Many assume that as long as they’re young and in good health, there’s no point in rushing to buy life insurance. As a result, they often put off securing lower insurance premiums while they still can. They often overlook that aging comes with higher costs and may not realize that life insurance can be a worthwhile investment.

While it’s not the right choice for everyone, life insurance can help people plan for future financial obligations. Delaying it could mean missing out on potential benefits and leaving yourself financially exposed down the line.

Keep reading to discover how you can prevent costly increases in life insurance premiums and how to proactively plan comprehensive coverage.

Why People Procrastinate Buying Life Insurance

Life insurance can be a vital safety net for your family, covering essential expenses and outstanding debts after your passing. It helps ease the financial burden and provides stability when they need it most. Here are the top reasons why, despite this, many individuals still tend to push back investing in this financial cushion:

The Consequences of Delaying To Buy Life Insurance

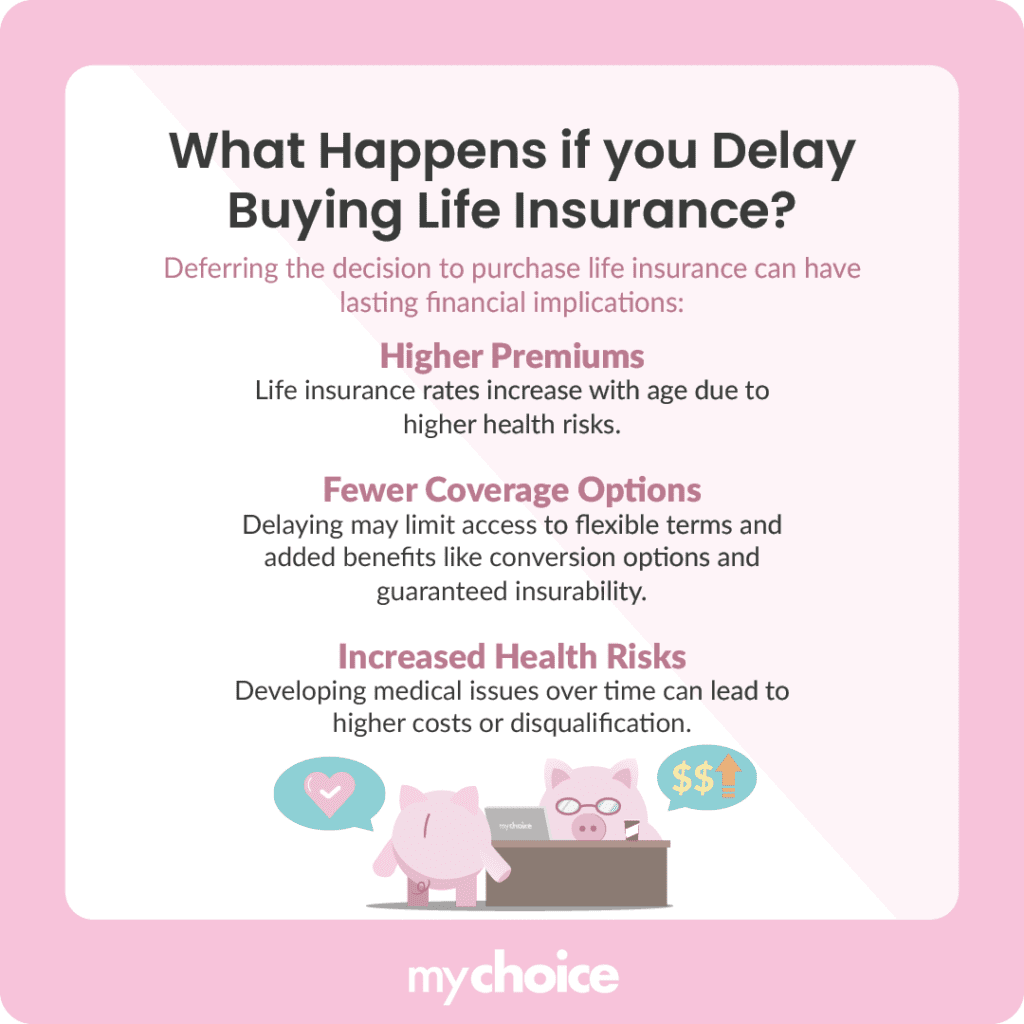

Deferring the decision to purchase life insurance can have lasting financial implications:

How Much Can Waiting To Buy Life Insurance Cost You In The Long Run?

Below is a summary of the average increase in life insurance policy costs from one age group to the other. This is based on a $500,000 coverage policy for non-smoking policyholders in Ontario, categorized by gender. The policy premiums rise significantly with age, underlining the importance of getting life insurance while young.

Term 10 Monthly Premium Changes

| Age Group | Average Premium Increase (Men) | Average Premium Increase (Women) |

|---|---|---|

| from 20-29 to 30-39 | +2.79% | +4.69% |

| from 30-39 to 40-49 | +25.01% | +30.43% |

| from 40-49 to 50-59 | +112.89% | +96.79% |

| from 50-59 to 60-69 | +179.11% | +174.63% |

Note: Securing a Term 10 policy in your 20s or 30s offers cost-effective coverage while you’re still young and healthy, whereas individuals in their 50s or older should evaluate their financial obligations and determine if a longer-term policy would be a better fit.

Term 20 Monthly Premium Changes

| Age Group | Average Premium Increase (Men) | Average Premium Increase (Women) |

|---|---|---|

| from 20-29 to 30-39 | +2.30% | +7.47% |

| from 30-39 to 40-49 | +52.72% | +56.09% |

| from 40-49 to 50-59 | +154.80% | +137.87% |

| from 50-59 to 60-69 | +198.72% | +212.11% |

Note: A Term 20 policy can offer a balance of affordability and coverage for those in their late 30s or early 40s, while those nearing retirement should reassess their financial needs and coverage requirements.

Term 30 Monthly Premium Changes

| Age Group | Average Premium Increase (Men) | Average Premium Increase (Women) |

|---|---|---|

| from 20-29 to 30-39 | +28.82% | +32.34% |

| from 30-39 to 40-49 | +95.67% | +98.23% |

| from 40-49 to 50-59 | +165.39% | +150.48% |

| from 50-59 to 60-69 | N/A | N/A |

Note: Securing a term life insurance policy can be difficult for those over 60 due to higher risk factors. If you’re under 40 with long-term financial commitments like a mortgage or children’s education, a 30-year term policy offers affordable protection. Older applicants may need to consider shorter-term or permanent options.

How To Get Started Today

Getting life insurance doesn’t have to be complicated. With the right approach, it can be a smooth process. Here are some practical steps to help you get started.

Key Advice From MyChoice

- Choose a permanent life insurance policy for long-term financial planning with living benefits.

- Consult a financial advisor to determine the most cost-effective option for your needs. They can help you choose the right policy based on your financial goals.

- Compare policy fees, premiums, and other costs against its potential financial gains. If you already have an existing policy, review it regularly to use it optimally.

- Borrow only what you can afford to repay. Regularly monitor the loan balance and ensure your policy doesn’t lapse.