Auto theft has become a significant problem for Canadians over the past decade. However, recent data shows that auto thefts are on the decline nationwide. Are auto theft rates decreasing for all provinces? What does this mean for your car insurance rates? Read on to learn why auto theft is declining and how this impacts your car insurance in Canada.

National Auto Thefts are on the Decline

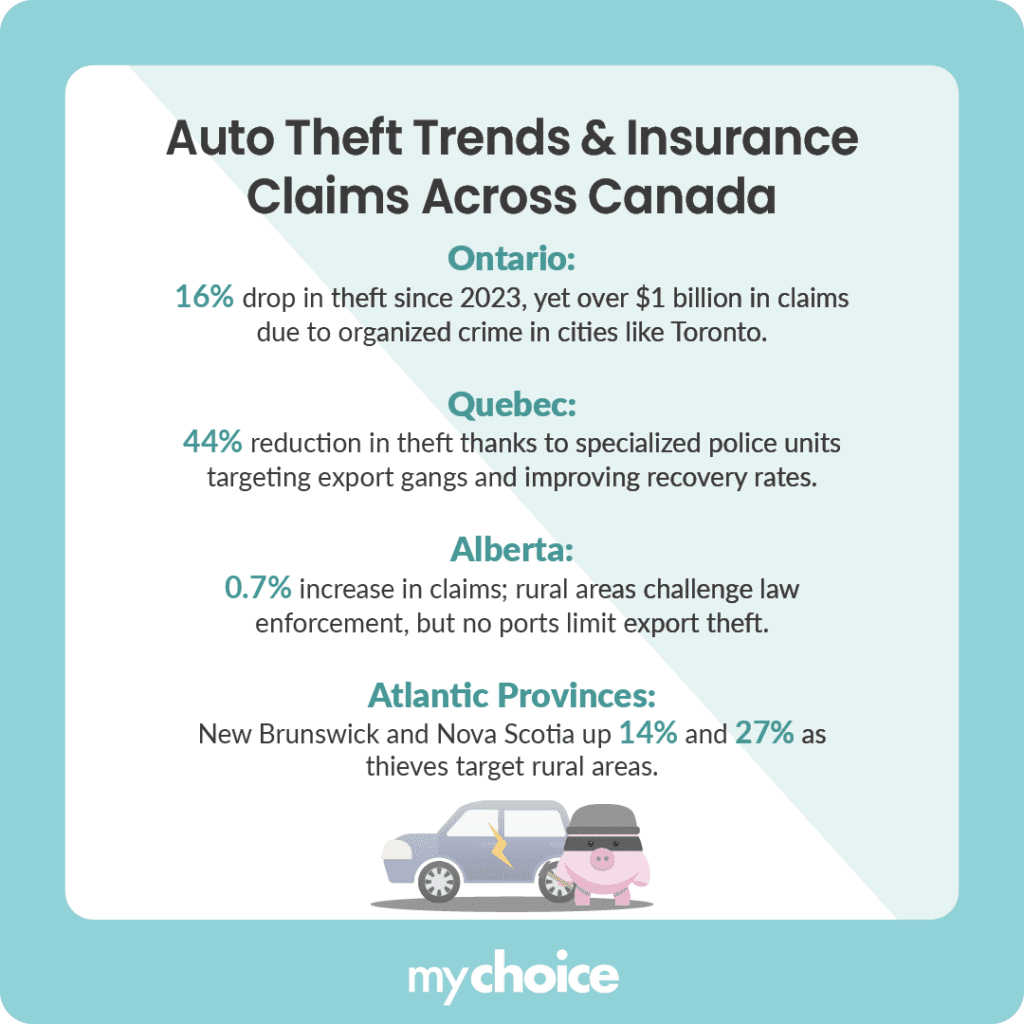

According to the Insurance Bureau of Canada (IBC), the number of auto theft insurance claims in the first half of 2024 has decreased by 19.4% compared to the same period in 2023. This trend is prevalent mainly in provinces like Ontario and Quebec. In Ontario, thefts dropped by 16%, while Quebec saw an impressive decline of 41% during the first half of 2024.

However, not all provinces share this positive trend. Alberta and New Brunswick are experiencing increases in thefts. Alberta’s claims rose by 0.7%, with claim values skyrocketing by 179% over the last decade. New Brunswick reported a significant rise of 14% in vehicle thefts compared to last year.

Here’s a table showing a summary of the regional trends in auto theft:

| Province | Change in Auto Theft Claims Since H1 2023 |

|---|---|

| Ontario | -16% |

| Quebec | -41% |

| Alberta | +0.7% |

| New Brunswick | +14% |

| Nova Scotia | +27% |

A Closer Look at Regional Differences

The landscape of auto theft in Canada varies significantly from province to province. While some areas experience declines in theft claims, others face alarming increases. To understand these regional differences, let’s take a closer look at some of the circumstances of each province and the measures they take against vehicle theft.

How Does This Impact Your Insurance Rates?

In general, rising auto theft rates lead to higher car insurance premiums as insurers adjust their risk assessments. The IBC notes that the increase in auto theft claims over the past decade has significantly impacted drivers’ insurance costs.

However, with recent declines in certain areas, drivers may see more stable or even lower premiums where crime rates are decreasing. Car theft rates also affect other factors that determine your insurance rates. These factors include:

As provinces like Ontario and Quebec implement tougher penalties and improve law enforcement efforts, we can expect further declines in auto theft rates. If these trends continue nationally, drivers might see more competitive car insurance premiums as insurers reassess their risk models based on improved safety conditions.

Key Advice From MyChoice

- Quebec and Ontario may see insurance rate decreases due to the lower incidence of auto theft claims. On the other hand, Alberta, New Brunswick, and Nova Scotia may experience higher insurance premiums.

- If your car is stolen and then found, notify your insurance company immediately to speed up the investigation and claims process.

- Take precautions to ensure that your car is not an easy target for aspiring thieves. Never leave your car running, invest in anti-theft devices, and make sure to park in a well-lit area if you need to park in public.