When planning for the future, many people often face the tough decision of purchasing life insurance or investing directly in the stock market. Both options have distinct benefits and drawbacks, but each serves a different financial end. Depending on your current situation, goals, and obligations, one option will make more sense to take than the other.

When does it make sense to get life insurance instead of investing in the market? Is it worth it to do both? When should you buy life insurance if you’re planning for the future? Read on to learn about the pros and cons of investing in the market vs. taking out life insurance.

When Does Buying Life Insurance Make More Sense Than Investing?

When considering financial strategies, it’s important to consider your goals, current financial situation, and risk tolerance. Whole life insurance policies offer a death benefit and a cash value component, which grows over time. However, the returns on the cash value of whole life insurance are generally lower than direct investments in the stock market, such as the S&P 500.

To illustrate the difference between life insurance and an investment in the market, let’s compare the returns in a hypothetical scenario:

Dave is a 30-year-old married man in good health. He doesn’t smoke and is deciding between paying an annual premium of $5,000 for a whole life insurance policy or investing in the S&P 500 fund for the same amount yearly. His whole life insurance policy has a cash value component and a $500,000 death benefit for his beneficiaries.

Dave’s insurance company provides him with a life insurance cash value chart showing an annual return of 4%. Assuming the investment into the S&P 500 has an average annual rate of 7%, here’s how the returns would compare over 30 years:

| Year | Whole Life Cash Value | S&P 500 Investment Value | Death Benefit |

|---|---|---|---|

| 5 | $27,082 | $28,754 | $500,000 |

| 10 | $60,918 | $71,152 | $500,000 |

| 15 | $101,772 | $130,106 | $500,000 |

| 20 | $151,259 | $212,743 | $500,000 |

| 25 | $211,362 | $329,316 | $500,000 |

| 30 | $284,497 | $493,482 | $500,000 |

After 30 years, the cash value accumulates to approximately $284,497. This steady and predictable growth offers a guaranteed return and a death benefit if something happens to Dave. Investing in the S&P 500 theoretically provides more value, but this higher return comes with increased risk due to market volatility.

If you’re considering your family’s financial future, life insurance is a safer and more consistent option than investing in stocks. However, if you plan to grow capital within your lifetime, market investments into funds like the S&P 500 will yield better returns.

Is Investing Always Better If You Plan to Leave an Inheritance?

Investing in the stock market is a decently effective strategy when you’re trying to build wealth for an inheritance. However, there are a few areas where life insurance has an edge over market investments. Life insurance provides a guaranteed, tax-free death benefit, which is passed to your beneficiaries promptly after death.

In contrast, investments are subject to volatile market conditions, which may affect the value of an inheritance. Not only that, but investment gains passed on to beneficiaries can be subject to capital gains tax, often becoming a headache for your loved ones to navigate, especially if you don’t use life insurance to offset capital gains. Investments also typically need to be liquidated before being claimed, which can be a time-consuming process subject to market conditions.

In most situations, investing in the market is more about building wealth that can be accessed during your lifetime. However, when paired with life insurance, investments can be a very effective way to pass down an inheritance to your heirs.

