the most commonly covered types of damages, but the reason for the damage can impact whether or not you get coverage. Specifically, these policies usually cover accidental damages, and not ones that are caused due to negligence or just the average wear-and-tear of life.

There are, however, three main scenarios where you can rely on your insurance to cover water-related damages. Let’s dive into those now:

Which Water Damages Aren’t Covered By Renters Insurance?

While tenant insurance offers a lot of protection, it’s important to know that not all types of water damage are covered. Here are a few key exceptions to keep in mind:

Key Advice from MyChoice

- Consider the neighborhood’s general issues – like flooding – and buy additional coverage as necessary

- Always contact your landlord the moment you see any leak-related issues

- Double-check your policy to see if there are any specific protections