Recent severe weather events have dramatically underscored the vulnerability of Canada’s insurance industry. Catastrophic losses caused by historic storms, floods, and wildfires have strained the resources of insurers nationwide, raising a serious question: how adequate is reinsurance capacity in the country?

The frequency and severity of natural disasters are expected to escalate further, leading insurance experts and companies to reassess how the country manages these risks. Read on to learn how 2024’s losses have impacted the industry, the challenges when getting foreign reinsurance capacity, and the way forward for a stable insurance landscape.

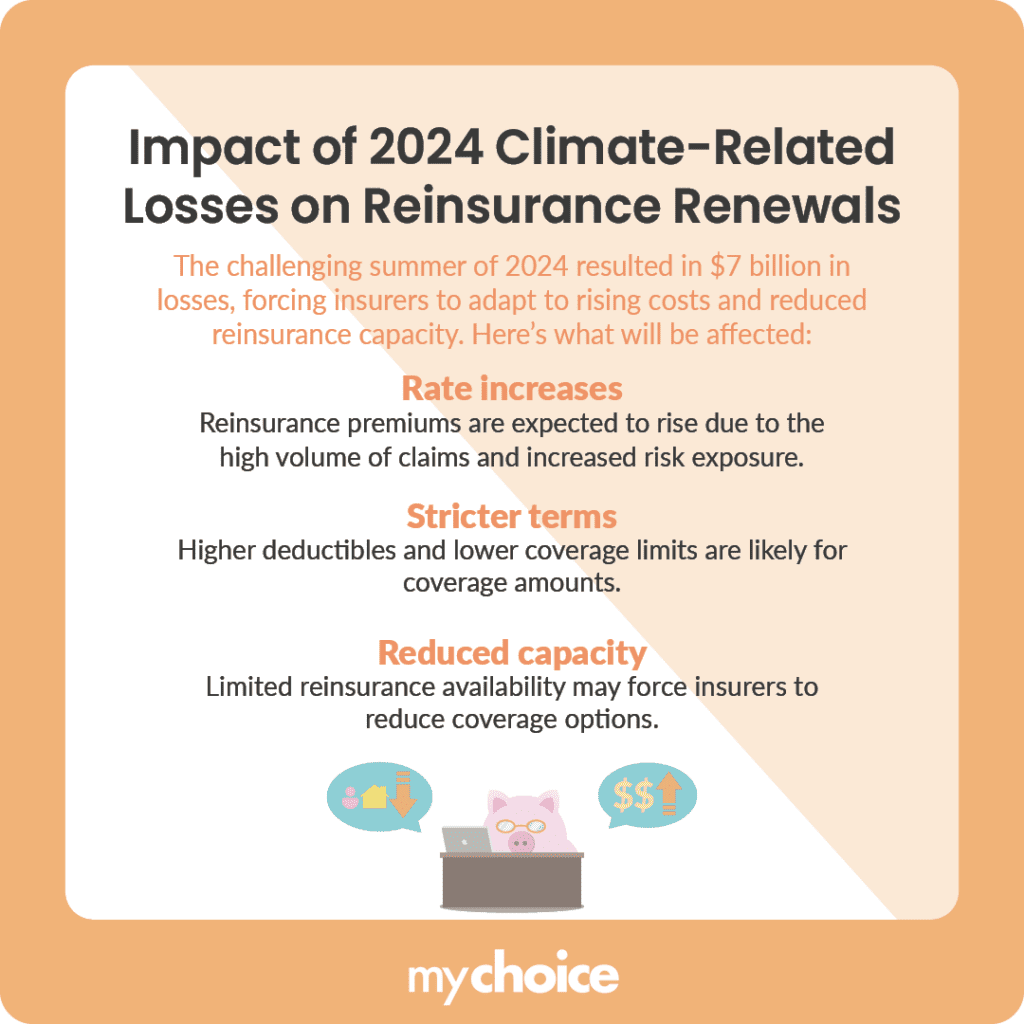

Impact of 2024 Catastrophe Losses on Reinsurance Renewals

The summer of 2024 marked a pivotal moment in Canada, with unprecedented losses due to natural catastrophes significantly shaping the reinsurance landscape. The IBC reported that the events of the summer of 2024 led to insured losses exceeding $7 billion and an estimated 228,000 insurance claims.

