Most car insurance policies will list a deductible amount. This is what you agree to pay each time you file a claim.

But how does a car insurance deductible work? What is the ideal deductible amount? How does it impact your premium? In this article, we give you all the info you need to understand car insurance deductibles and if they’re right for you.

What Is a Car Insurance Deductible?

A car insurance deductible is the amount you have to pay every time you file a claim before your insurance kicks in to cover the rest of it.

For example, let’s say that you’re making a claim for a $1000 repair on your car with a $100 deductible. The total amount you can actually claim from your insurer will be $900, and you can only claim it after you pay the first $100. The other $100 will have been “deducted” from the claimable amount (i.e. shouldered by you), hence the term “deductible”.

How Do Car Insurance Deductibles Work?

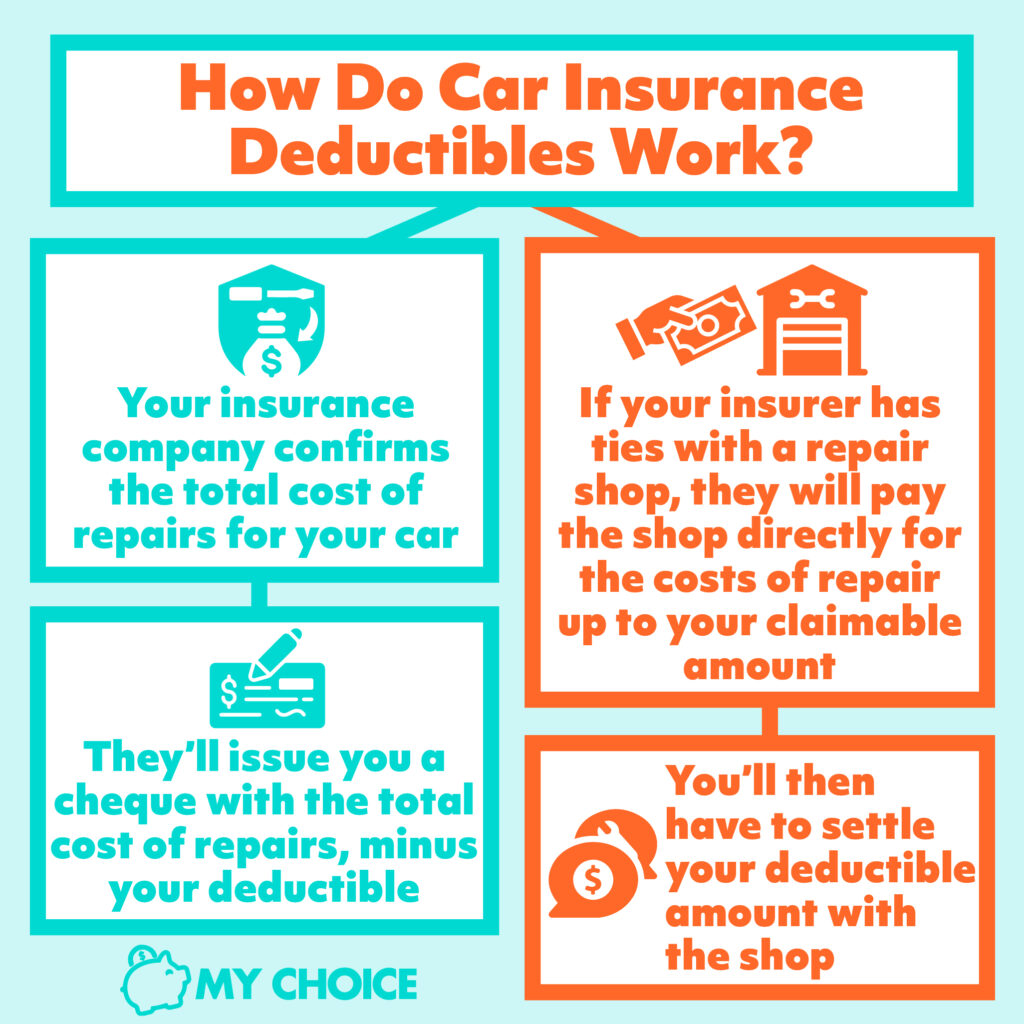

Car insurance deductibles work in two ways:

- After confirming the total cost of repairs for your car, your insurance company will issue you a cheque amounting to the total cost of repairs, minus your deductible.

