Out-of-pocket expenses for cancer patients are expected to increase by 20.35% in the next decade

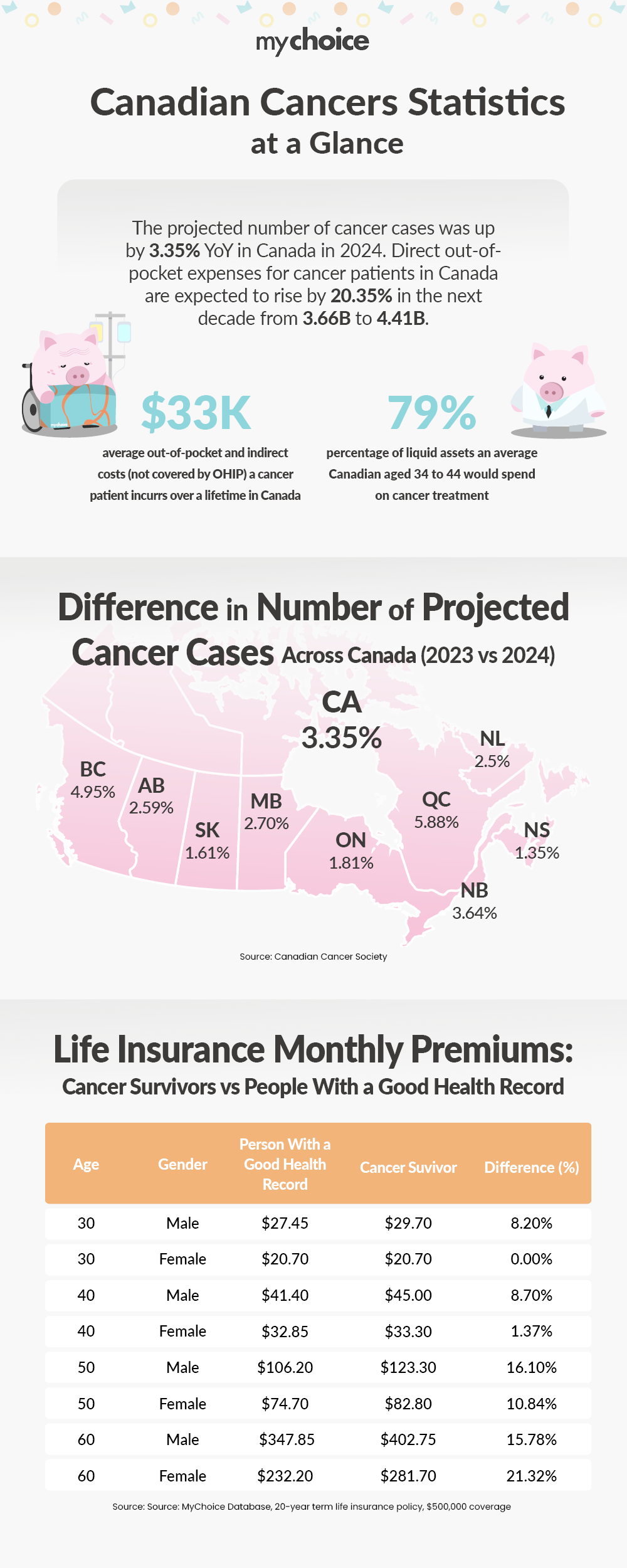

Cancer continues to pose a significant challenge for Canada and its healthcare system. The Canadian Cancer Society reports that the projected number of cancer cases in 2024 increased by 3.35% compared to the data from 2023. The total societal cost of cancer in Canada is estimated to be $37.7 billion, with almost 80%, or $30.2 billion, being covered by the federal healthcare system. However, cancer patients and their families are still expected to cover the remaining 20%, which amounts to $7.5 billion.

A recent survey by the Canadian Partnership Against Cancer revealed that 40% of cancer survivors in Canada have concerns about obtaining life insurance. In response, our team at MyChoice, a leading Insurtech company in Canada, conducted a study to examine the seriousness of this trend and to provide clarity for cancer patients exploring life insurance options.

