Yes, auto insurance companies can check your credit scores. In some provinces, insurance companies do this to calculate your premiums. However, that doesn’t mean it’s the end-all, be-all of your premium calculations.

So, how does your credit score influence your auto insurance and what are the rules surrounding it? Keep reading to learn more.

How Insurance Companies Check Your Credit Score

Do insurance companies do a credit check on you when you apply for a car insurance policy? In certain provinces, yes. Auto insurance companies in Canada generally contact major credit reporting agencies like TransUnion or Equifax.

The good news is they can only see your credit score. Insurance companies also generally do a soft credit check, which doesn’t impact your score, as opposed to hard credit checks, which do.

What Insurers Can and Can Not Do With Your Credit Information

Insurers generally check your credit score because they want to see how responsible you are with money. In many cases, people with low credit scores tend to make more insurance claims, which makes them higher-risk individuals.

However, there are rules for credit checking set up by the Insurance Bureau of Canada (IBC). Let’s take a look at what insurers can and cannot do in terms of credit checking.

- Insurance companies must get your consent before performing a credit check.

- Insurance companies cannot refuse or end coverage because you didn’t consent to a credit check or have a lower credit score.

- Insurance companies must guide individuals who have their credit ratings negatively impacted by extraordinary life events.

- Insurance companies must use other relevant factors to calculate premiums for people without a credit history.

Refusing a Credit Check

If you don’t want the auto insurance company to look at your credit score, you can refuse the check. As per the IBC’s code of conduct, you cannot be denied insurance coverage by refusing a credit check. However, your premiums may be influenced because the insurance company may need to scrutinize other factors to ensure you’re a low-risk person to insure.

How Your Credit Score Affects Car Insurance

Generally, car insurance companies check your credit score to determine your premium. By doing so, they can gauge whether or not you’re reliable with money. People with low credit scores are generally seen as riskier, so insurers may give you higher rates if your credit scores are low.

