When you take out a life insurance policy, you’ll be tasked with naming primary and contingent beneficiaries. Many individuals know the importance of naming primary beneficiaries for life insurance policies and estate plans, but it can be just as important to understand the role contingent beneficiaries play in your estate plan.

What are contingent beneficiaries? Why should you include them in your life insurance policy? What are the differences between primary and contingent beneficiaries? Read on to learn about the nuances of contingent beneficiaries in life insurance and when they can receive a life insurance payout.

What’s the Role of a Contingent Beneficiary in Life Insurance?

Life insurance is more than just a financial safety net, it’s also a strategic tool for estate planning. In a life insurance policy, the contingent beneficiary is the individual or entity you designate to receive the benefits of a policy if the primary beneficiary is either unable or unwilling to accept them.

This secondary designation provides additional security for your life insurance policy. If any of your primary beneficiaries can’t receive the death benefit, the contingent beneficiary can ensure that the intended financial support can still be utilized as you intended. Designating a contingent beneficiary (conditions apply) in your policy helps guarantee that your financial legacy is delivered to its intended recipients without unnecessary delays or legal entanglements.

Primary vs Contingent Beneficiary

Before you designate primary and contingent beneficiaries in your life insurance policy, there are a few key differences you should be aware of:

| Category | Primary Beneficiary | Contingent Beneficiary |

|---|---|---|

| Definition | The first-choice recipient of the death benefit upon the policyholder’s passing. | The backup recipient who receives benefits if the primary beneficiary is not able to claim them. |

| Activation | Immediately receives benefits upon the policyholder’s death, as long as they are eligible. | May only receive benefits if the primary beneficiary is unavailable, deceased, or declines the benefit. |

| Legal Priority | Holds the highest legal priority in receiving the benefit. | Holds a secondary priority, activated after the primary beneficiary’s disqualification. |

| Review Frequency | Often prioritized during life insurance policy reviews as part of estate planning. May change with life events. | Can be overlooked during routine reviews, but is still important for ensuring estate continuity. |

| Potential for Conflict | Less prone to legal disputes. | Needs clear designation to avoid conflicts and disputes in case of unexpected circumstances. |

