Your home’s foundation is more than just concrete and steel. It’s the base on which your safety and peace of mind rest. Unfortunately, this vital part of your home often goes overlooked until visible cracks appear or moisture seeps in. When these issues happen, the cost of repairing a foundation can become a huge financial burden for homeowners.

Homeowner’s insurance can sometimes cover the cost of foundation repairs, but usually only for specific perils. What kind of foundation damage does your insurance policy cover? What steps can you take to ensure that your insurance policy will cover repairs? Read on to learn about how much home insurance protects your home’s foundation.

Does Home Insurance Cover Foundation Repair?

Yes, home insurance can cover foundation repair. However, depending on whether you have broad or comprehensive home insurance, your policy may not cover damage to your foundation from specific sources. Here is a table that goes into what kinds of foundation damage your home insurance policy will generally cover:

| Scenario | Broad Home Insurance | Comprehensive Home Insurance |

|---|---|---|

| Sudden, accidental plumbing leak | Typically covered, but reimbursement for actual foundation repairs can be limited without specific endorsements. | Generally covers both the source of the leak and resulting structural damage. |

| Settling, or cracking from normal wear and tear | Typically not covered. | Also typically not covered. |

| Damage from earthquakes | Usually not covered unless you add an earthquake endorsement. | Also not covered unless you add an earthquake endorsement. |

| Damage from flooding | Generally not covered unless you add an overland flooding endorsement. | Also typically not covered unless you add an overland flooding endorsement. |

| Damage from hurricanes and high winds | Typically covered. However, some insurers may have high wind deductibles or specific conditions in coastal or storm-prone provinces. | Generally covered. |

| Burst water heater | Often covered if sudden and accidental, but may be limited to direct damage. Whether or not the foundation repair is included can depend on how the damage is classified. | Typically covers sudden and accidental discharges, including potential foundation repair costs if not explicitly excluded. |

| Vandalism | Generally covered as a named peril. | Generally covered. |

| Fire damage | Generally covered as a named peril. | Generally covered. |

| Poor construction or negligence | Excluded. | Also excluded. |

How Can I Make Sure that My Foundation Is Covered?

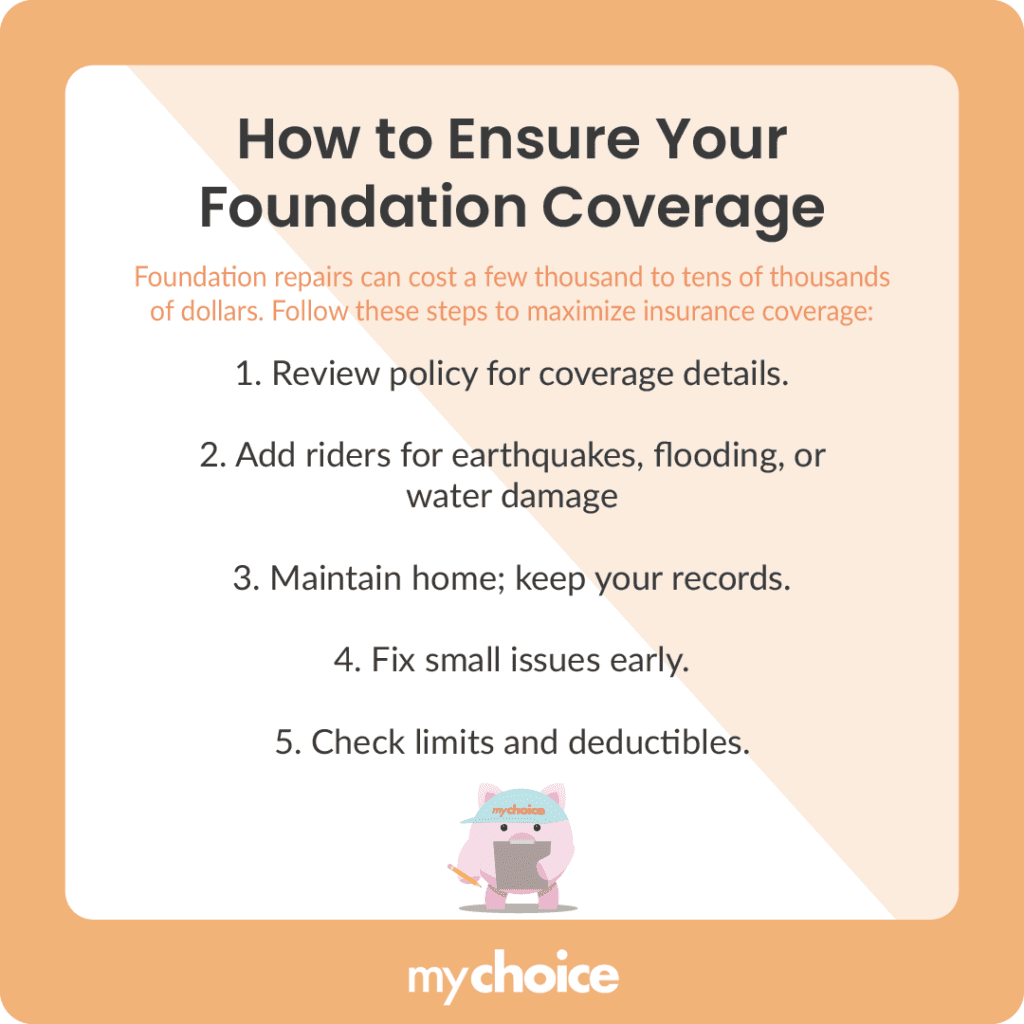

Foundation repairs can be expensive, often ranging from a few thousand dollars to tens of thousands, depending on the severity of the damage and the complexity of the repair. Homeowners will want to make sure that they have the best chance of insurance coverage in the event of foundation damage.

Here are some steps you can take to maximize your insurance coverage:

Adapting to Climate & Construction Changes

Other than adjusting your insurance policy, you’ll also need to account for changes in climate patterns and changing construction standards. Your home’s foundation may be vulnerable to extreme weather incidents, but advancements in construction technology and investing in protective measures can minimize the risk of foundation damage.

Key Advice from MyChoice

- Closely read your insurance policy’s coverage details and consult your insurance agent regarding specific risks in your region.

- Adding riders or endorsements to your policy can provide protection for hazards like earthquakes, flooding, and other extreme weather events.

- Regular inspections, immediate repairs, and proper record-keeping can increase your chances of a successful insurance claim if major damage occurs.