Life insurance can be an investment, but you can’t invest in all types of life insurance. To invest in life insurance, you need a policy with a cash value component.

Is life insurance an investment? Yes, it can be. But is it a good investment? Read on to find out.

What Kinds of Life Insurance Policies Are Considered Investments?

Life insurance policies are investments when they have a cash value component. This cash value builds up as you pay premiums. Once you have enough cash value built up, you can withdraw the money as a source of funds or use it as loan collateral.

Two major life insurance policy types have cash value components:

- Whole life insurance

- Universal life insurance

Both work similarly in that their cash value builds up as you pay premiums. So, what makes them different? Whole life insurance is simpler because you pay premiums, and the insurer chooses where to invest the money. You can just sit back and watch the cash value grow.

Universal life insurance is better if you want a hands-on approach to your investments. You can choose where to invest your premiums, potentially netting you bigger gains. But you may not gain as much if your investment choices perform poorly.

Universal policies also have more flexibility when it comes to premiums. You can pay as much or as little as you want as long as you meet the minimum set by insurers. Any money you pay above the minimum will go into your investment portfolio.

Is Life Insurance a Worthwhile Investment?

Life insurance can be a worthwhile investment if it fits your needs. There’s no one “best” investment vehicle, just ones that work for you and those that don’t.

Life insurance is a worthwhile investment if you want insurance protection benefits and earn capital gains simultaneously. Permanent policies also allow a hands-off approach to investing.

Investing in a permanent life policy is generally safe. However, it might not be as profitable as other, more hands-on investments like stocks and real estate. That said, other investment vehicles may be riskier, and you risk losing money.

At the end of the day, whether life insurance is a worthwhile investment depends on your needs and risk tolerance.

Who Should Invest in Life Insurance?

You should invest in life insurance if you want a relatively hands-off approach to investing and also want life insurance protection. You should also consider investing in life insurance if:

- You’ve maxed out your retirement account contributions.

- You’re caring for a lifelong dependent.

- You want to reduce your family’s estate taxes.

- You want to branch out into other investment vehicles.

