In Canada, continuous vehicle coverage is a legal requirement. However, drivers may occasionally find lapses in their car insurance history due to missed payments, shifting insurers, or periods of low usage.

Whatever the reason, lapses in your car insurance history can lead to significant consequences, including higher premiums or legal debacles. Explore what happens when there’s a break in your car insurance and what you can do to avoid the consequences.

Why Insurers Care About Lapses in Coverage

Insurers care about coverage lapses because they perceive the policyholder as a higher risk. Think of it like credit scoring: On average, people with higher credit scores have fewer and smaller claims. The same goes for auto insurance. Why insurers perceive you as a higher risk might be because of the following reasons:

The Underwriting Process and Lapses in Coverage

The underwriting process is critical to how insurance companies price policies for drivers. One of the factors insurers consider most heavily during this process is a driver’s insurance history.

Gaps in coverage can raise red flags because they suggest that a driver may struggle to maintain their policy or imply a higher likelihood of filing a claim. These gaps can cause insurers to raise premiums, and some companies may be reluctant to provide coverage altogether.

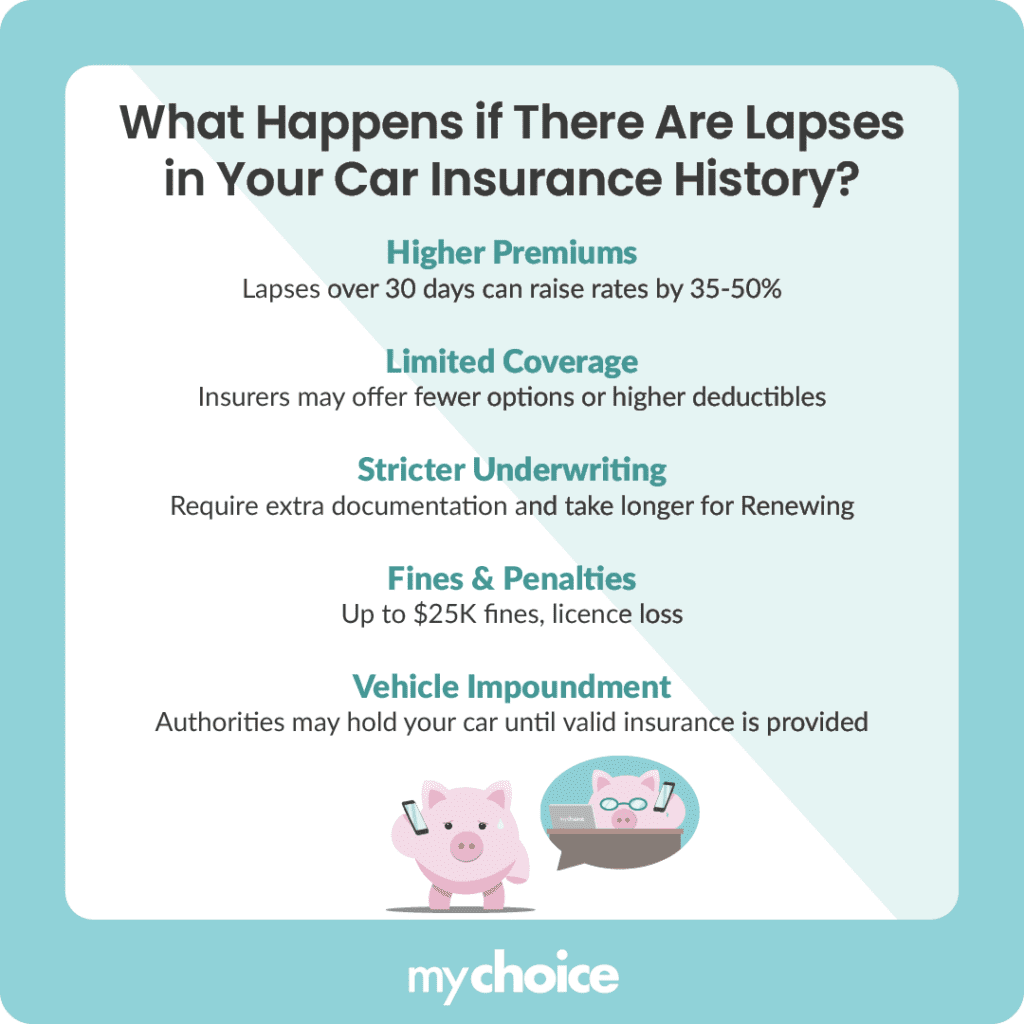

What Are the Consequences of Lapses in Your Car Insurance History?

Lapses in car insurance history can significantly impact your insurance premiums and coverage options. Here’s a breakdown of the potential impact of frequent lapses.

How to Keep Your Insurance History from Lapsing

Keeping your insurance history updated is vital to avoiding legal and financial consequences. Here’s what you can do to keep your insurance history from lapsing.

Key Advice From MyChoice

- Be meticulous when documenting your proof of insurance. Keep a folder of your past insurance policies, proof of address, and a comprehensive driving record.

- Consider working with a broker or agent to help you track your policy. They can also help you find the most competitive insurance rates.

- Check for policy gaps when changing vehicles or consider transferring coverage from one vehicle to another.

- Get non-owner car insurance if you plan to drive a vehicle that isn’t yours. This can be helpful if you’re driving a friend or family member’s car. Alternatively, if you can’t pay for a policy, stay on a family policy for the short term.