Buying a home is one of the most significant investments you will make in your lifetime. Purchasing home insurance is one of the best ways to protect that investment. Knowing when to purchase home insurance is just as important as understanding what it covers.

When should you buy home insurance? Do you need home insurance in the first place? Does the kind of home insurance you get matter? Read on to learn more about the right time to buy home insurance and why it matters.

Do You Need Home Insurance?

While home insurance is not legally required in Canada, it is often necessary for those who have a mortgage. Mortgage lenders mandate home insurance because it protects their financial interest in the property. If a homeowner defaults on their loan and the house suffers damage, the lender risks losing their investment. By requiring proof of insurance before closing on a mortgage, lenders ensure that funds are available to repair or rebuild the home if necessary.

Additionally, some homeowner associations (HOAs) may require residents to maintain home insurance as part of their community guidelines. This requirement helps protect all residents by ensuring that properties are adequately insured against any potential risks.

Types of Home Insurance and What They Cover

Before looking for a good home insurance policy, you first need to understand two of the most common types of home insurance and what they cover. These are broad home insurance and comprehensive home insurance, with each having its advantages and drawbacks.

Both broad and comprehensive home insurance covers the building itself against any peril that isn’t specifically excluded from the policy. However, the main difference between these two types is how they cover the contents of your home.

Broad home insurance only covers your possessions against perils specifically named in your policy, while comprehensive insurance covers them against everything that isn’t excluded. This difference means that comprehensive insurance protects your home’s contents from a lot more perils, but that does make it more expensive than broad insurance.

However, there are perils that are usually excluded from these two types of home insurance. A standard home insurance policy may not protect you against disasters such as floods, earthquakes, and wildfires. Thankfully, you can purchase additional coverage if needed.

Why Timing Matters

Timing plays a critical role when it comes to buying home insurance. Delaying the purchase of home insurance can lead to some negative consequences. If you wait for too long before searching for a suitable home insurance policy, you may not find a policy that fits your specific needs for a reasonable price. Waiting until the last minute can also create unnecessary stress as you rush to find a suitable policy before closing.

Ideally, you should purchase your policy before closing on your new home. This timing allows you to provide proof of insurance to your lender during the closing process. This proof is very important, as without it, your mortgage may be delayed or denied entirely, jeopardizing your home buying process.

When to Start Shopping for Home Insurance

A general rule of thumb is to start shopping for home insurance at least three weeks before your closing date. This timeframe allows you ample opportunity to compare different policies and find one that suits your needs and budget. Starting early also gives you time to gather the necessary documentation and understand the various coverage options available.

It’s important to note that some insurance companies will require a home inspection to be done before giving a quote, so aim to schedule the inspection as soon as you can to avoid delays. Ideally, aim to finalize your choice at least one week before closing so that you can obtain an insurance binder – a temporary proof of coverage required by lenders – well in advance.

In some cases, it may be beneficial to start looking even earlier, especially if you’re considering multiple properties or want to explore various coverage options thoroughly.

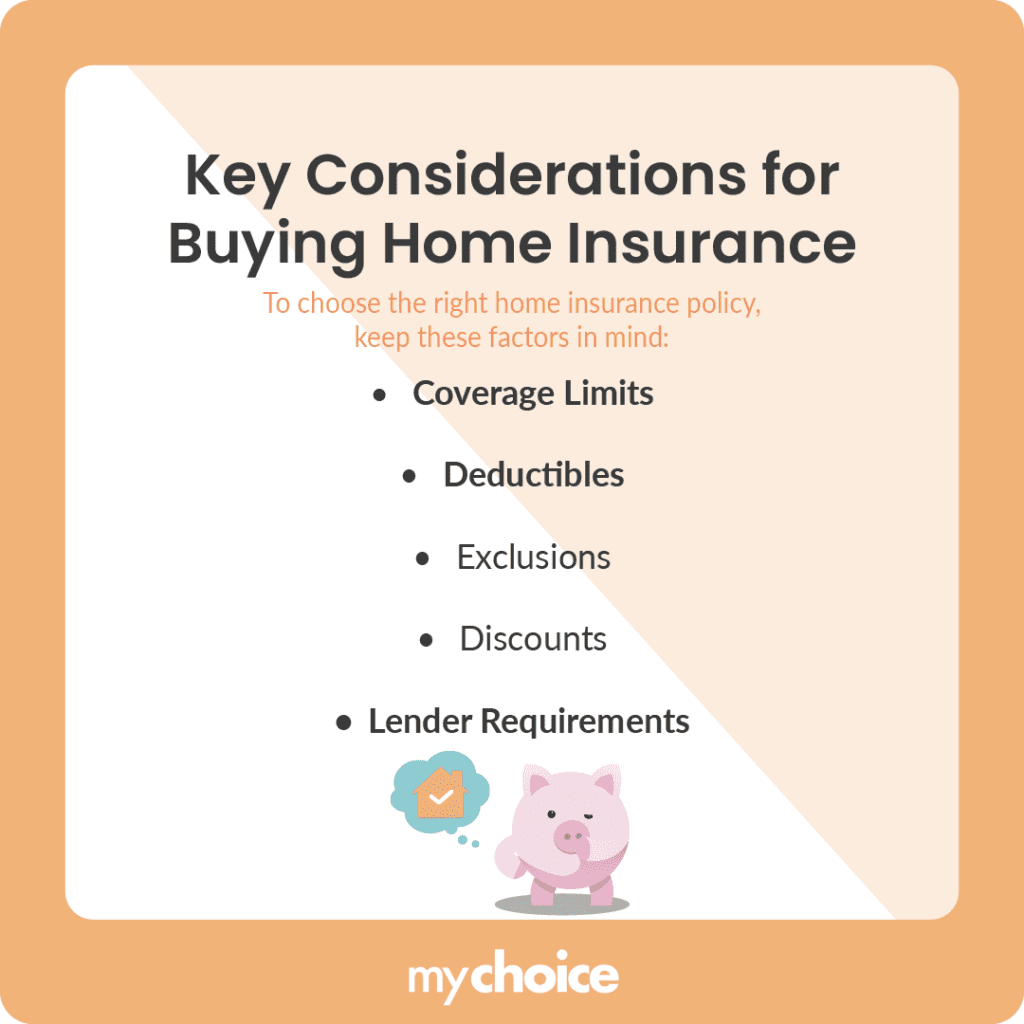

Key Considerations Before Buying Home Insurance

If you’re not sure how to choose the right home insurance policy for your needs, then consider the following factors before making a decision:

Key Advice from MyChoice

- Start shopping around for home insurance as soon as possible. This will give you enough time to consider the best options, gather the needed documents, and get a home inspection if needed.

- If you live in a flood or earthquake-prone zone, it may be a good idea to purchase additional coverage with your home insurance policy.

- Acquire an insurance binder one week before closing on your house at the latest. This will ensure that you’re complying with any requirements that lenders have regarding home insurance.