Because of this unprecedented increase, insurers urgently need to adapt their strategies in time for upcoming renewals scheduled for January 1, 2025. Industry experts anticipate the following challenges:

Challenges in Attracting Foreign Reinsurance Capacity

Enhanced reinsurance capacity would not only provide insurers with financial backing to cover large-scale losses, but also give policyholders confidence that their claims will be paid. Foreign reinsurers could provide increased capacity, but Canada’s property and casualty (P&C) insurance industry faces several hurdles in attracting international players.

Two of the biggest obstacles are regulatory complexities and compliance burdens. Currently, foreign reinsurers need to tackle these before entering or expanding in the Canadian market:

- Stringent collateral requirements that may not align with global standards

- Complex, time-consuming processes for getting licences

- Extensive reporting requirements that increase operational costs

Other challenges include Canada’s geographic concentration of risk and limited market size. Canada’s risk exposure is concentrated in specific regions, such as wildfire-prone parts of Alberta and flood-prone zones in British Columbia. This concentration increases the likelihood of correlated losses and a high volume of claims from a single event, making the market less appealing to foreign reinsurers.

Apart from regional risk considerations, Canada has a smaller insurance market compared to other regions and countries like the United States or Europe. Combined with the difficulties of complying with Canadian regulations, foreign insurers may prioritize these larger markets instead. As a result, Canadian insurers may struggle to secure enough coverage during a climate-related disaster.

Regulatory Barriers and Business Implications

Canada’s regulatory environment poses significant challenges for both domestic and foreign reinsurers. There are stringent requirements in place – both at present and planned for the future – that increase operational costs and complicate compliance processes. As a result, the Canadian market may be less attractive for international reinsurers.

One such barrier is Guideline B-3 under the Office of the Superintendent of Financial Institutions (OSFI) Guidelines. Set to take effect on January 1, 2025, Guideline B-3 requires detailed Reinsurance Risk Management Policies (RRMPs) which include safeguards like counterparty risk analysis. Guideline B-2, on the other hand, requires robust capital reserves in case of a reinsurer’s default.

Adding requirements for due diligence and capital keeps a system transparent and trustworthy, but for foreign insurers, it may be too costly or operationally challenging to invest in. If these regulations remain set to take effect soon, Canada could struggle in the future with trying to increase its reinsurance through international players.

A Call for Pragmatic Regulatory Approaches

The Canadian market can be made more appealing to foreign reinsurers through practical regulatory reforms. By adopting more flexible compliance measures and reducing unnecessary bureaucratic hurdles, Canada could become more attractive to international reinsurers.

For example, streamlining approval processes or simplifying collateral requirements could encourage foreign reinsurers without compromising standards. This approach won’t just bolster reinsurance capacity in Canada – it will also promote healthy competition within the insurance industry.

Other flexible measures that contribute to regulation and should be considered for adoption include:

The Importance of a Stable Reinsurance Market

Having a stable reinsurance market is key to ensuring fair service to policyholders and maintaining a competitive insurance landscape. As climate-related disasters continue to escalate in frequency and scale in Canada, enhancing reinsurance capacity becomes a high priority for safeguarding against a potential financial crisis.

A strong, secure reinsurance market would provide Canadian insurers with greater financial resilience. This would enable them to manage risks effectively while ensuring that policyholders will receive timely support during catastrophic events. What’s more, a robust reinsurance framework can help reduce the impact of rising premiums on consumers by distributing risk more evenly across various players in the industry.

Key Advice from MyChoice

- Canadian insurers should prioritize investing in risk mitigation initiatives to reduce vulnerability to future catastrophes.

- With the increase in claims because of weather events, many insurers are raising their premiums. Be prepared for potential increases when renewing your home insurance policy.

- If you’re facing rising costs or changes in coverage, consult your insurance company. Ask about any alternative options that maintain necessary protections without breaking the bank.

- Keep an updated inventory of your belongings, along with photos and receipts. This documentation will be key should you ever need to file a home insurance claim.