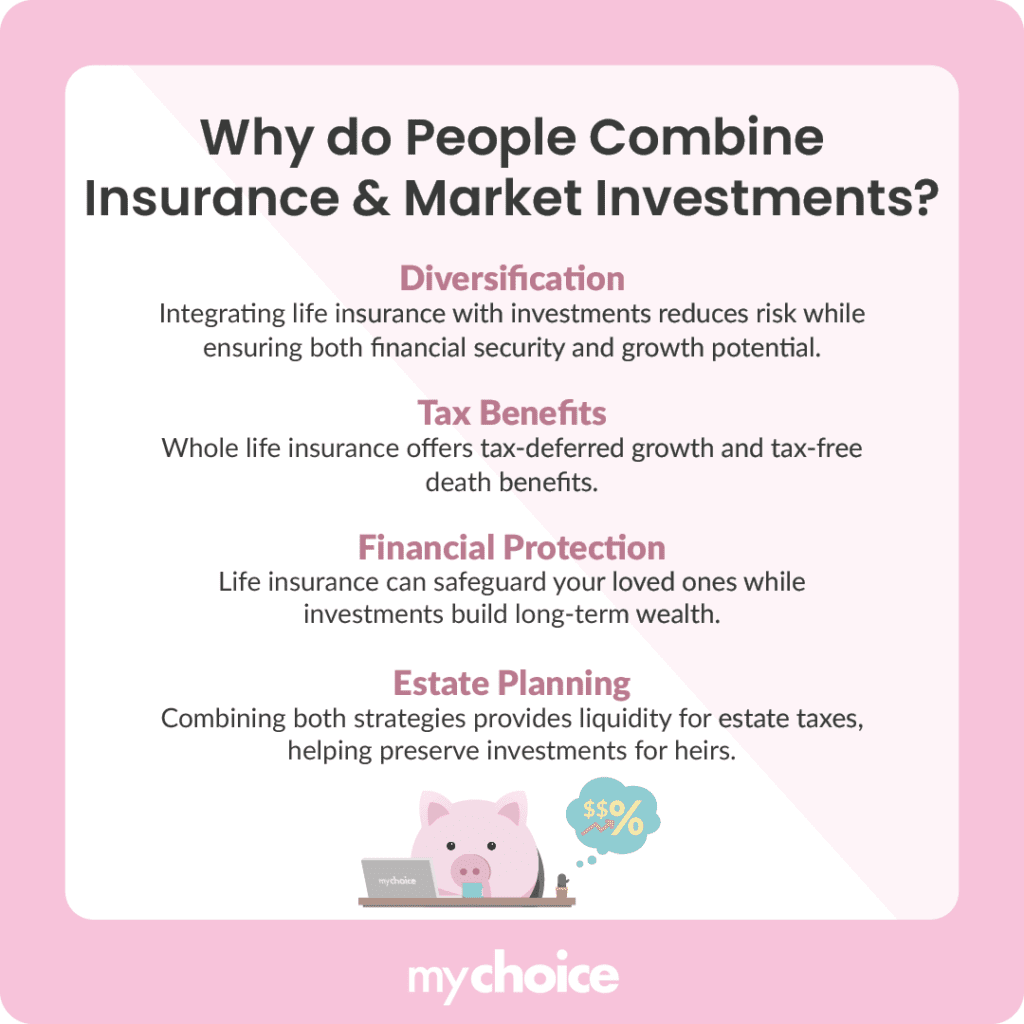

Main Reasons People Combine Insurance & Market Investments

When someone is considering combining whole life insurance with market investments, it’s usually part of a financial strategy that allows them to grow capital over time while still allowing for some safety for their loved ones in case of their demise. Here are some reasons why combining both investments makes for a sound financial plan:

How Much Could Waiting to Buy Life Insurance Cost You in the Long Run?

Waiting to buy life insurance until later in life can result in significantly higher premiums and reduced coverage options. If you’re young, procrastinating life insurance coverage could potentially raise your premiums by up to 200%. For example, getting a 20-year term life insurance policy in your 30s is around 50% cheaper than waiting until your 40s, and waiting from your 40s to your 50s sees a premium jump of around 150%. As you age, some coverage options may also be considered too high risk for insurance companies, limiting your choices when it comes to insurance.

Buying a life insurance policy while young and healthy locks in the cheaper premium rate, meaning you’ll enjoy the most affordable life insurance premiums well into your senior years. Combining these affordable premiums with a permanent life insurance policy will greatly benefit both you and your loved ones, as you’ll benefit from appreciating cash value on your policy while protecting your family from financial strain in the event of your passing.

Key Advice from MyChoice

- If you can afford it, combining life insurance with market investment is the best way to protect your family from financial stress while ensuring a sizable inheritance.

- Purchasing life insurance at a younger age can lock in lower premiums and more favorable terms, providing long-term financial advantages.

- Before deciding on an investment approach, evaluate your current financial situation, future obligations, goals, and your dependents’ needs to determine the most efficient option.