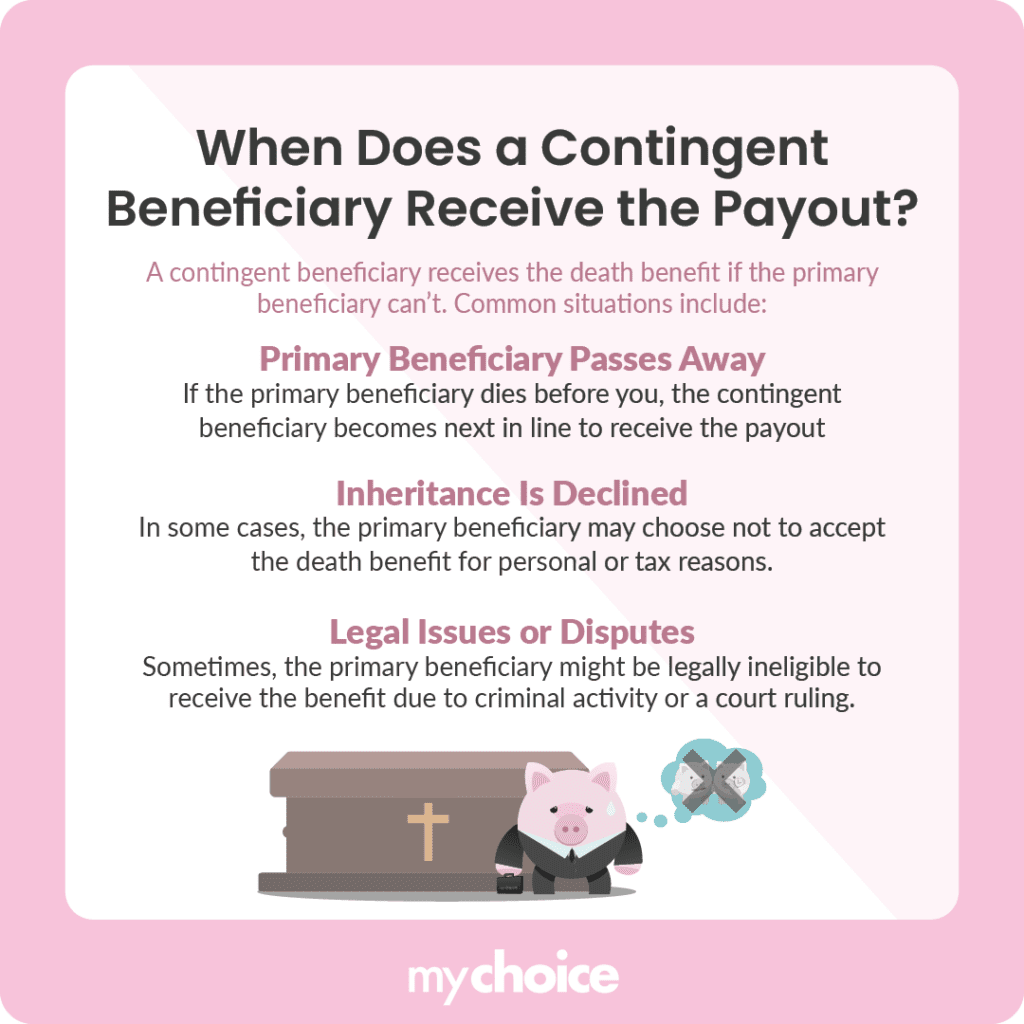

Situations Where a Contingent Beneficiary Might Step In

There are a few situations where a contingent beneficiary might need to step in to receive a death benefit. Here are some of those scenarios:

“Per Stirpes” vs. “Per Capita” Designations

When structuring beneficiaries in your policy, the terms “per stirpes” and “per capita” are often used. These are legal designations that determine how the benefits are divided among descendants. They are particularly relevant in complex family scenarios where you want to designate how a death benefit will be distributed among certain groups.

Red Flags for Policyholders to Monitor

Your family may face unnecessary financial stress if your life insurer can’t pay out on a policy promptly due to liquidity issues. While life insurers in Canada are subject to stringent regulatory oversight, policyholders should watch for indicators of potential liquidity issues, including:

Choosing between these two can have significant implications for how your legacy is distributed, especially in blended families or when multiple generations are involved. The per stirpes designation typically offers a more structured approach that maintains the intended generational balance, whereas per capita can be simpler but may not reflect the nuances of family relationships and contributions.

Revisiting and Updating Your Beneficiaries

Estate planning is not a one-time event: it requires periodic reviews to adjust to changes in your personal life and financial circumstances. Regularly revisit your beneficiary designations to make sure your estate plan remains aligned with your current wishes and life situation.

It is a good idea to review your life insurance policy after major life changes. Your priorities and financial plans can change drastically because of events like:

- Marriage

- Divorce

- Having children

- The death of a beneficiary.

As your family and financial situation evolve, so should your beneficiary designations. This can involve updating the names on your policy as well as revisiting the type of designation that best suits your current family dynamics.

Formally documenting any changes made to your life insurance policy is essential to minimize the risk of disputes or conflict after your passing. Remember to clearly communicate your decisions to trusted advisors and family members as well. Taking a proactive approach to documentation and communication helps to preserve your legacy and provide your loved ones with a roadmap that reduces stress during a time of loss.

Key Advice from MyChoice

- Establish both primary and contingent beneficiaries to create a comprehensive safety net. This ensures that your death benefits are distributed as intended, regardless of unforeseen changes in your family dynamics or personal circumstances.

- Revisit your beneficiary designations regularly, especially after significant life events. Depending on your financial situation and intentions, consider whether to name a beneficiary as revocable or irrevocable.

- Consider your family dynamic and intended beneficiaries when deciding whether to apply a per stirpes or per capita designation for your life insurance.