The life insurance industry in Canada is experiencing significant growth, marked by a notable year-over-year increase in applications. This surge comes from several factors, including heightened awareness of financial security, economic uncertainties, and shifts in age demographics.

How much is the life insurance industry growing? What type of policy is the most popular right now? Read on to find out all you need to know about the increase in Canadian life insurance applications in 2024.

Understanding the Double-Digit Growth Across Age Groups

The growth in life insurance applications is not uniform across all demographics. Recent statistics indicate that individuals aged 61 and older are driving much of this surge, with double-digit growth rates reported in this age group. Here’s a comparison of how much each age demographic has grown in terms of life insurance purchased year-to-date, according to the data provided by the MIB group:

| Age range | 0-30 | 31-50 | 51-60 | 61-70 | 71+ |

|---|---|---|---|---|---|

| Percentage growth compared to 2023 | 4.6% | 1.2% | 6.3% | 37.8% | 118.7% |

While there are still decent increases in life insurance purchases from consumers under 60, the age group driving the surge is the 60+ age bracket. This divergence highlights the fact that many older Canadians are increasingly prioritizing life insurance as they approach retirement and seek to ensure their loved ones are financially protected.

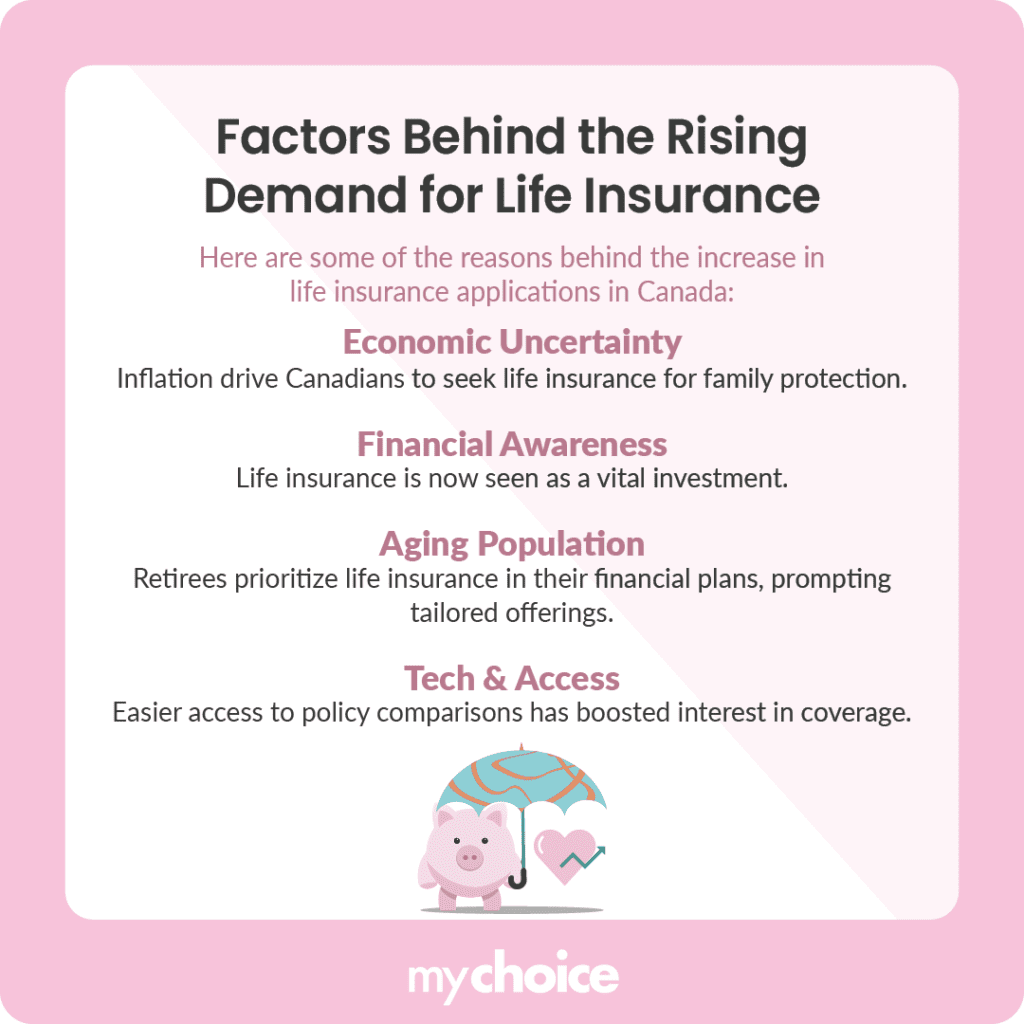

Factors Behind the Rising Demand

The surge in life insurance purchases are a boon to the insurance industry driven by several factors. Here are some of the reasons behind the increase in life insurance applications:

Collectively, these factors signal an environment that’s conducive to the continued growth of the life insurance sector. As education on life insurance as a financial instrument becomes more accessible, it’s predicted that many more Canadians will seek life insurance policies to secure their family’s futures.

Trends in Term Life, Universal Life, and Whole Life Policies

The Canadian life insurance market exhibits diverse trends across various policy types, with each type having drastically different demands across different age groups.

How to Navigate the Growing Life Insurance Market

As the life insurance market expands with more options available than ever before, knowing what policy is right for you is increasingly important to securing your family’s future. Here are some tips to help you choose the right life insurance policy:

Key Advice from MyChoice

- Whole life insurance is still the top seller for Canadian life insurance, but universal life policies are growing explosively, especially in the 71+ age bracket.

- Taking out a life insurance policy before turning 30 will give you the cheapest premiums due to the decreased risk factor for young people.

- Compare similar policies from different insurers to get an idea of the best deal available for your chosen life insurance policy.