Renovating your home is an excellent way to boost its value and improve functionality. However, home renovations can introduce risks like accidental damage, structural surprises, and liability concerns that may or may not be covered by your home insurance policy.

These unexpected coverage gaps may leave you with an incomplete room and a few thousand dollars short. Before diving headfirst into a contractor agreement, you should understand how renovations can affect your home insurance policy.

Does My Current Home Insurance Policy Cover Damages from Renovations?

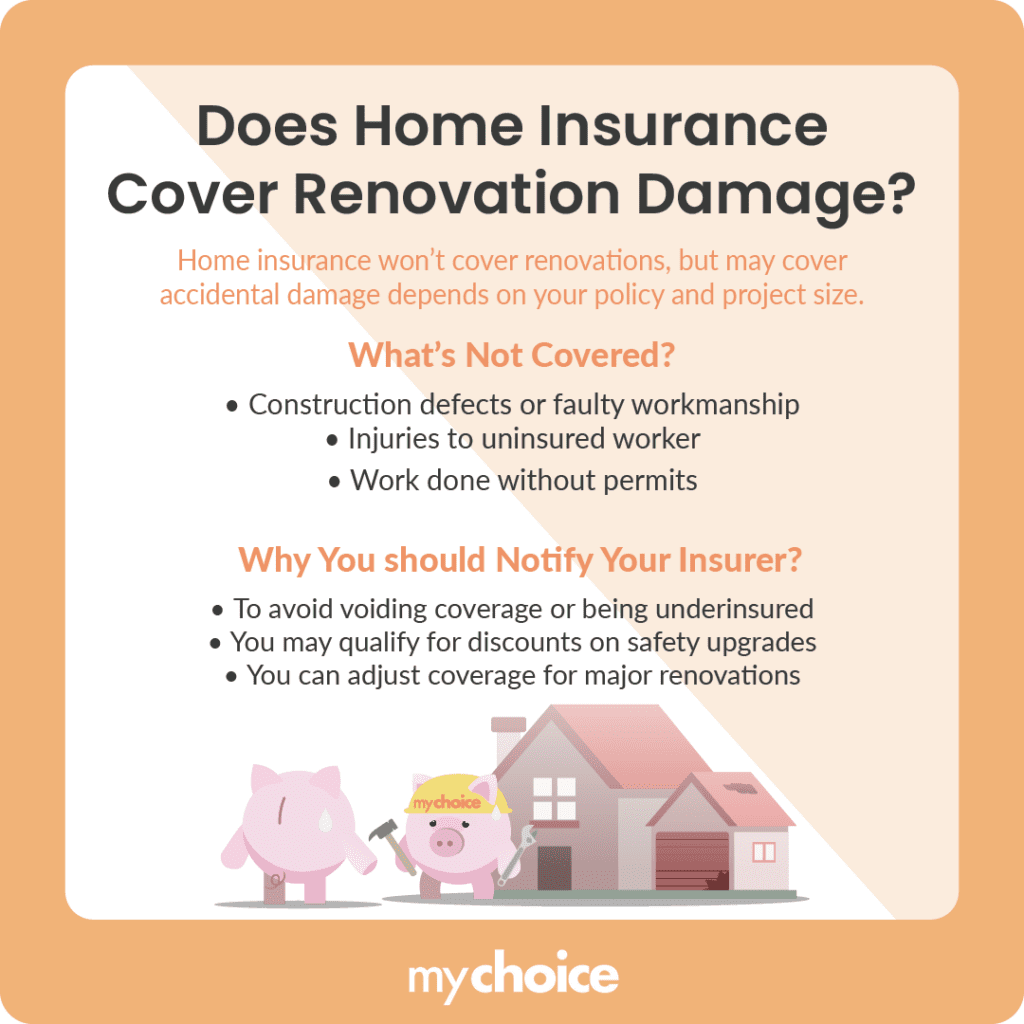

The short answer is that it depends. Home insurance won’t cover renovations directly, but it can cover accidental damage to your property, including foundation repair. For example, it might cover a burst pipe or fire during renovation, but coverage will ultimately depend on the project scale. It will also depend on whether you have broad or comprehensive home insurance.

