Cash value life insurance is a type of permanent life insurance that includes both a death benefit and a cash value component – but it goes a little bit deeper than just that.

Unlike term life insurance, which provides coverage for a specific period, cash value life insurance remains in force for the policyholder’s lifetime as long as premiums are paid. This more comprehensive coverage offers both a financial safety net for beneficiaries and a savings or investment vehicle for the policyholder.

Cash Value Life Insurance Explained

If you’ve ever found yourself wondering “what is cash value life insurance, exactly?” then you’ve come to the right place.

Simply put, cash value life insurance is an umbrella term used to refer to whole life policies that contain a cash value component. It combines the traditional death benefit (the amount paid out to beneficiaries upon the policyholder’s death) with an investment or savings element.

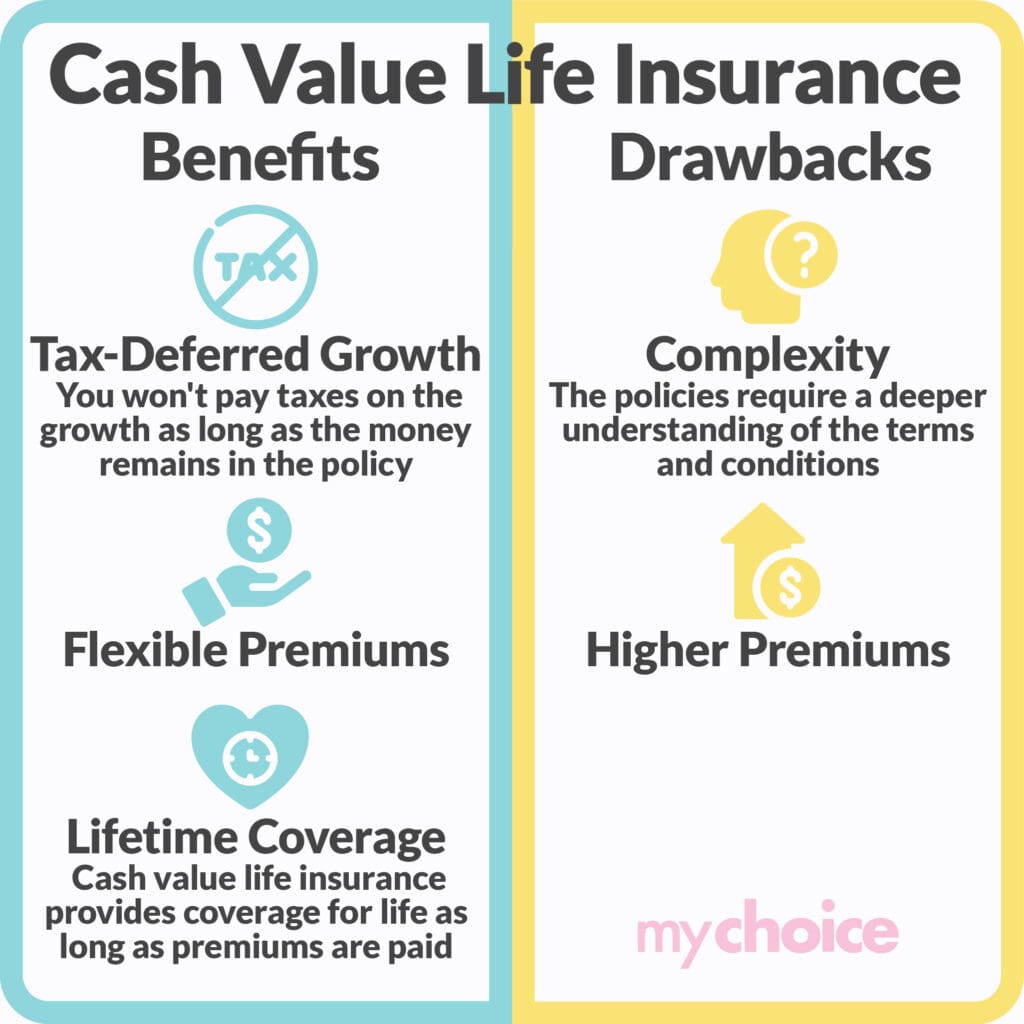

Because of this, premiums for cash value life insurance in Canada can be higher than their term life counterparts. As you make these regular payments, the policy’s tax-deferred cash value begins to grow. It’s kind of like making small deposits into the policy on top of paying off the premiums and interest. The growth rate depends on the type of policy and the insurer’s terms.

How to Withdraw from The Cash Value

The cash value of a life insurance policy can be accessed by the policyholder during their lifetime, providing a versatile financial resource that can be used for various purposes.

Policyholders can access the cash value of their life insurance in several ways:

Surrendering A Policy For Cash Value

Policyholders have the option to “surrender” their insurance policy, which basically means you’ll be terminating it before anything is actually paid out. This can be done to access the plan’s full cash value, but it doesn’t come without a few drawbacks. Surrendering a policy often comes with penalties and fees, particularly in the early years of the policy. This is on top of any taxes you’ll also have to pay.

But if you’re past the point when surrendering your policy incurs large fees because of the plan’s age, you’re able to choose between a lump sum payment or incremental payments. However, some policies don’t allow for this level of flexibility and will have the terms laid out in your contract.

Different Kinds of Life Insurance With Cash Value

Cash value components are quite attractive to many people, but they’re a little bit different depending on the kind of policy you end up purchasing. Here are some of the most common life insurance policies that include a cash value element:

Key Advice from MyChoice

- Cash value life insurance provides both a death benefit and a savings component.

- It’s a very versatile tool for providing for your family while serving as a financial safety net.

- Different kinds of cash value policies have disparate terms, so researching before buying is essential.