Updating the address on your car insurance policy is a small but necessary step to take when you move homes. What are the steps to change the insurance address on your auto insurance policy? How does your address affect your insurance premiums? Let’s find out in this deep dive on changing your car insurance address in Canada.

Performing a change of address for car insurance is a fairly straightforward process that can change how high your auto insurance rates are. It’s important to make sure that your address is accurate, otherwise, you can face penalties from your insurance providers or even jail time for insurance fraud.

How Do I Change My Address on My Car Insurance Policy?

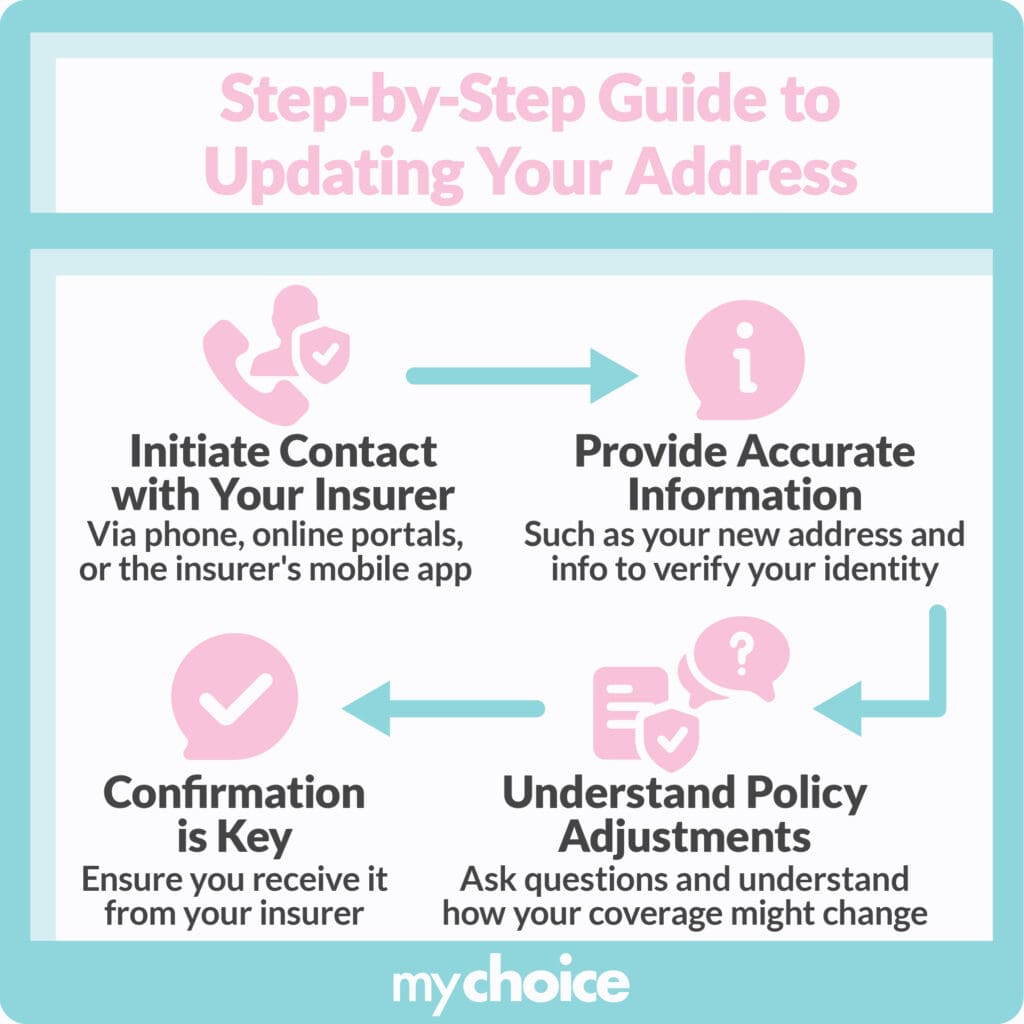

Performing a car insurance change address is a fairly simple process. Here’s the step-by-step guide on how to change your address on your insurance policy:

- Contact your insurance provider: Depending on the avenues your insurance provider offers, you can contact them through phone, mobile app, or online portal.

- Provide accurate information: Be sure to clearly communicate your new address and when you’re moving. If your insurance provider has a mobile app or online portal, you can easily update your address by changing your details on your profile.