For example, if you plan to undergo significant structural renovations and foundational upgrades, your insurer may request that you upgrade your policy to adjust for risk. However, regardless of your policy type and coverage, it won’t typically cover the following:

- Damage because of construction defects or faulty workmanship

- Injuries to uninsured workers

- Work completed without the appropriate permits

Insurers will also request that you specify the renovations, as they may alter your risk profile. If you renovate without notifying your insurer, you risk:

- Voiding parts of your policy

- Becoming underinsured if your home value increases

- Missing potential discounts for safety upgrades

When discussing home renovations with your insurer, disclose information like how much the renovation will cost, what changes you plan to make, how long you foresee the project will take, and whether the home will be unoccupied during the renovation process.

DIY vs. Hired Help: Different Risks, Different Rules

DIY renovations can shrink your budget and give you complete control over your home’s appearance, but they also pose unique risks that can affect your home insurance coverage.

Renovating your home without professional help means taking on the entire liability for any mistakes and damage. Thus, when going the DIY route, it’s vital to consider the following:

The safer option is hiring professional help, as it reduces personal liability. Most contractors have general liability insurance and workers’ compensation coverage. Before you proceed with work, review your contractor’s proof of insurance and verify that they are licensed and bonded. Compare what their insurance covers versus what your policy will have to cover.

Can I Get Renovation Insurance?

Standard homeowners insurance won’t cover most of the costs associated with renovations. However, you can apply for specific endorsements or policies to cover renovation-related accidents and changes.

Builder’s risk insurance, for example, can cover construction materials against risks like theft or natural disasters. You can also apply for liability insurance to cover costs for accidents or injuries.

What Happens if I Move Out During Renovations?

You might move out during renovations for many reasons, including allowing the renovation team to work uninterrupted and reduce disruptions to your daily life. But does this affect your insurance? It can.

Insurance companies may consider vacant homes at higher risk of vandalism, theft, damage, and delayed emergency response. Most standard home insurance policies have a grace period of 30 to 60 days of vacancy before your policy becomes limited. If you make a claim after this period, your insurer may deny it.

Fortunately, there are steps you can take to protect your property while you aren’t living in it:

- Discuss your vacancy policy with your insurance provider and provide your renovation plans.

- Add a vacancy permit or endorsement to your policy to keep key coverages active.

- Install security systems to notify you of fires, intruders, or other emergencies.

- Regularly visit your home during the renovation process.

Handling Unforeseen Hazards (Mold, Asbestos, Structural Surprises)

Renovations can uncover pre-existing damage you may not have known was in your home. Many of these issues can be costly and, unfortunately, not covered by insurance.

Mold, for instance, isn’t always covered by home insurance, especially if it grows due to long-term neglect. However, home insurance can cover mould resulting from a sudden, accidental event like a burst pipe.

The same principle applies to structural damage and asbestos. Unless the damage occurred suddenly and accidentally, your insurance policy isn’t likely to cover it – especially asbestos. Studies have found that over 240,000 Canadian homes might still contain asbestos. Because asbestos poses significant health risks, you’ll likely need specialty coverage or a pollution liability endorsement to get financial help removing it.

Similarly, if you uncover foundation cracks, termites, unsafe electrical systems, and rotting support beams, your insurer may cover secondary damage but not finance full replacements.

How to Use Renovations to Lower Your Home Insurance Premium

Renovations are an excellent way to make your home more functional and increase its value, but did you know that some renovation projects can lower your home insurance premiums? Here’s how you can use renovations to save money on your home insurance.

Key Advice From MyChoice

- Consider additional riders to protect against fires, thefts, and other hazards during renovation or construction.

- Review your policy limits, especially for personal liability and medical payments coverage. If you’re hiring a contractor, ensure they have coverage in case their workers are injured on the job.

- Understand what renovations can influence homeowners insurance. While additions like pools and saunas can increase your home’s value, they also increase liabilities and hazards.