Linking Auto Theft Spike to Record-High Insurance Premiums Across Ontario Cities

Ontario is confronting an alarming escalation in auto theft, with the Toronto Police Chief reporting a doubling of last year’s carjacking cases just three months into 2024. The most recent analysis of the Ministry of Transportation data reported by The Trillium looks into Ontario carjackings from November 2021 to January 2024. Around 40,510 vehicles have been reported stolen in just over two years. This staggering figure averages out to more than 50 thefts daily. According to the report posted by the Insurance Bureau of Canada, auto thefts cause car insurance premiums to rise by an average of $130 annually for Ontario drivers. The recent uptrend in auto thefts not only heightens the financial burden on vehicle owners but also signals a troubling trend that could further disrupt the auto insurance landscape.

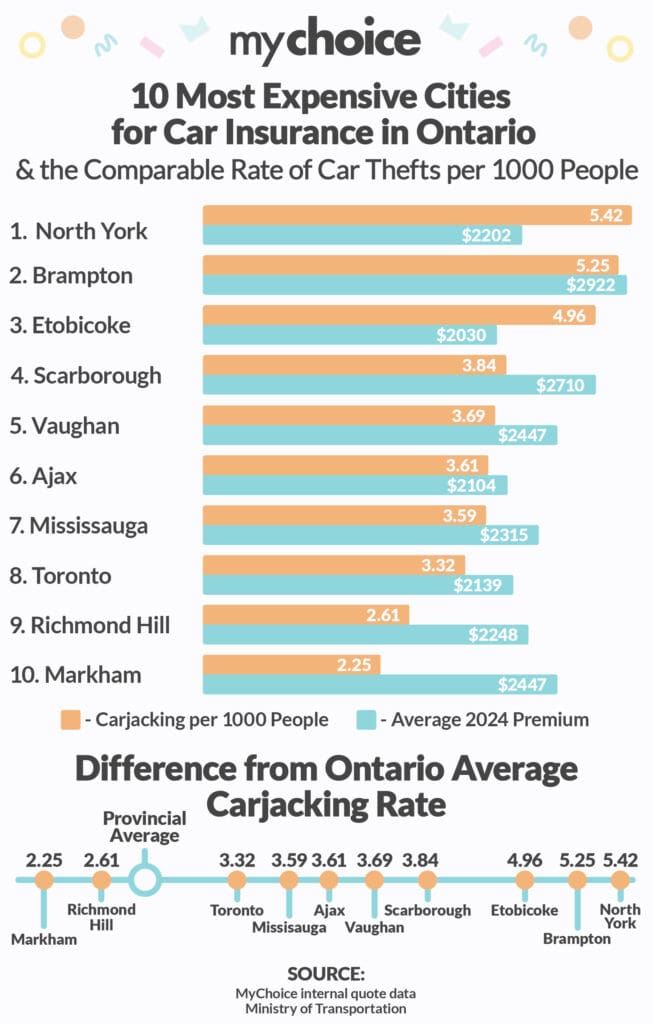

In response to this concerning trend, our team has conducted a study using both our internal quote data and the Ministry of Transportation data to determine the correlation between carjacking rates and auto insurance premiums across Ontario cities. We looked at the carjacking rates across the Ontario cities with a population size of over 100,000 people and compared those to the monthly insurance premiums across the same cities.

Brampton recorded one of the highest carjacking rates at approximately 5.25 incidents per 1,000 residents, and it also consequently leads the list of most expensive car insurance premiums at nearly $2,922 monthly. Etobicoke and Scarborough follow, with the theft rates of 4.96 and 3.84 respectively, and corresponding premiums of about $2,030 and $2,710.

What stands out, however, is the situation in Markham and Richmond Hill, both of which, despite being among the most expensive for car insurance – with premiums around $2,447 and $2,248, respectively – are below the Ontario average for carjacking incidents. This discrepancy suggests that while theft rates significantly influence insurance prices, they are not the sole determinant, and other factors such as collision rates, population density and road conditions impact the rates in these areas.

Aren Mirzaian, CEO of MyChoice, underscores the criticality of awareness and informed decision-making for car owners. “As carjackings escalate, so does the urgency for comprehensive insurance coverage. At MyChoice, we aim to empower our users with thorough insights into how such alarming theft rates can affect their insurance costs.”

To mitigate risks and bolster protection, we suggest that drivers opt for comprehensive or all-perils insurance policies. Each offers varying degrees of safeguarding, from covering unforeseen damages to providing extensive coverage, including theft. Ultimately, while the rise in auto theft is a pressing issue, informed choices and adequate insurance coverage can provide substantial relief to car owners in Ontario.

Raw Data:

| City | Carjacking per 1000 residents | Average monthly car insurance premium |

|---|---|---|

| North York | 5.42 | $2,202 |

| Brampton | 5.25 | $2,922 |

| Etobicoke | 4.96 | $2,030 |

| Scarborough | 3.84 | $2,710 |

| Vaughan | 3.69 | $2,447 |

| Ajax | 3.61 | $2,104 |

| Mississauga | 3.59 | $2,315 |

| Toronto | 3.32 | $2,139 |

| Ontario Average | 2.69 | $1,673 |

| Richmond Hill | 2.61 | $2,248 |

| Markham | 2.25 | $2,447 |