When it comes to issues with a car’s transmission, many drivers often ask “Does auto insurance cover transmission failure?” Understanding what your auto insurance covers can save you from unexpected expenses and help you make informed decisions about your vehicle’s maintenance and repairs.

Does insurance cover transmission repair? When does insurance not cover transmission damage? In this article, we’ll explore the specifics of auto insurance coverage related to transmission damage and when you can expect your insurance company to cover repairs.

Understanding Auto Insurance Coverage & Implications to Your Transmission

Before diving into the specifics of transmission coverage, you must become familiar with the basics of auto insurance in Ontario.

Every driver is required to have an auto insurance policy before being allowed to drive in Canada legally. It’s important to know what type of coverage your policy offers to know what situations you can expect insurance to help cover your repair costs.

Knowing the difference between these types of coverage is important, as they dictate how your insurance will respond in the event of transmission damage. Be sure to read your insurance policy thoroughly to know how much coverage you have in the event of a transmission failure.

What is Transmission Damage and What Causes it?

Transmission damage refers to any issues affecting the vehicle’s transmission system, which is responsible for transferring power from the engine to the wheels. When your transmission sustains heavy damage, your car may be able to start, but won’t be able to move since your transmission system isn’t spinning your wheels. Common causes of transmission damage include:

When Does Auto Insurance Cover Transmission Damage?

Generally, insurance companies will cover repairs to your transmission if you can prove that it was caused by an accident or other event that you’re insured against. Collision coverage will cover the repair costs of your transmission if it was damaged in an accident, while comprehensive coverage will cover damage due to non-collision events, such as natural disasters, theft, vandalism, or falling objects. Uninsured motorist coverage can also cover the repair costs of a damaged transmission if it gets damaged in a collision with an uninsured driver.

When Does Auto Insurance Not Cover Transmission Damage?

Transmission damage can occur due to a variety of factors, and not all transmission damage will be covered by your insurance policy. If your transmission stops working due to normal wear and tear or lack of maintenance, you’ll have to pay for repairs out of pocket. Similarly, if your transmission stops working due to a mechanical failure, insurance won’t cover the repairs.

Additional Coverage Options for Transmission Repairs

If you’re concerned about potential transmission issues, consider these additional coverage options:

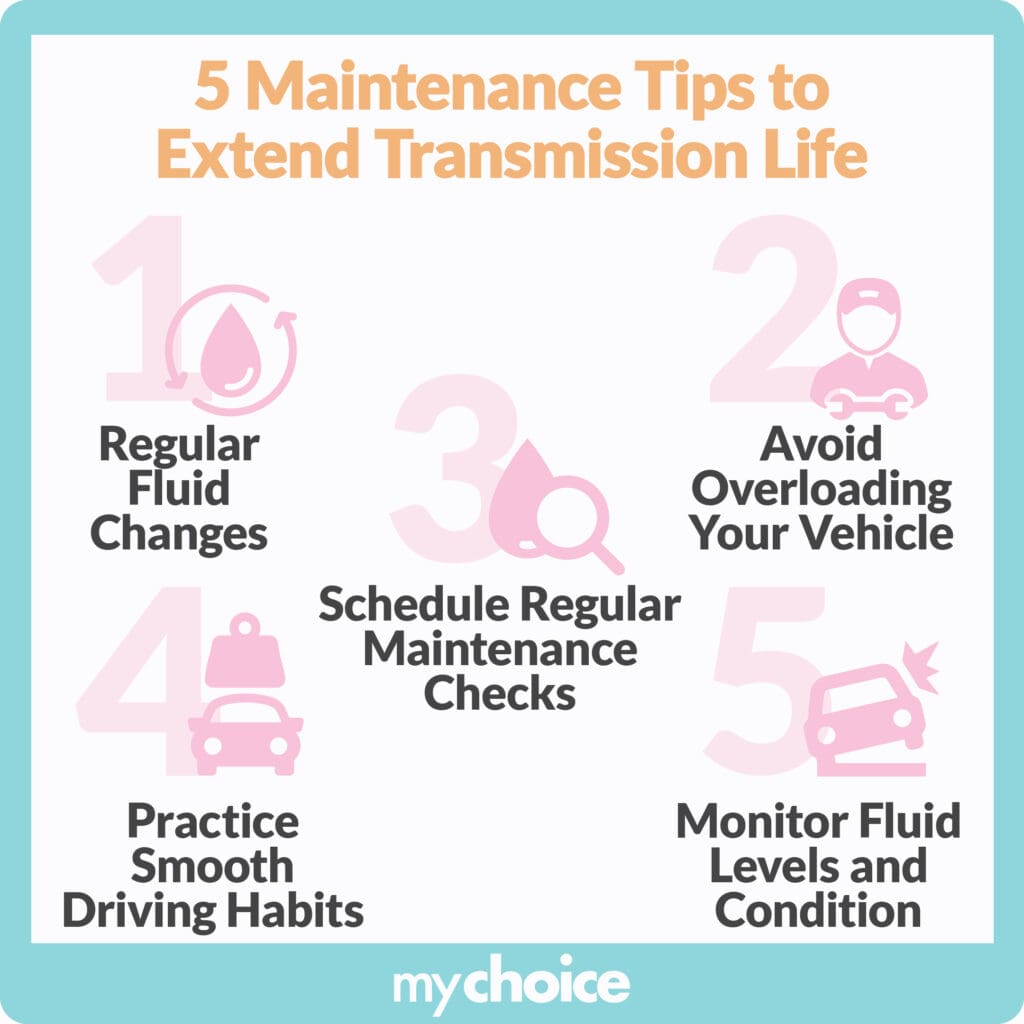

Maintenance Tips to Extend Transmission Life

Maintaining your transmission is important to keep your car operating smoothly. Here are five practical tips to help extend the life of your transmission:

Key Advice from MyChoice

- Some insurance providers can offer mechanical breakdown insurance, which can cover your repair costs when your transmission fails due to a mechanical issue.

- Damage to your transmission can be covered by your regular insurance policy if its caused by a collision or event that you’re insured against.

- Keep your car maintained regularly and avoid driving in ways that stress your transmission to avoid the chance of a transmission breakdown.