The Number of Cigarette Smokers in Canada Decreased by 18.79% Since 2019 – More Than Double the Previous Period

In 2021, Canadian households spent an average of $551 on tobacco products and smokers’ supplies, primarily on cigarettes. This amount is comparable to the average household expenditure on public transportation, which was $598. However, the financial cost is just part of the problem. Lung cancer is the leading cause of cancer death in Canada, with an estimated 21,000 Canadians expected to have died from it in 2021.

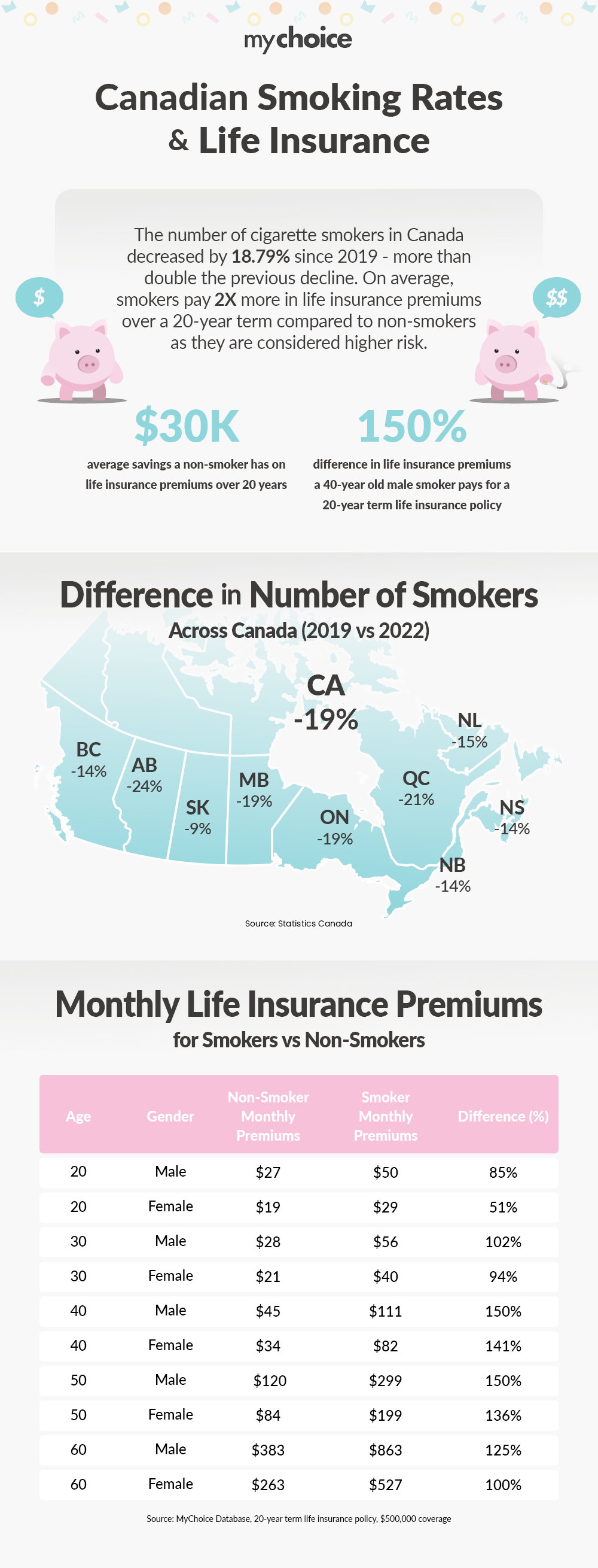

To shed more light on this issue, our team conducted a study to explore how smoking rates have changed over the past decade. Using data from Statistics Canada’s annual community health survey, the team compared how the number of cigarette smokers in Canada changed from 2019 to 2022 with the four years prior. Additionally, we examined the differences in life insurance premiums between smokers and non-smokers using data from their database of life insurance quotes.

Below are the key findings from the study:

- Cigarette smoking rates in Canada have been declining fast since COVID-19. Nationally, the number of cigarette smokers decreased by 18.79% from 2019 to 2022, compared to a 7.81% decrease from 2015 to 2018.

- The cigarette smoking rates among people aged 65+ increased by 9.75% from 2019 to 2022 compared to a 10.09% increase between the years of 2015 and 2018

- In 2022, 20% of young adults aged 20 to 24 years reported having vaped at least once in the past 30 days, up from 15% in 2019, 13% in 2020 and 17% in 2021.

- On Average, smokers pay 2X more in life insurance premiums over a 20-year term compared to non-smokers.

- On average, smokers could save $29,599 over a 20-year term by quitting smoking.

Smoking rates in Canada have been declining since COVID-19, but the rate of decline varies across provinces. Provinces like Alberta saw a significant reduction of 24.17%, while others like New Brunswick experienced a smaller decline of 14.42%.

| Province | Difference in Number of Cigarette Smokers (2015 vs 2018) | Difference in Number of Cigarette Smokers (2019 vs 2022) |

|---|---|---|

| Alberta | -8.99% | -24.17% |

| British Columbia | -9.09% | -13.74% |

| Manitoba | -6.47% | -18.89% |

| New Brunswick | -15.43% | -14.42% |

| Newfoundland and Labrador | -25.02% | -14.79% |

| Nova Scotia | -3.59% | -13.61% |

| Ontario | -9.04% | -18.86% |

| Prince Edward Island | 20.97% | n/a |

| Quebec | -4.19% | -20.98% |

| Saskatchewan | -4.99% | -9.39% |

| Canada | -7.81% | -18.79% |

The reduction in smoking rates is a positive trend that could lead to lower healthcare costs and better life expectancy in the long run. However, the varying rates of decline across provinces suggest that more targeted public health initiatives may be necessary to continue this downward trend.

Life Insurance is another area where smoking hits your wallet hard. Insurance companies calculate premiums based on risk factors that could affect a policyholder’s lifespan, and smoking is one of the most significant due to its well-documented health risks like heart disease, stroke, and various forms of cancer. As a result, smokers are considered higher risk, leading to substantially higher premiums. Below is the difference in pricing for a 20-year term life insurance policy with $500,000 coverage across different age groups and genders.

| Age | Gender | Non-Smoker Premiums Over 20 Years | Smoker Premiums Over 20 Years | Difference (%) |

|---|---|---|---|---|

| 20 | Male | $6,480 | $11,988 | 85.00% |

| 20 | Female | $4,644 | $7,020 | 51.16% |

| 30 | Male | $6,696 | $13,500 | 101.61% |

| 30 | Female | $4,968 | $9,612 | 93.48% |

| 40 | Male | $10,692 | $26,676 | 149.49% |

| 40 | Female | $8,208 | $19,764 | 140.79% |

| 50 | Male | $28,728 | $71,712 | 149.62% |

| 50 | Female | $20,196 | $47,736 | 136.36% |

| 60 | Male | $92,016 | $207,216 | 125.20% |

| 60 | Female | $63,180 | $126,576 | 100.34% |

Matt Roberts, COO of MyChoice, commented on the findings: “Our study highlights a significant financial burden that smoking places on individuals, beyond the well-known health risks. Smokers not only face higher medical expenses but also substantially higher life insurance premiums. It’s crucial for Canadians to be aware of these costs when making lifestyle choices. Quitting smoking can lead to enormous savings, both in terms of health and finances.”