Borrowing against your life insurance can be a good idea if it fits your financial needs. However, this is only viable if you have an insurance policy with a cash value component.

Aside from its primary purpose of providing a death benefit when you pass away, your life insurance can also be used as a source of funds through its policy loan feature.

What types of loans are you eligible for with your life insurance, and how does it compare to other loan methods? Keep reading to find the answers to those questions and so much more.

What Type of Life Insurance Policy Supports Loans?

Only life insurance policies with cash value components support loans because you use your life insurance policy’s cash value as collateral. You can’t borrow from a term life insurance policy because it has no cash value to act as collateral. If you’re still deciding between term and whole life insurance, the availability of policy loans can be a consideration.

Additionally, you can use your life insurance as loan collateral, distinct from life insurance policy loans.

How Much Can You Borrow From Your Life Insurance Policy?

How much money you can borrow from a life insurance policy depends on the insurer and your cash value amount. Most insurers allow you to borrow up to 90% of your cash value, but the limit may be higher or lower depending on the company.

Since you’re borrowing with the cash value as collateral, you may not be able to take out big loans when your policy is new. If you’re looking to borrow a substantial amount of cash, you must wait until the cash value in your account builds up, which may take some time.

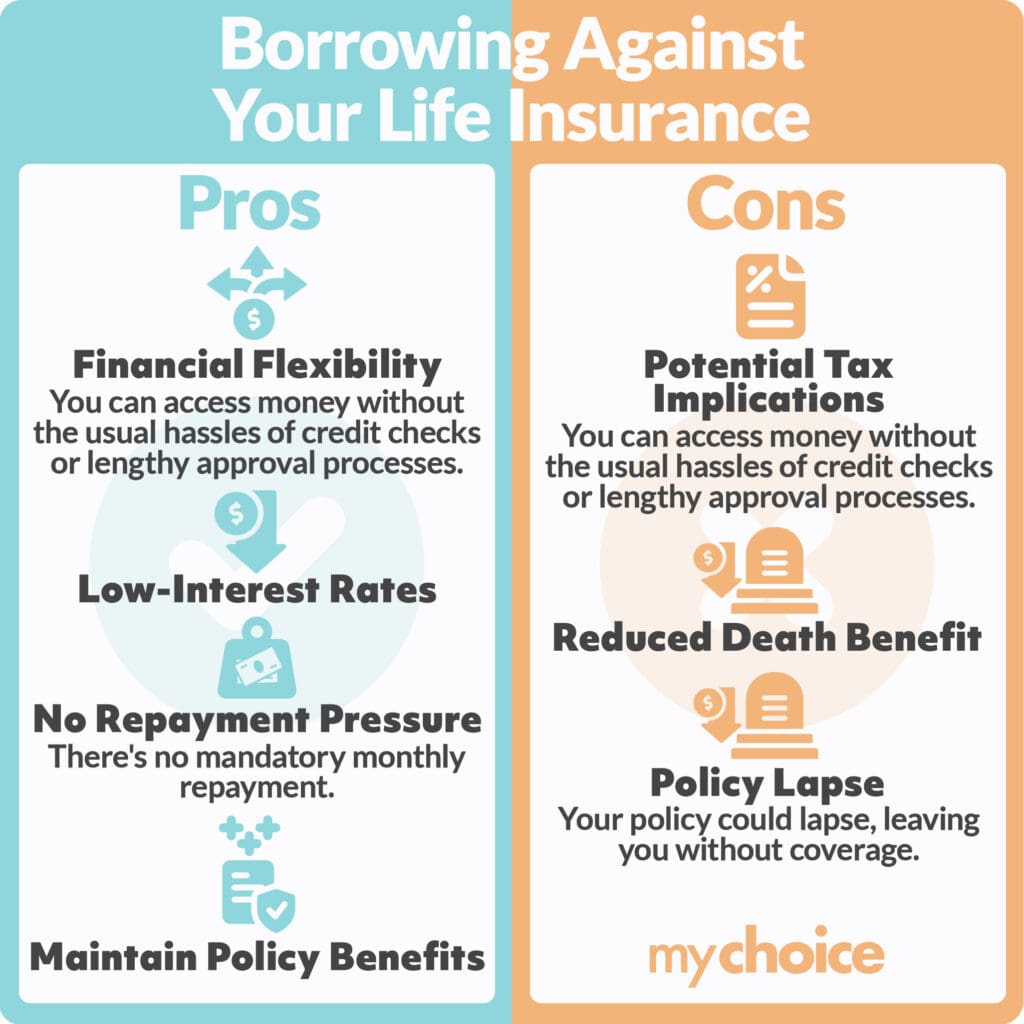

Pros and Cons of Borrowing Against Life Insurance

Thinking about borrowing against your life insurance policy? It’s a good idea to learn the pros and cons first. Let’s take a look:

Should You Borrow Against Your Life Insurance?

Whether or not to borrow against your life insurance depends on your financial needs and the options available to you. Before making your decision, consider the pros and cons of policy loans and other options.

Does Borrowing Against My Life Insurance Policy Impact My Policy Value?

Generally speaking, borrowing against your life insurance policy won’t impact your policy value. However, this only counts when you fully repay the loan before you pass away. If you pass away before the loan is repaid, part of your policy’s death benefit will be used to repay the loan, meaning your beneficiaries will receive a smaller death benefit.

Another thing to note is that your loan’s interest will keep accruing as long as you don’t make loan payments. If the loan amount exceeds your policy’s cash value, your policy can lapse.

Borrowing Against Life Insurance vs Other Loan Methods

How does borrowing against life insurance stack up against other loan methods? For a better look, let’s break it down into a table:

| Loan type | Interest rates | Loan amount | Loan term | Potential disadvantages |

|---|---|---|---|---|

| Life insurance policy loans | Generally 5-8% | Depending on your cash value amount, typically 90%. | No deadline for repayment, but interest will keep accruing as long as you have an outstanding loan. | Passing away before repaying the loan means your beneficiaries will receive a smaller death benefit. |

| Home equity loans | Generally lower than personal loans. | Up to 80% of your home’s value. | Varies from 1 to 10 years. | Your home may be repossessed if you default on your loan. |

| Personal loans | Depends on the lender’s rates. | Ranges from $1,000 to above $50,000, depending on how creditworthy you are. | Generally between 6 months and 5 years. | Generally higher interest rates and may damage your credit score. |

Which One Should I Choose?

You should choose whichever loan method that fits your needs and risk profile. To some, it may be daunting to put their home up as collateral or risk damage to their credit score. It’s best to weigh the available options and

Key Advice From MyChoice

Now that you’ve learned about life insurance policy loans let’s review some key advice to keep in mind:

- Life insurance policy loans are only available if your life insurance has a cash value component.

- Most insurers allow you to borrow up to 90% of your cash value.

- You don’t have to repay a policy loan, but if you pass away with an active loan, your beneficiaries will receive a smaller death benefit because a portion of it goes to repaying the loan.

- You may need to build up cash value before taking out a substantial policy loan.