Canada’s Pharmacare Act (Bill C–64) passed its third reading in the House of Commons on June 3, 2024. Currently headed to the Senate, this bill is considered by many as a big step in giving Canadians access to important medications. Others, however, are concerned that it might disrupt existing workplace drug coverage for an estimated 27 million Canadians and leave them underinsured.

What is the Canada Pharmacare Act supposed to do, and how will it affect life insurance policies? Learn how this important piece of legislation will affect Canadian insurers, policyholders, and existing workplace drug plans.

The Pharmacare Act aims to make pharmaceutical products more accessible and affordable for Canadians, providing universal coverage of prescription drugs nationwide.

Potential Changes for Life Insurance Buyers

The Pharmacare Act doesn’t have any provisions that directly change life insurance policies or quotes. Its coverage extends to public healthcare, not private insurance. However, the Act may indirectly impact life insurance premiums.

By making prescription medications more accessible, Canadians may have better health outcomes that may result in lower life insurance premiums. Critics of the Act, however, have noted that public funding allocations and approval with individual provinces and territories can take a long time before they’re actually implemented.

Public plans also generally provide less coverage than private plans at present. Opponents of the Act have raised the question of how much additional coverage it will bring to public plans, and if it would be better to allocate funding instead solely to help those with inadequate coverage.

Until more details of the Act’s timeline and initial phase are known, life insurance buyers may still want to shop, compare, and purchase in case they can get more comprehensive coverage from private companies.

Effects on Existing Life Insurance Policyholders

Existing life insurance policyholders will not be directly impacted by the Pharmacare Act – at least, not immediately. In the long run, the Pharmacare Act will affect drug costs and health outcomes, which can affect life insurance underwriting and offered premiums.

However, nothing in the Act in its present form indicates any regulation or serious effect on life insurance. The Pharmacare Act is focused on creating a national healthcare plan and may potentially affect workplace drug plans, but it has no direct aims toward the private insurance market.