- Understand policy adjustments: Depending on where you’re moving, your insurance rates may be adjusted. You can clarify the possible changes in your policy by calling your insurance provider. If you’re moving to a place where your current provider doesn’t provide coverage, you may need to switch insurance providers entirely.

- Make sure your change of address is confirmed: When you’ve changed your address on your car insurance policy, be sure that you get a confirmation from your insurance provider about your address change and any adjustments to your insurance premiums.

Regardless of the method your insurance provider offers for changing your car insurance address, it should only take a little bit of time to accomplish. Being on top of changing your auto insurance address will save you a headache later on, so it’s highly recommended that you do this as soon as possible.

Do I Need to Update My Address on My Car Insurance Policy?

Yes, you need to update your address on your car insurance policy when you’re moving homes. Just like updating your vehicle registration address and driver’s license address, this is a necessary step to perform if you want to avoid unforeseen consequences.

Your insurance premiums can increase or decrease depending on where you’re living, so keeping your insurance provider updated with your current address is necessary to get an accurate rate on your insurance premiums.

How Does Changing My Address Affect My Insurance Premiums?

Changing your address can change how much you pay for your insurance premiums. One of the biggest factors insurance companies use to determine your insurance premiums is where your car will usually be driven. Big cities like the Greater Toronto Area will command higher insurance rates since there’s a higher volume of drivers and traffic accidents, while quieter provinces like New Brunswick will result in lower insurance premiums.

Even moving between neighborhoods can affect your insurance premiums. Two areas in the same city can have vastly different insurance rates due to the incidence of car theft, vandalism, and traffic incidents in the area. Generally, addresses in nicer neighborhoods or gated communities will have lower premiums compared to addresses in downtown urban areas. However, addresses in quiet areas with low crime rates and lower populations tend to result in much lower insurance premiums.

Does My Home Address Need to Match My Car Insurance Address?

Your home address does not need to match your car insurance address. However, this is only valid for specific cases, like if you’re on your parents’ insurance policy but you’re living somewhere else for university and driving your car there.

This doesn’t mean that you should be lying about your address to get cheaper insurance premiums. There can be some heavy penalties if your insurance provider finds out that you’ve been using a false address for your car insurance policy.

What are the Consequences of Lying About Your Car Insurance Address?

It can be tempting to use a different address on your car insurance policy to save a few bucks. But insurance providers have a number of ways to find out if you’re lying about the information on your insurance policy. If they find out that you’re using a false address for your car insurance, there can be some heavy consequences:

- Insurance claim denial: In the event that you file an insurance claim, a false address can give your insurance provider the grounds to deny your claim. This means that you’ll have to cover any costs incurred out of your own pocket.

- Higher insurance premiums: If your insurance provider finds out that you’re lying about your address on your insurance profile, they can levy penalties in the form of higher insurance premiums. Even if you decide to switch providers, you’ll still face higher premiums.

- Black mark on your profile: Insurance companies like to share information with each other, like the insurance profiles of certain policy holders. If you lie about your address on your insurance profile, that can lead to a black mark being applied to your profile, which makes it very hard to find an insurance provider to take out an auto insurance policy in the future.

- Policy cancellation: Your insurance provider can choose to cancel your policy altogether if they deem that you’ve lied egregiously on your insurance profile. This can lead to you not being able to legally drive your car, and make looking for future auto insurance policies after cancellation extremely difficult and expensive.

- Insurance fraud charge: In extreme cases, your insurance provider can charge you with insurance fraud. This is a criminal charge which can lead to a lengthy court case and a criminal record if convicted.

Do I Need to Change Auto Insurance Providers if I’m Moving to a Different Province?

Some auto insurance providers don’t offer policies to customers in certain provinces, so you may need to switch insurance providers if you’re moving to a province that your original insurance provider doesn’t cover. It’s best to check with your current provider if they offer coverage in the province you’re moving to.

Key Advice From My Choice

Now that we’ve gone through how to change your address on your car insurance policy and why it’s important, here are some key pieces of advice:

- Contact your insurance provider immediately to update your address when you move homes. You can update your address through a mobile app or online portal if your provider offers those options.

- Your insurance premiums can increase or decrease depending on the area you move to. Densely populated urban areas typically have higher rates than less-populated rural towns.

- Provide accurate information. Using a fake address to save on insurance costs can result in huge consequences in the long run.

- If you’re moving provinces, check with your provider if they offer coverage to that specific province. Otherwise, you may need to switch insurance providers once you move.