Seniors can still benefit from life insurance depending on their financial needs and goals. A policy can prevent their loved ones from being financially burdened in case of their passing and cover final expenses. However, choosing a life insurance policy can be tricky, especially when there’s so much on the line.

How Much Do Seniors Pay For Life Insurance?

Seniors in Canada typically pay between $200 and $300 annually for life insurance. This range includes basic coverage, though seniors can pay up to $1,000 yearly for more comprehensive coverage.

However, the amount seniors pay for life insurance will ultimately depend on their age, driving history, health, and choice of policy type.

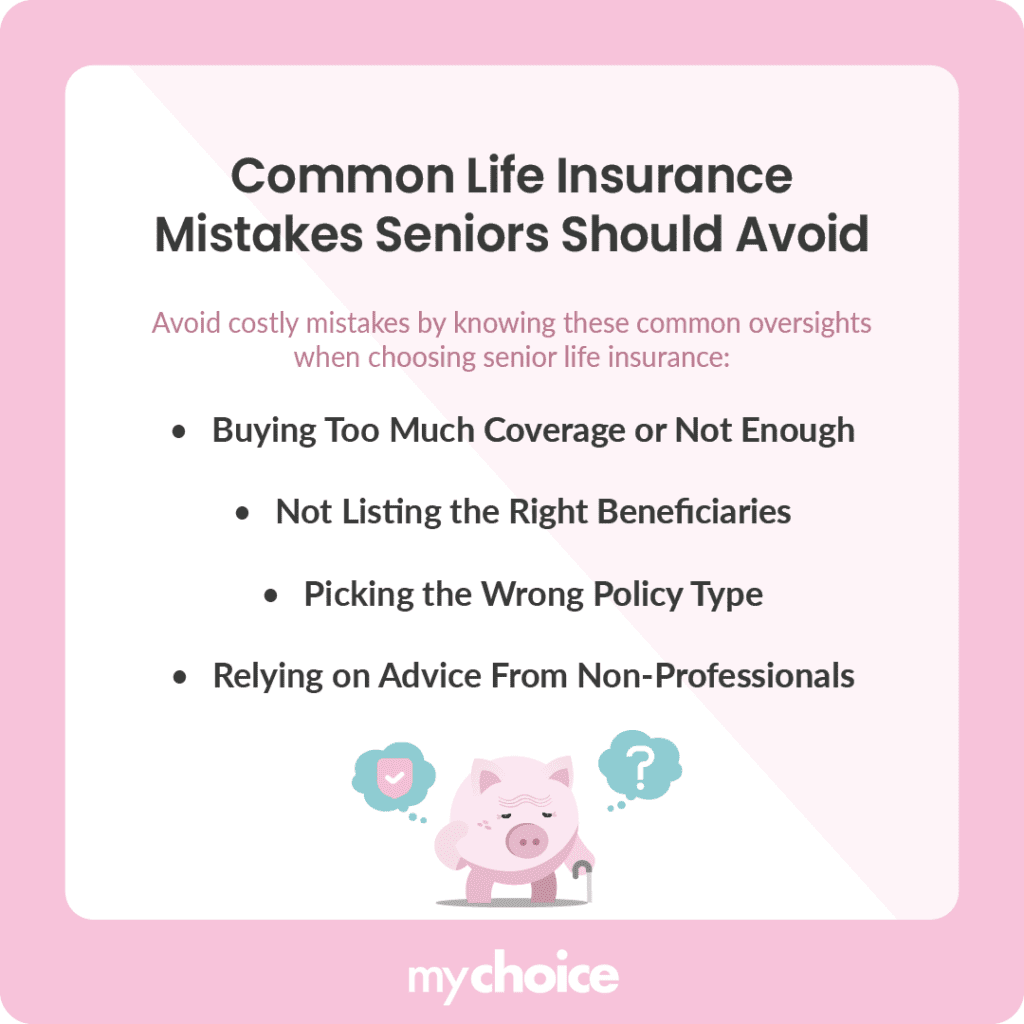

Costly Life Insurance Mistakes Seniors Should Avoid

Choosing a life insurance policy can be complex, and getting the wrong senior life insurance policy can be a costly mistake. Here are some common yet overlooked mistakes seniors should remember when shopping for life insurance.

Key Advice from MyChoice

- Consider why you need life insurance to determine how much you should spend on a policy. Review your financial responsibilities, such as paying off a mortgage or leaving money for a spouse, child, or other family member.

- Choose a term life insurance policy instead of a whole life policy. Term life insurance policy is cheaper and provides coverage for an appropriate amount of time.

- Make sure to update your beneficiaries every few years, especially if there is a death in the family or you go through a significant life change like a divorce.

- Work with a licensed insurance professional to weigh your options. Always compare quotes between different insurance providers to get the best value.