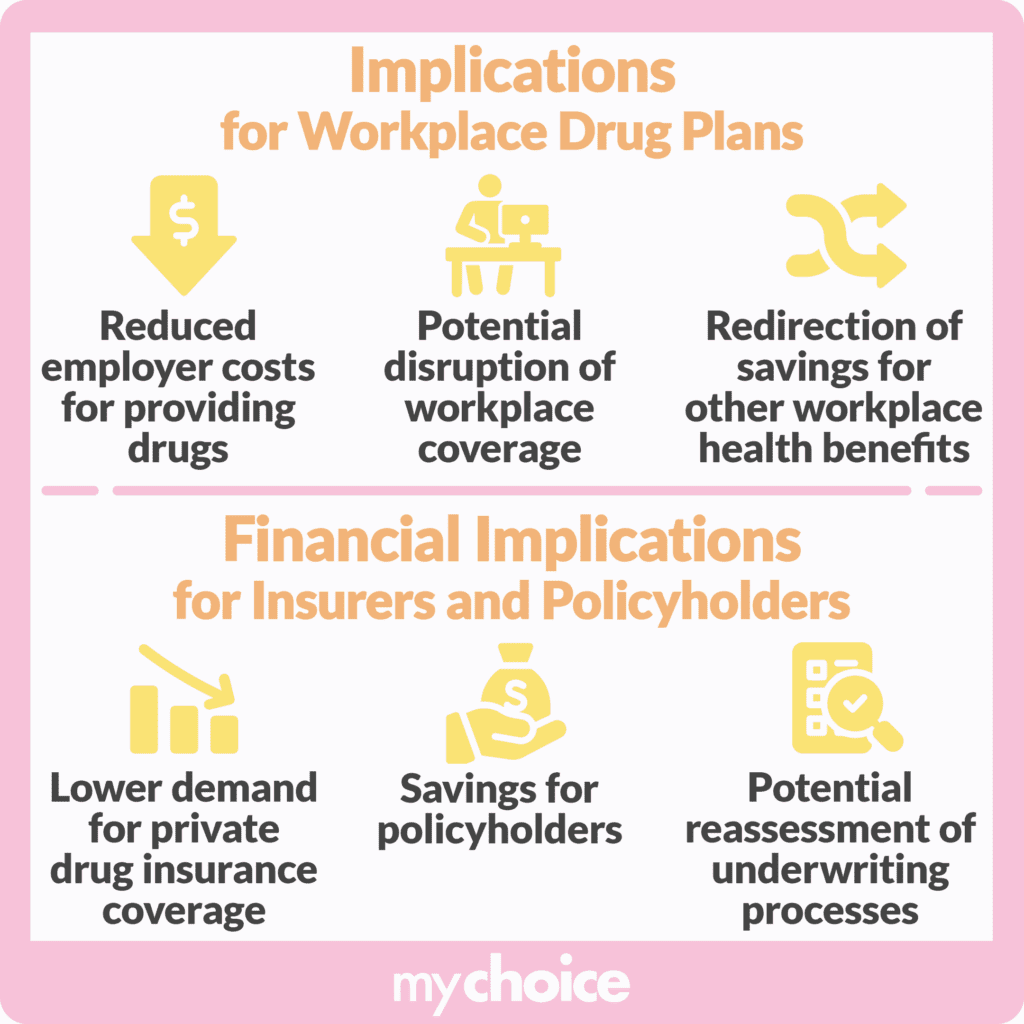

Implications for Workplace Drug Plans

There are projected savings and benefits under the Pharmacare Act for both Canadian employers and employees with workplace drug plans. However, there are also changes that may not be welcome. Here are the Act’s major implications for workplace drug plans:

- Potential disruption of workplace coverage: The Canadian Life and Health Insurance Association (CLHIA) has raised concerns that the Act may disrupt smooth, continuous workplace drug coverage. They’ve also expressed the risk of limited choice for specific medications.

- Reduced employer costs for providing drugs: Because the Act is intended to cover prescription medications, particularly for diabetes and contraception, employers now have the option to reduce drug benefits and their costs.

- Redirection of savings for other workplace health benefits: With the savings they have from reduced drug plans, employers may choose to provide other benefits instead, such as dental care or mental wellness initiatives.

If you’re already part of a workplace drug plan, it’s best to compare how your plan’s existing coverage compares to that under the Pharmacare Act. Even if the Pharmacare Act passes, employers may still see a need for supplemental private coverage.

Financial Implications for Insurers and Policyholders

Based on the current provisions of the Pharmacare Act and its initial phase, its implementation will financially affect private insurers and policyholders in the following ways:

- Lower demand for private drug insurance coverage: Because the Pharmacare Act will have a single-payer universal drug plan, it’s predicted that there will be a drop in demand for private plans.

- Savings for policyholders: Policyholders who’ve had to get additional private prescription plans can gradually discontinue them when the Act is fully rolled out for key medications. This is expected to lower costs for policyholders later on, as well as employers that provide workplace drug plans.

- Potential reassessment of underwriting processes: Because of the projection of improved general health and greater accessibility to treatment from the Pharmacare Act, private life insurers need to adjust their underwriting process to better estimate the risk of paying out claims.