- Many insurance companies have ties with repair shops, and going to one of them could make the claims process easier. In these cases, your insurer will pay the shop directly for the costs of repair up to your claimable amount. You will then have to settle the rest (your deductible amount) with the shop upon picking up your car.

In both cases, while your insurer will shoulder the brunt of the cost, the deductible amount will come from you.

When Do You Pay Deductible Car Insurance?

You pay deductible car insurance each time you file a claim.

Having a deductible can be helpful for costly repairs, as it establishes a “ceiling limit” to how much you’ll have to shell out, while your insurer covers the rest. But how about for instances where the cost of repairs totals less than your deductible?

Insurers take your deductible into account before shouldering any costs. Thus, if your deductible is higher than the cost of repairs, it may be more economical to just pay out of pocket instead of filing a claim.

In this sense, when you file a claim, the deductible is both the “ceiling limit” (i.e. the maximum you pay when filing) as well as the “floor limit” (i.e. the minimum amount you have to pay when filing).

Types of Auto Insurance Deductibles

Some of the most common types of auto insurance deductibles are:

- Collision insurance deductible: Collision insurance covers the cost of repairing or replacing your vehicle if it gets damaged in an accident. Your deductible depends on whether you were at fault or responsible for the accident. If you were the one at fault, you will be charged the full deductible amount. If you were involved but not the party at fault, you will only be deducted a partial amount.

- Comprehensive insurance deductible: Comprehensive insurance covers repairs or replacement of your car in the case of other types of damage, such as vandalism, fire, or theft. When filing a comprehensive insurance claim, you will always be deducted the full amount.

- Disappearing deductible: A disappearing (or vanishing) deductible can be added on top of your coverage to further lower the cost of your premium. For each year you do not file, your payment is reduced by a percentage, which varies per insurer. However, take note that not all insurers offer this option, and if they do, you will need to qualify to apply.

These are just some of the different types of auto insurance deductibles out there. Make sure to talk to your insurance broker and ask the right questions so you can get the best deal for you.

Should You Get Deductible Car Insurance?

Whether or not you should get deductible car insurance is ultimately up to you. One advantage of getting deductible car insurance is that it can actually lower your insurance premiums.

In a nutshell, you can think about insurance premiums and insurance deductibles having an inverse relationship. That is, when one goes up, the other goes down. Your insurer may offer lower premiums if you agree to pay a higher deductible, which could save you money in the long run. If you don’t see yourself filing claims that often, this might be a good arrangement for you.

On the other hand, having a higher deductible means that you’ll have to shell out more each time you make a claim. Remember also that your deductible is considered first when making a claim, so setting your deductible too high could work against you in practice.

Here’s an example: let’s say you get involved in an accident and the total cost for repairs totals less than your deductible. When you file a claim with your insurance company, that deductible amount will still be charged to you in full. In this situation, it would be more economical to pay for the whole repair out of pocket.

Having deductible car insurance could benefit you by lowering your monthly premium, but setting it too high could defeat the purpose of having it in the first place.

Factors to Consider When Setting Your Car Insurance Deductible Amount

Here are some factors to consider when setting your car insurance deductible amount:

Financial Capacity

As the policyholder, you have the liberty to set your deductible amount. Ask yourself how much you can budget each month for your insurance premium. Can you afford to pay a little more? Or do you need more cushion for daily expenses? Try to picture yourself making an insurance claim, too. Will you be able to pay the deductible?

Take the time to consider your financial situation so you can set a realistic deductible insurance amount. In addition, many insurance companies offer alternative solutions for folks who can’t afford car insurance.

Location

If you live in a big city like Toronto or Montreal, the chances of getting into a car accident are greater than if you live in a sleepy, rural town. If your area doesn’t see a lot of car accidents, increasing your deductible might be a good idea.

Being in a low-traffic area means that you’re less likely to get in an accident and file a claim. And with a higher deductible, your premiums will be decreased — meaning, more savings for you in the long run.

Frequency of Claims

Since you’ll have to pay the deductible amount each time you make a claim, you should assess how often you see yourself making insurance claims. If you live in a high-traffic area with lots of cars or get into a lot of accidents, lowering your deductible might be your best option. You’d have to pay a higher premium, but at least you wouldn’t have to shell out as much on each repair, especially for small damages.

The Bottom Line

There are many factors to consider when deciding if a car insurance deductible would be helpful to you. You’ll have to assess your financial situation, the traffic situation in your area, your driving history, and other things.

With these things in mind, you can be confident when navigating the tricky world of car insurance and have a policy that works for you even before you hit the road.