Purchasing life insurance provides a financial cushion for individuals and families in the face of death. Through life insurance, individuals can provide their loved ones with a tax-free benefit – but this may not be true for cross-border policies.

As a Canadian, you may wonder why you’d ever need to purchase an insurance policy in the United States. You’d be surprised to know there are many reasons – maybe there are opportunities for cost savings or broader product offerings. Whatever the case, it’s best to explore the potential advantages, disadvantages, and limitations of buying life insurance from US companies as a Canadian citizen before deciding.

Buying US Life Insurance as a Canadian Resident

Canadians can purchase life insurance in the US depending on their status. You may qualify if you have a green card or are a specific type of visa holder. However, requirements may vary depending on the insurance company you choose.

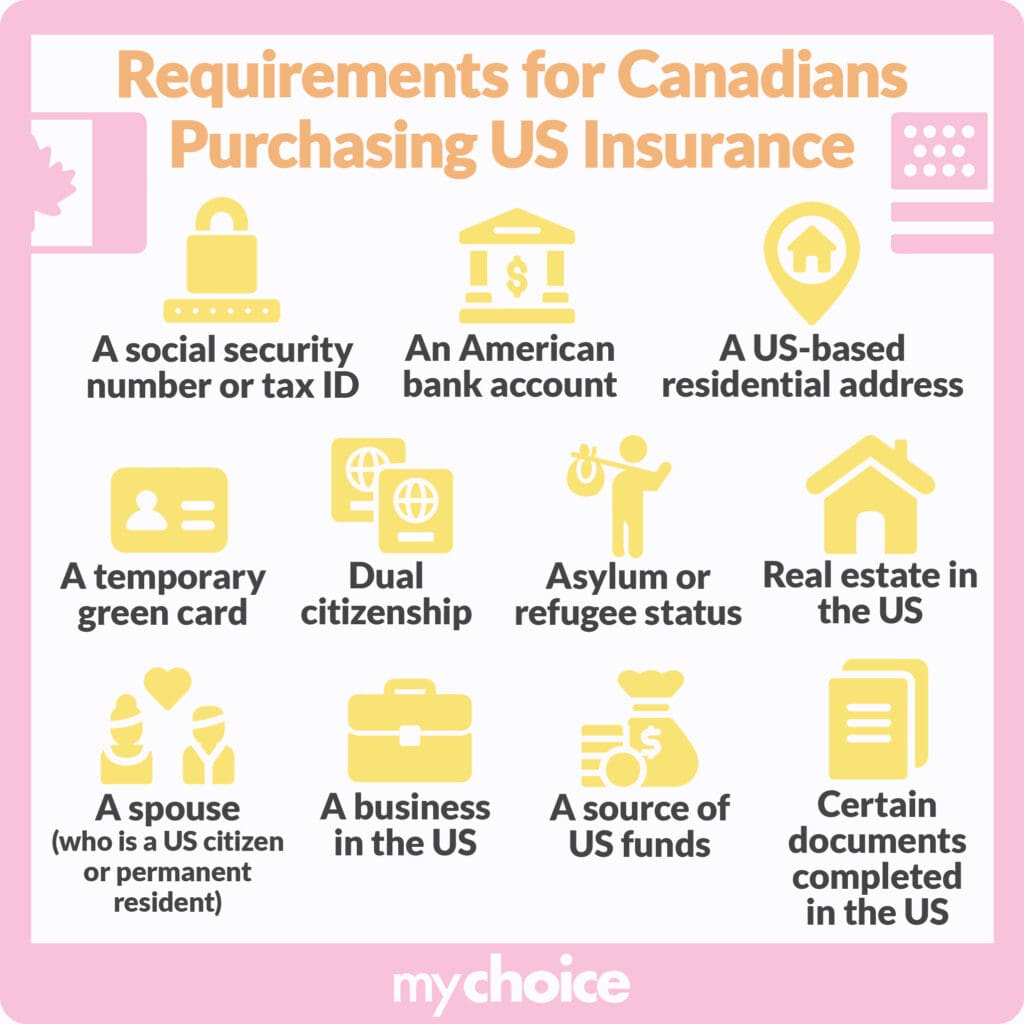

Requirements for Canadians Purchasing US Insurance

As a Canadian, you can qualify for an American insurance policy if you have the following:

- An American bank account

- A social security number or tax ID

- A US-based residential address

- A temporary green card

- Dual citizenship

- Asylum or refugee status

- A spouse who is a US citizen or permanent resident

- Real estate in the US

- A business in the US

- A source of US funds you can use to pay premiums

- The application requirements, medical exam, and other documents completed in the US

Factors to Consider When Purchasing US Life Insurance as a Non-US Citizen

While Canadian residents can purchase US life insurance, the process and standards may differ significantly. Here’s what to consider.

Pros and Cons of Purchasing US Life Insurance as a Canadian Resident

If you’re a Canadian resident, why buy a US insurance policy? Here are the benefits to consider:

However, purchasing US life insurance as a Canadian resident may also have drawbacks:

What is the Best Type of Life Insurance for a Canadian Resident in the US?

Like in Canada, US insurance companies typically offer two basic policies: term life insurance and permanent life insurance. So, which one is better for a Canadian resident?

Key Advice From MyChoice

- Seek advice from a qualified life insurance professional who can guide you through the differences and nuances between Canadian and US life insurance policies. They can also assist you in the application process, preparing you for regulatory differences and tax implications.

- Keep an eye on currency exchange fluctuations. Consider hedging strategies and stay aware of any potential changes.

- Consider the long-term implications of buying a US insurance policy, such as possibly filing claims outside the country.