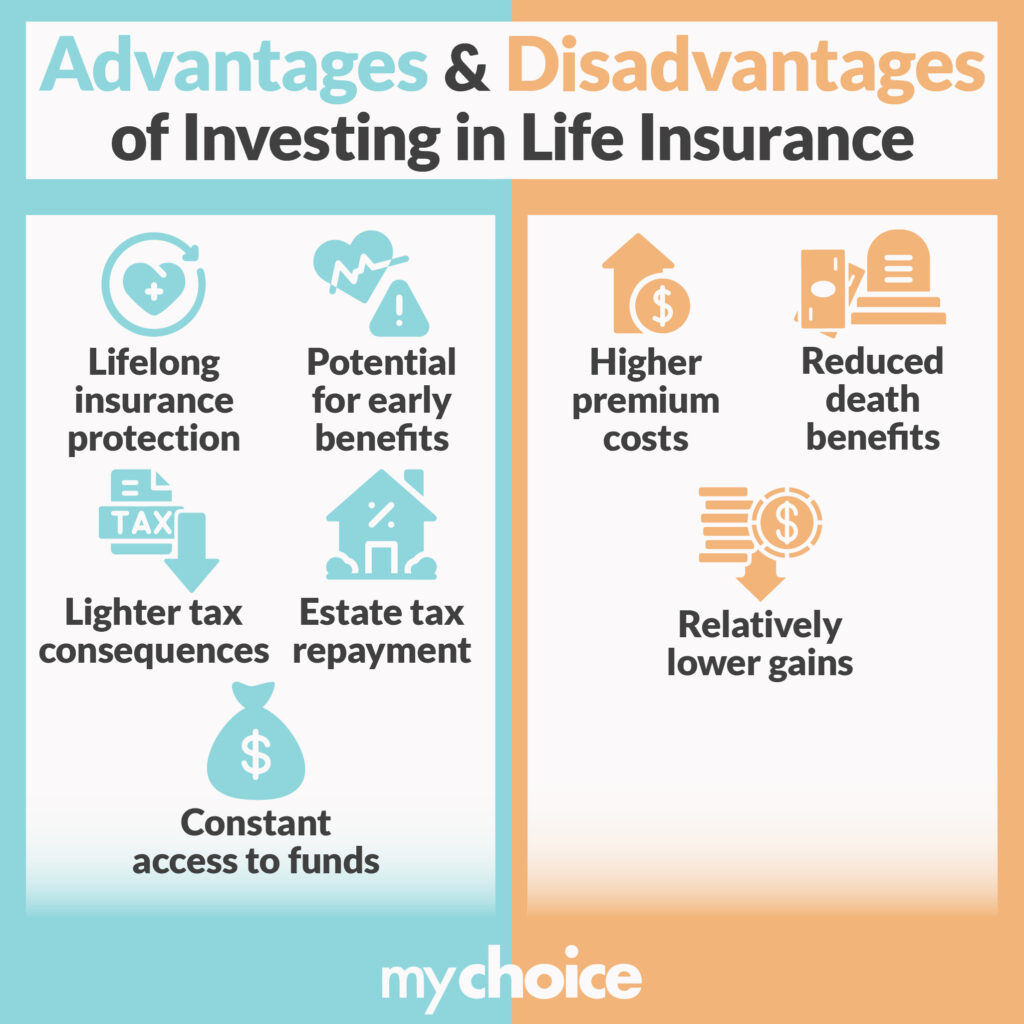

Advantages of Using Life Insurance as an Investment

Here are several reasons why life insurance is a good investment:

- Lifelong insurance protection: Naturally, you can benefit from your policy’s insurance protection. Whenever you die, your loved ones can benefit from your insurance coverage.

- Lighter tax consequences: Your insurance policy’s cash value grows tax-free. That means your cash value builds quicker than other taxed investment vehicles. Check our guide on taxes and life insurance to learn more.

- Estate tax repayment: Your death benefit isn’t subject to estate taxes. This means your beneficiaries can use your insurance coverage to pay any estate taxes charged on your other assets.

- Constant access to funds: The cash value in your policy can cover unexpected expenses or become emergency funds.

- Potential for early benefits: Some insurance policies allow you to receive a portion of your benefits early if you develop certain medical conditions. These accelerated benefits may improve your quality of life during your final months.

Disadvantages of Using Life Insurance as an Investment

Conversely, investing in life insurance has its drawbacks. Here are some of them:

- Higher premium costs: The main drawback of whole-life or universal policies is their relatively higher premiums. They’re typically more expensive than term policies because part of those premiums is reinvested to build your cash value.

- Reduced death benefits: Your beneficiaries may receive a smaller death benefit if you decide to accelerate its payout during your final months.

- Relatively lower gains: Life insurance investments usually have lower returns than more active investment vehicles like stocks and real estate.

Should I Invest in Life Insurance?

Whether to invest in life insurance depends on your insurance protection needs and risk appetite. Let’s dive deeper into when life insurance is a good investment and when it isn’t.

When Is Life Insurance a Good Investment?

Life insurance is a good investment if you want lifelong insurance protection bundled with an investment component.

People who invest in whole life insurance generally aren’t fussy about the small details of their investments and prefer to be hands-off investors. They just want to pay their premiums and rest assured, knowing their cash value will build up. They want to take the smallest risk, even if it means getting smaller rewards.

But that doesn’t mean hands-on investors can’t benefit from life insurance investments. Universal life insurance policyholders are typically more concerned about their investments and would like some say in how their money is used. That’s why they take a policy that gives them a say on where their premiums should go.

Still torn between universal and whole life insurance policies? Our article comparing universal life insurance and whole life insurance can help.

When Is Life Insurance Not a Good Investment?

Life insurance isn’t a good investment if you want the most freedom out of your investments. Universal life policies give you some freedom, but you’re still limited to pre-set portfolios to invest in.

If you want more freedom to invest your money, a term life policy might be better for you. Term policies generally have cheaper premiums, which means you have more money to spend on investment vehicles of your choice.

That doesn’t mean you’re completely closed off to whole-life policies, though. Many insurers let you convert a term life insurance policy into a whole-life one if you choose. So, there’s a chance to shift gears if you choose risky investments in your youth, then move to safer investments as you age.

Some insurers also let you get a small whole-life policy add-on. This add-on is often called final expense insurance and offers smaller death benefits typically used to cover funeral costs.

How does term life insurance compare to whole-life policies? Read our term life insurance and whole life insurance comparisons to learn more.

The Bottom Line

Life insurance can be a viable investment vehicle.

However, it provides smaller gains in exchange for lower risk. Investing in life insurance is best if you want a hands-off investment vehicle. Life insurance investments are also good for emergency funds and estate planning.

Whether or not you invest in life insurance, you should always get your documents in order. Tell your beneficiaries where to find your certificate of insurance and other important paperwork so your claims process goes as smoothly as possible.