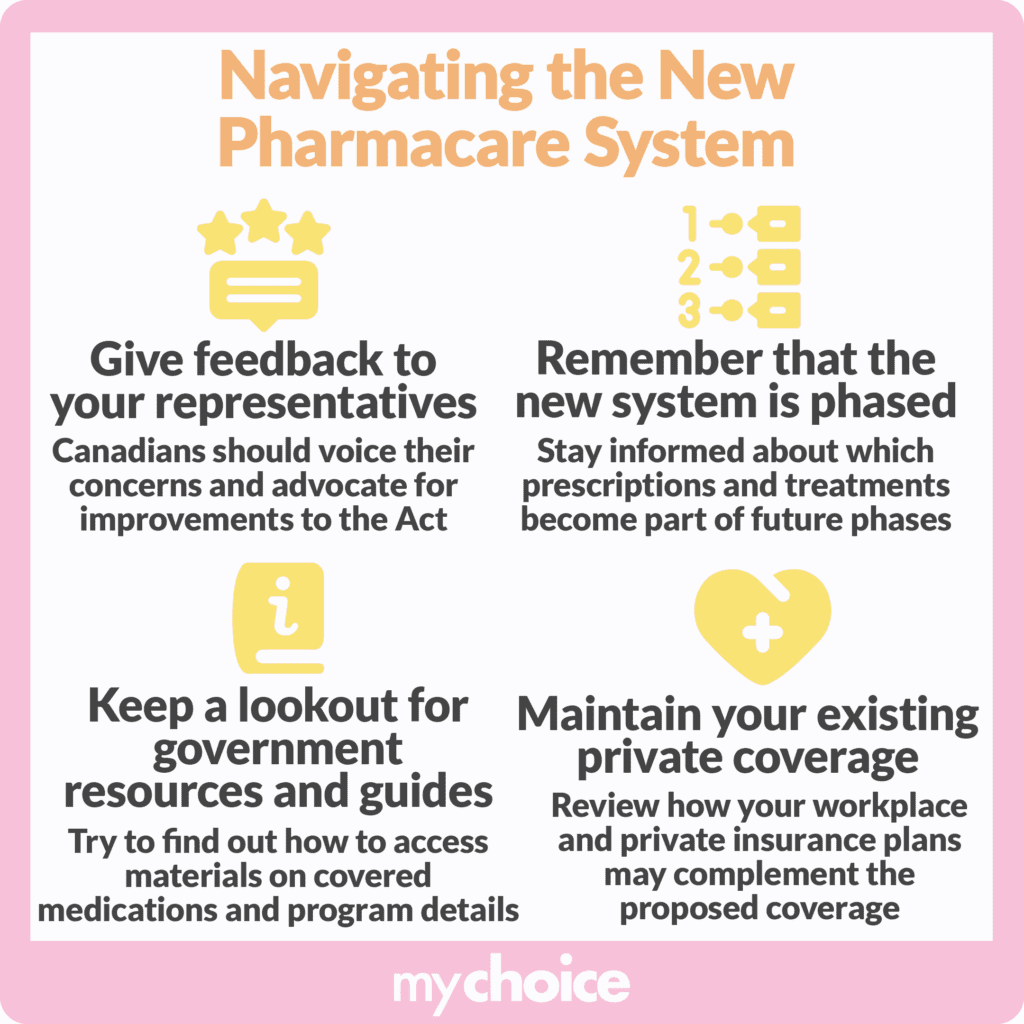

Navigating the New Pharmacare System

Now that you know the key points of the Pharmacare Act and how it may affect your coverage, here’s how you can stay informed during the transition to this landmark program:

- Maintain your existing private coverage: Review how your existing workplace and private insurance plans may complement the proposed Pharmacare coverage. Note that there’s a possibility that your employer may still prefer to keep supplemental private plans, especially if there are delays in rollouts or gaps in coverage.

- Remember that the new system is phased: The Pharmacare Act will have several stages, with the initial phase focused on diabetes medications and contraceptives. It’s important to stay informed about which prescriptions and treatments become part of future phases, especially if you have a medical condition that you are currently covering with public or private plans.

- Give feedback to your representatives: Canadians should voice their concerns and advocate for improvements to the Pharmacare Act to their elected representatives as they start implementation. This will help shape how the Pharmacare system works over time and address issues that were potentially overlooked during its proposal in the Houses.

- Keep a lookout for government resources and guides: With the creation of the CDA and the plan to develop a national formulary, make it a point to find out how to access materials on covered medications and program details.

Key Takeaways from MyChoice

- The Pharmacare Act is intended to implement a nationwide strategy to make prescription drugs, including those for diabetes, more affordable and accessible for Canadians. This may lead to better health outcomes for the public in the long run.

- The Act doesn’t directly impact life insurance, but the improvement in general health outcomes and better drug accessibility may lead to lower premiums down the line.

- Information about the Act’s rollout and full coverage is still somewhat limited and in the initial phase of planning. Until more details are disclosed, you may want to get a life insurance policy to prepare for your loved ones’ financial future and avoid having a coverage gap.