Different challenges have significantly impacted Canada’s home and auto insurance industries in the last five years. One of these is the rise in climate-related weather claims, with more Canadians experiencing unusual cold or warm weather, leading to more flooding or wildfires that damage or destroy their property.

In May 2024, Statistics Canada released an article about the impact of extreme weather trends and catastrophic (CAT) claims on the profitability of personal property insurance – which is synonymous with homeowners’ insurance.

Recent Trends in Extreme Weather Events

The May 2024 StatCan analysis found that “once in 100 years” events are happening more frequently – more wildfires, worse flooding, and higher temperatures than ever. Despite this, flooding coverage is mostly available only to consumers in low or medium-risk areas and many Canadians aren’t even aware that they live in high-risk areas.

According to the same StatCan report, as of 2020, only 6% of respondents knew they lived in a designated flood-risk area. Because of the risk assessment of some regions, Canadian consumers may need to rethink where to build or rebuild their homes to reduce the chance of suffering due to extreme weather events. Temperatures are seen to continue to rise, so severe weather events will happen more frequently and further increase the need for property protection.

Home Insurance Inflation is Rising

Earlier this year, we published a report analyzing the impact of severe weather events in Canada on home insurance inflation, which was at 7.66% YoY across the country as of January 2024.

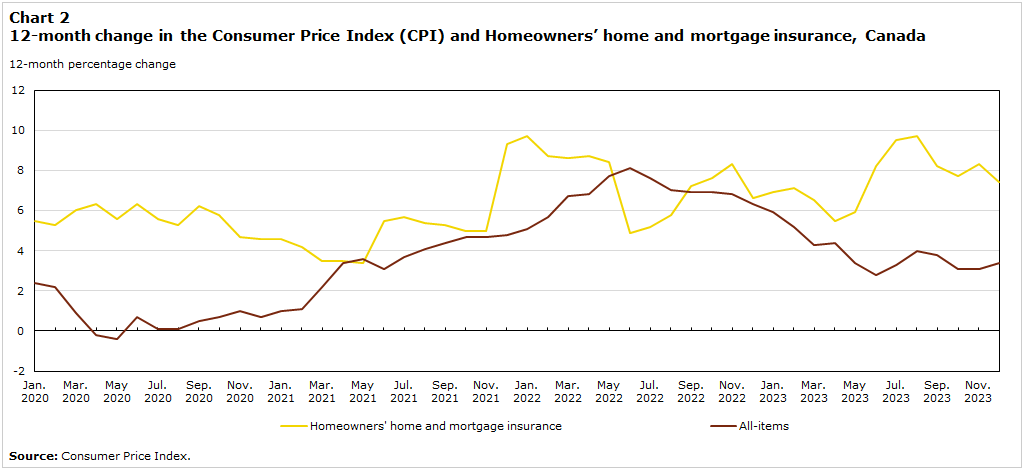

The new Statistics Canada report highlighted that the home insurance CPI index has consistently outpaced the overall inflation numbers in Canada since January 2020.

The increase in severe weather events had a direct negative impact on home insurance profitability across Canada. The more events there are, the more claims insurers need to pay out – reducing their profit margins yearly. Claims cost increased from $2.5 billion in 2021 to $3.4 billion and $3.1 billion in 2022 and 2023, respectively.

Higher claims costs lead to lower profitability for insurers, meaning some insurers may increase premiums across the board for home and auto insurance. Provincial governments usually try to moderate rate changes through freezes and caps, but these are typically only in place for a limited period.

