Home insurance is essential for Canadian homeowners, providing coverage against risks in case of damage or loss to their main dwelling and personal belongings. But where do detached structures like garages fall in terms of coverage? Does it make a difference if your garage is attached to your home?

Learn more about how home insurance covers garages and other detached structures. In this article, we’ll explain how to determine the right amount of coverage for your garage, how business activities affect your garage’s coverage, and how often you should review your policy’s detached structure coverage.

What Are Detached Structures?

Detached structures are any permanent buildings on your property that are not physically attached to your main residence. While these structures all serve different purposes for your household, they also pose potential liabilities and risks. Examples of detached structures include:

- Gazebos

- Tool sheds

- Pool houses

- Fences

- Detached garages

Are Detached Structures Covered by My Home Insurance?

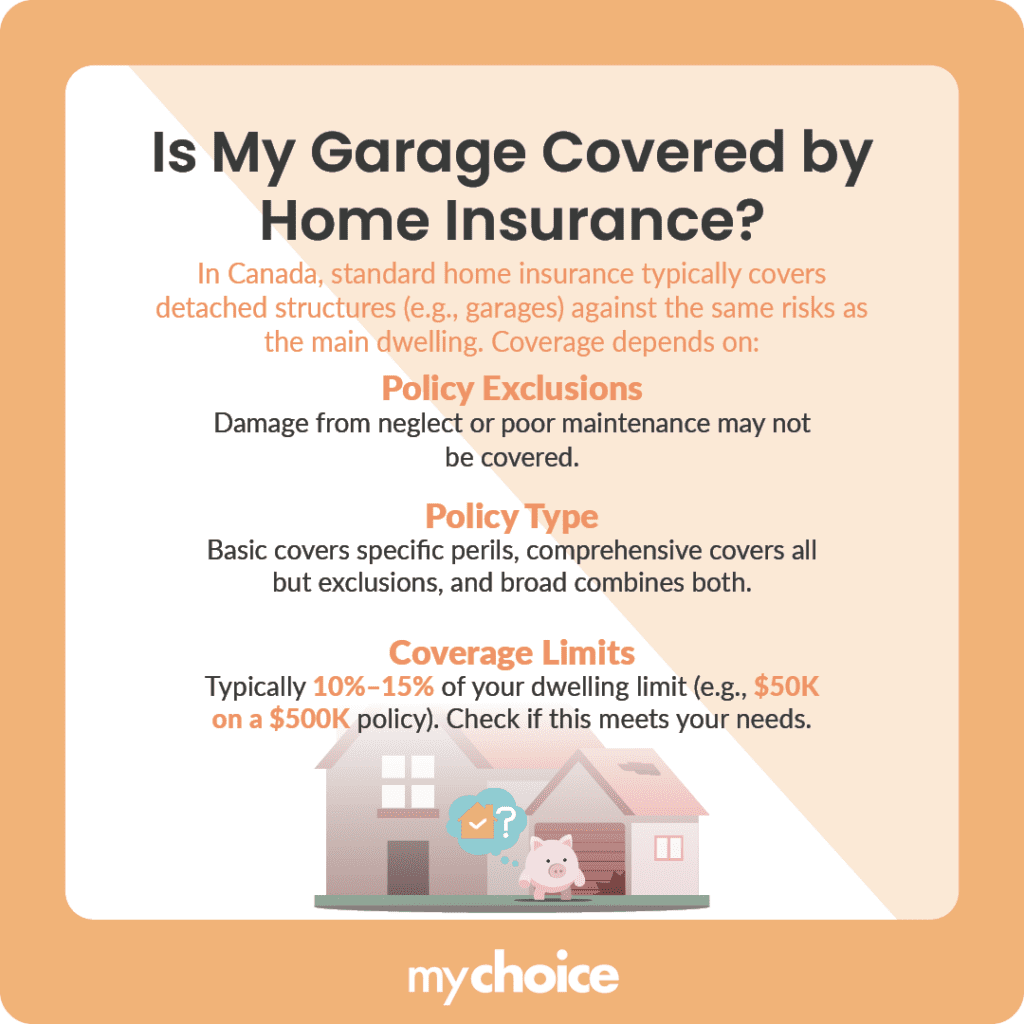

While home insurance offers substantial protection against theft and In most cases, detached structures are covered by standard home insurance policies in Canada. A home insurance policy protects detached structures against the same risks covered for the main dwelling.

However, the extent to which a detached structure is covered is affected by these factors:

Does Homeowners Insurance Cover Garage Door Damage by Your Car?

If you damage your garage door with your car, coverage for the damage will depend on whether the garage is attached to your home or a detached structure. Damage to a garage door is generally covered under homeowners insurance if the door is attached to the home, as it will be considered part of the home itself.

Detached garages, however, may fall under an “other structures” clause in your policy and have a lower coverage limit. Consider increasing your detached garage’s coverage through a separate endorsement, especially if it has unique features or high-value items.

How Does Working in My Garage Affect My Coverage?

Many homeowners use their garages not just for storing their cars, but as workshops or hobby spaces. If you’re using your garage for business-related activities, this can significantly impact your home insurance coverage. These are important considerations when using your garage for business activities:

How Do I Determine The Right Amount of Coverage for My Garage?

To determine the right amount of coverage for your garage insurance, you need to consider different factors such as your type of garage and its contents. Here’s what you need to keep in mind to help you assess your coverage needs for your garage more effectively:

How Often Should I Review My Home Insurance Policy for Detached Structures?

To ensure that your detached structures are adequately covered under your home insurance policy, it’s advisable to review your policy at least once a year. Additionally, you should consider reviewing it whenever significant changes occur. Here are key events that should make you review your policy:

Key Advice from MyChoice

- Keep an updated inventory of items stored in your garage along with photographs and receipts for high-value items. This will facilitate easier and faster claims processing if needed.

- If you live in an area prone to natural disasters like floods or fires, standard homeowners insurance may not provide enough coverage for your detached structures. You may need an additional policy for them, especially if they’ve been upgraded.

- When filing a claim, consider that your homeowners policy may have a deductible that could exceed the repair costs. This means it might not be worth filing a claim if the repair cost is lower than the deductible.