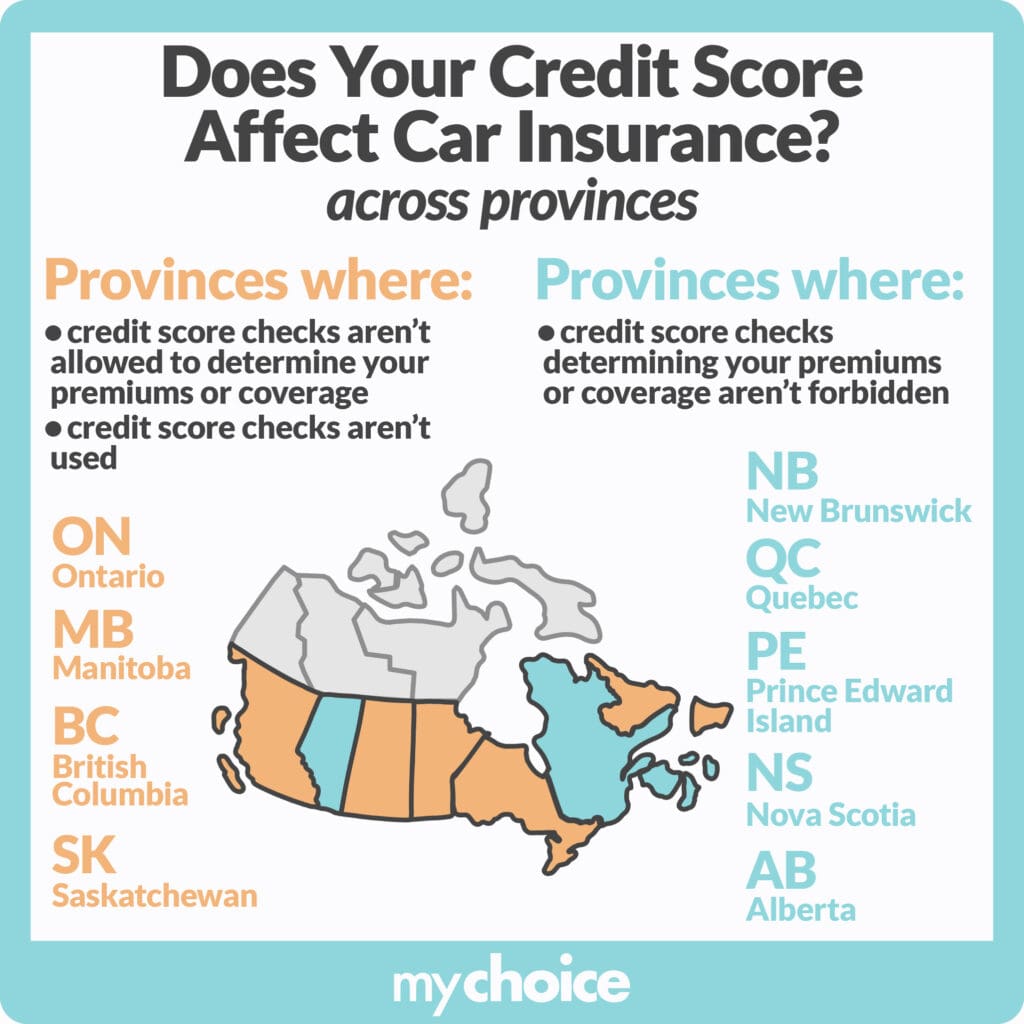

Credit Score Checking for Car Insurance Across Provinces

Whether or not a car insurance provider can check your credit score depends on where you are because the Insurance Bureau of Canada’s (IBC) regulations require them to comply with provincial laws. For example, car insurance companies in Ontario are prohibited from checking your credit score, while insurers in Alberta can only do so with your consent. Here’s a reference table to help you determine if credit score checking by car insurers is allowed in your province:

| Province | Can car insurance companies check your credit score here? |

|---|---|

| Ontario | No, car insurers are legally prohibited from checking your credit score. |

| Newfoundland and Labrador | No, car insurers are legally prohibited from checking your credit score. |

| British Columbia | No legal prohibition, but credit scores aren’t used as a guideline for premium calculations. |

| Manitoba | No legal prohibition, but credit scores aren’t used as a guideline for premium calculations. |

| Saskatchewan | No legal prohibition, but credit scores aren’t used as a guideline for premium calculations. |

| New Brunswick | Not forbidden, but it’s an uncommon practice. |

| Prince Edward Island | Not forbidden, but it’s an uncommon practice. |

| Quebec | Not forbidden, but it’s an uncommon practice. |

| Alberta | Yes, but only with your consent. |

| Nova Scotia | Yes, but only with your consent. |

Other Factors Influencing Car Insurance Rates

Based on the table above, we can conclude that credit scores only impact your car insurance rates in specific scenarios and if you live in certain areas. Instead of worrying about improving your credit score to get the best rates, it’s better to pay attention to the following factors that have more influence on your car insurance rates.

Here are factors that influence your car insurance rates, according to the IBC:

- Your car’s make, model, production year, and safety features.

- Personal details like your age, gender, and marital status.

- Your driving history, including any previous insurance claims and driving convictions. Things like speeding tickets and licence suspensions may raise your premiums. Your history of driving courses may also be considered.

- How long you’ve had a driver’s licence.

- Your annual driving mileage.

- Your car’s usage, whether it’s just for personal use or if you use it commercially.

If you have multiple people on your auto insurance policy, their details will also figure into your premium calculations.

What Influences Your Credit Score?

Your credit score is influenced by things that make you more or less creditworthy. Things that may raise or lower your credit score include:

- Your bill payment habits.

- The amount of money you owe to creditors.

- The number of your credit accounts.

- The age of your credit accounts.

Improving Your Credit Score

Here are some things to do that can improve your credit score:

- Making payments on time.

- Contacting your lender or credit provider if you need help paying a bill.

- Staying under your credit limit.

- Keeping a credit account open for a long time. This even applies if you have old credit accounts that you don’t use.

- Limiting your credit inquiries.

- Mixing different types of credit products.

Key Advice From MyChoice

Now that we’ve learned more about how credit scores can affect your car insurance rates let’s take a look at some of our top tips:

- In some provinces, credit scores can’t affect your car insurance rates at all because they’re not included in your premium calculations.

- You can refuse a credit check by car insurers if you don’t want them to look at your credit score.

- Your credit score is just one of many determining factors that influence your car insurance rates.

- You can improve your credit score by making payments on time, staying under your credit limit, and using different types of credit products.

If you’re looking to compare life insurance quotes from Canada’s top insurers, visit MyChoice!