Financial Performance of the P&C Insurance Industry

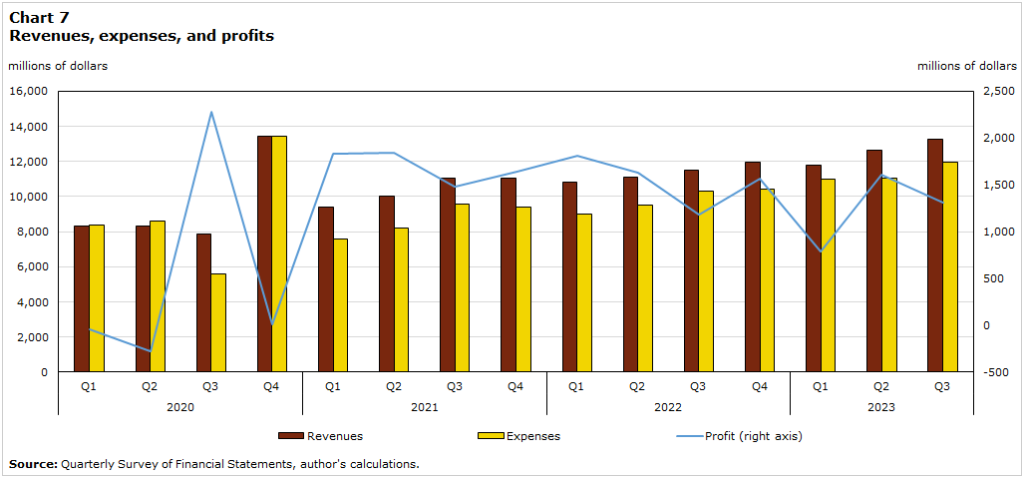

The P&C insurance industry is made up of property (personal and commercial), auto (private and commercial) and other (boiler and machinery, liability, and surety) insurance. In 2020, the P&C insurance industry wasn’t profitable – something largely attributed to higher expenses during the COVID-19 pandemic.

Profitability has since recovered from 2021 to 2023, despite claims rising steeply in steeply in 2022 and 2023. This was assessed by StatCan by comparing Canadian claims ratios from 2020 to 2023. A claim ratio is computed by examining the percentage of claims costs incurred in relation to the premiums earned. A ratio below 100% means an insurer is making an underwriting profit, while a ratio above means the insurer is paying out more in claims than it’s making through premiums.

Regulatory and Market Dynamics

When it comes to consumer information, pushing for strong regulations, and supporting consumer-friendly prices, Canadians have some recourse. Consumers can rely on the Insurance Bureau of Canada (IBC) and the Property and Casualty Insurance Compensation Corporation (PACICC) to keep them informed and advocate for more affordable coverage. The PACICC also protects consumers if their insurer becomes insolvent, preventing financial losses where possible.

In some provinces, insurance – particularly auto insurance – is regulated by the government. For example, minimum auto insurance is mandatory in every province and they can regulate rate increases by requiring approval before these rates can be changed. Some provinces like Manitoba and British Columbia require consumers to buy mandatory auto insurance through a government insurer, though they can get additional coverage from private providers.

When market conditions are especially harsh, provincial bodies can even give rate caps or freezes for a limited period. However, home insurance is not regulated or mandatory even though it’s a requirement for a mortgage across Canada. Consumers may have to consider bundling different insurance policies to stay on budget and to keep their own premiums low.

Rising Input Costs and Replacement Costs

Home and auto insurers always have to account for inputs and replacements, such as concrete, lumber, appliances, and labour. These inputs and replacements are important considerations for insurers because they have to handle rebuilding costs in the present market. Simply put, because it’s become more expensive for insurers to replace or rebuild a home, a consumer is more likely to need more coverage.

The COVID-19 pandemic also had an uptick in home renovations despite supplies being harder to source and transport, which may have compounded the increase in expense for insurers. Because renovations tend to add value to homes, the cost of insuring them and replacing them will also go up.

Consumer Impact and Affordability

The overall increase in extreme weather events and claim payouts in Canada will likely lead to higher premiums in the next few years. Despite the profitable claims ratios from 2021 to 2023, P&C insurers’ profits were eaten by the sharp increase in expenses, inflation, and hiring. This reduced profitability may drive some insurers to increase premiums to sufficiently cover claims and minimize the dent in their bottom line.

Consumers may have difficulty finding sufficient coverage for their homes and vehicles as prices go up, so it’s important to shop around and find ways to lower their offered rates. Some things they do include bundling insurance policies and repairing or updating outdated utility systems.

However, those living in high-risk areas for floods, hail, and fire may have to reconsider. More than insurance premiums, the steep financial and mental toll of rebuilding may not be worth the price and they should reconsider relocation as the more affordable choice. If possible, they should opt into additional coverage that best addresses the most common risks they face, such as overland flooding.

Key Takeaways from MyChoice

- Because of the higher incidence of wildfires and flooding in various parts of Canada, expect premiums to continue to go up in the next few years.

- Insurers may struggle to consistently offer affordable insurance because of the sharp increase in extreme weather incidents. Compare rates between insurance companies using MyChoice to find the best deal for your budget and desired coverage.

- You may want to review your policy coverage. More insurers are offering overland water coverage as a result of severe weather, but most consumers aren’t opting into this additional coverage despite this.

- Provincial bodies may impose price caps or freezes to help consumers, but these are only for a given period of time. Further, home insurance isn’t regulated, so shop around and talk to your potential insurer about what you can do to lower your premiums.