Below are the key findings from the study:

- According to MyChoice’s internal data, cancer survivors pay 10.29% more in life insurance premiums in Canada than people with a good health history.

- The average cancer patient faces nearly $33,000 in out-of-pocket expenses (not covered by OHIP) and lost income during their treatment and recovery. This represents approximately 79% of all liquid assets that an average Canadian aged 35 to 44 has, excluding their pension assets.

- Direct out-of-pocket expenses for cancer patients are expected to increase by 20.35% over the next decade, from $3.66 billion to $4.41 billion. These expenses include transportation, travel, accommodation, medications, vitamins and supplements, devices and equipment, professional homecare, and caregiving, as well as clinical medical visits.

- Cancer patients can still obtain life insurance, although they might face limited options and higher premiums. Options like guaranteed issue life insurance and simplified issue life insurance do not require a medical exam during the application process, which can be advantageous for cancer patients.

- The projected number of cancer cases in 2024 rose by 3.35% in Canada. The largest increases were observed in Quebec (5.88%), British Columbia (4.95%), and New Brunswick (3.64%).

Matthew Roberts, COO of MyChoice, shares his perspective on the role of life insurance in financial planning: “Life Insurance can help mitigate some of the out-of-pocket expenses that will come with cancer treatment. If you’re diagnosed with cancer after purchasing a life insurance policy, your coverage will remain active as long as you continue to pay your premiums. The insurer cannot cancel or increase your premiums because of the diagnosis. This underscores the importance of obtaining life insurance while you’re young.”

If you own a life insurance policy upon your cancer diagnosis, your policy can offer financial support to you and your family in several ways:

Navigating life insurance with a history of cancer requires a nuanced approach. Despite the challenges, the availability of diverse insurance options, from guaranteed issue to term life and critical illness insurance, ensures that financial security is attainable. It’s all about finding the right fit, and our goal is to illuminate that path.

Below is a summary of the insurance options available to people after a cancer diagnosis:

| Policy Type | Eligibility/Criteria | Max Coverage Amount | Premiums | Medical Exam/Questionnaire |

|---|---|---|---|---|

| Guaranteed Issue Life Insurance | – Currently diagnosed with cancer – Recent remission | $25K – $50K | High | Not Required |

| Simplified Issue Life Insurance (No Medical) | – Some health issues but not severe – May be declined for term life | Up to $500K | Medium | Not Required |

| Term Life Insurance (for Survivors) | – Remission for 2+ years (varies by insurer) – Good overall health | Up to $5M | Low | Required |

| Group Life Insurance (through employer) | – Currently employed | Varies (often based on salary) | Varies | Typically none |

Canada has made significant progress in cancer care from 2021 through 2024, with new strides in early detection and treatment. Screening programs have expanded drastically in the last few years on the early detection front. According to the Canadian Partnership Against Cancer organization, Canada is implementing lung cancer screening for high-risk individuals nationwide, and cervical screening is shifting from Pap tests to more sensitive HPV-based testing, aligned with the national goal to eliminate cervical cancer by 2040. At the same time, treatment innovations such as immunotherapy are improving patient outcomes – for example, advanced melanoma survival rates have dramatically increased (from around 20% one-year survival to 50% ten-year survival) thanks to immune-based therapies, and Canadian-led trials have shown that adding immunotherapy before surgery can boost cure rates in cancers like bladder cancer.

Addditionaly, in a major leap forward for cancer treatment, thousands of NHS patients in England are set to participate in clinical trials of personalised cancer vaccines– a groundbreaking approach using mRNA technology similar to COVID-19 vaccines. The initiative called the Cancer Vaccine Launch Pad, is rolling out across 30 hospitals and aims to match patients with tailored vaccine trials designed to train the immune system to detect and eliminate lingering cancer cells.