Dealing with a loved one’s passing is never easy, and wading through the complexities of inheritance law makes it all the more challenging. Understanding what it means to be a beneficiary — along with the rights and responsibilities that come with it — can make the process less daunting.

Have you been named as beneficiary of a will? Keep reading to find out what the next steps are for beneficiaries in Ontario.

Beneficiary of Will in Ontario: A Quick Overview

A will is a legal document declaring how a person would like their assets and properties to be distributed after they die. This document covers assets such as:

- Personal belongings

- Real estate

- Money

- Investments

- Insurance policies

A person, organization, or trust designated to receive an asset in a will is called a “beneficiary.” If you’re a beneficiary of an investment or retirement account, you’ll receive the balance in said account.

If you’re a beneficiary of a life insurance policy, you’ll receive the death benefit upon the policyholder’s death — that is, if the deceased did not surrender the policy to receive the accumulated cash value while they were alive. Note that the cause of death can impact the payout timeline. Deaths from natural causes or accidents typically lead to straightforward claims, but cases involving unlawful activities may necessitate an investigation.

Eligible Beneficiaries

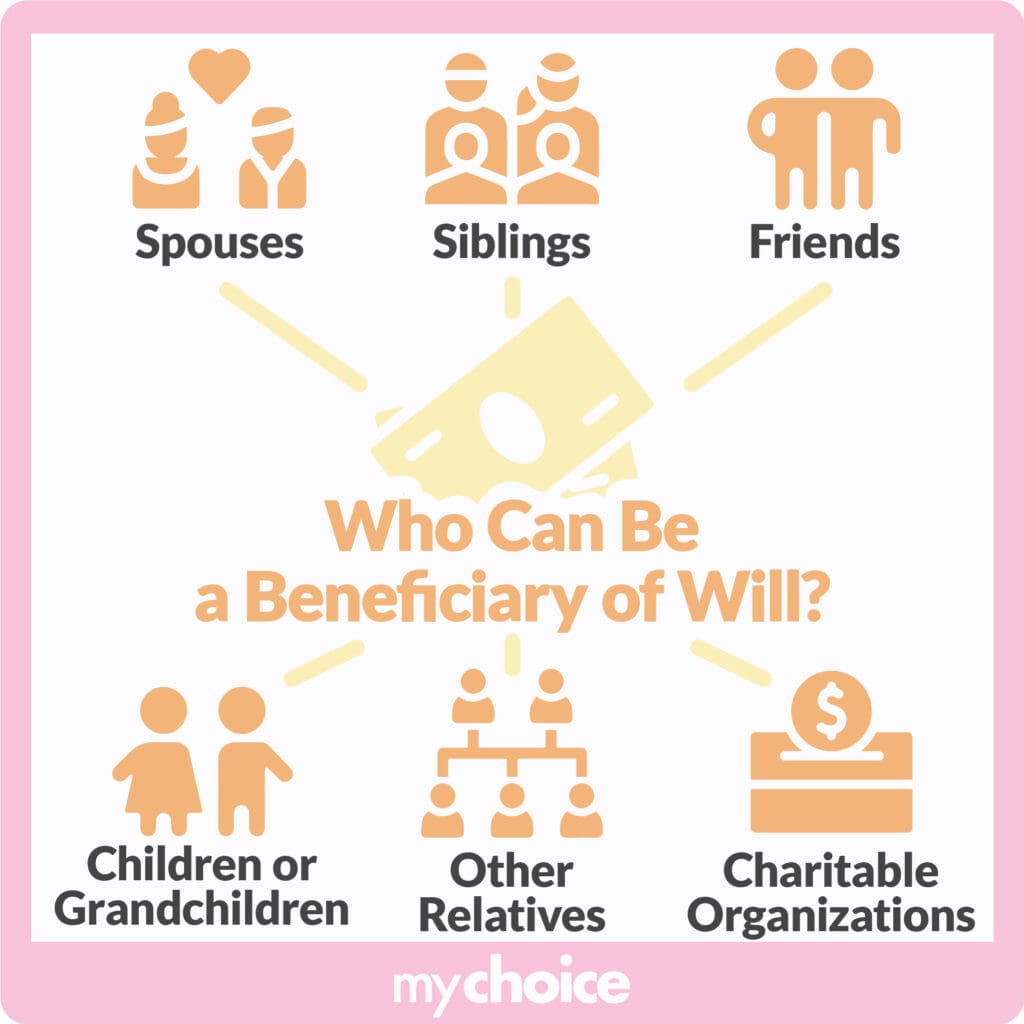

In Ontario, a testator (the creator of the will) can name the following people as beneficiaries:

- A spouse

- Siblings

- Children or grandchildren

- Other relatives, such as nieces and nephews, aunts and uncles, and cousins

- Friends

- Charitable organizations

Although minors can be named in a will, they’re not allowed to inherit property right away. An appointed guardian will have to oversee the designated assets until they come of age.

Primary, Contingent, and Residual Beneficiaries

Primary beneficiaries are first in line to receive specific assets or portions of the estate. If a primary beneficiary dies before the testator or cannot fulfill the conditions set in the will, their inheritance goes to the contingent beneficiaries. Residual or remainder beneficiaries receive whatever assets aren’t designated to a specific person or entity. Multiple residual beneficiaries can be named to receive percentages of the remaining estate.

Do Beneficiaries Have Legal Rights?

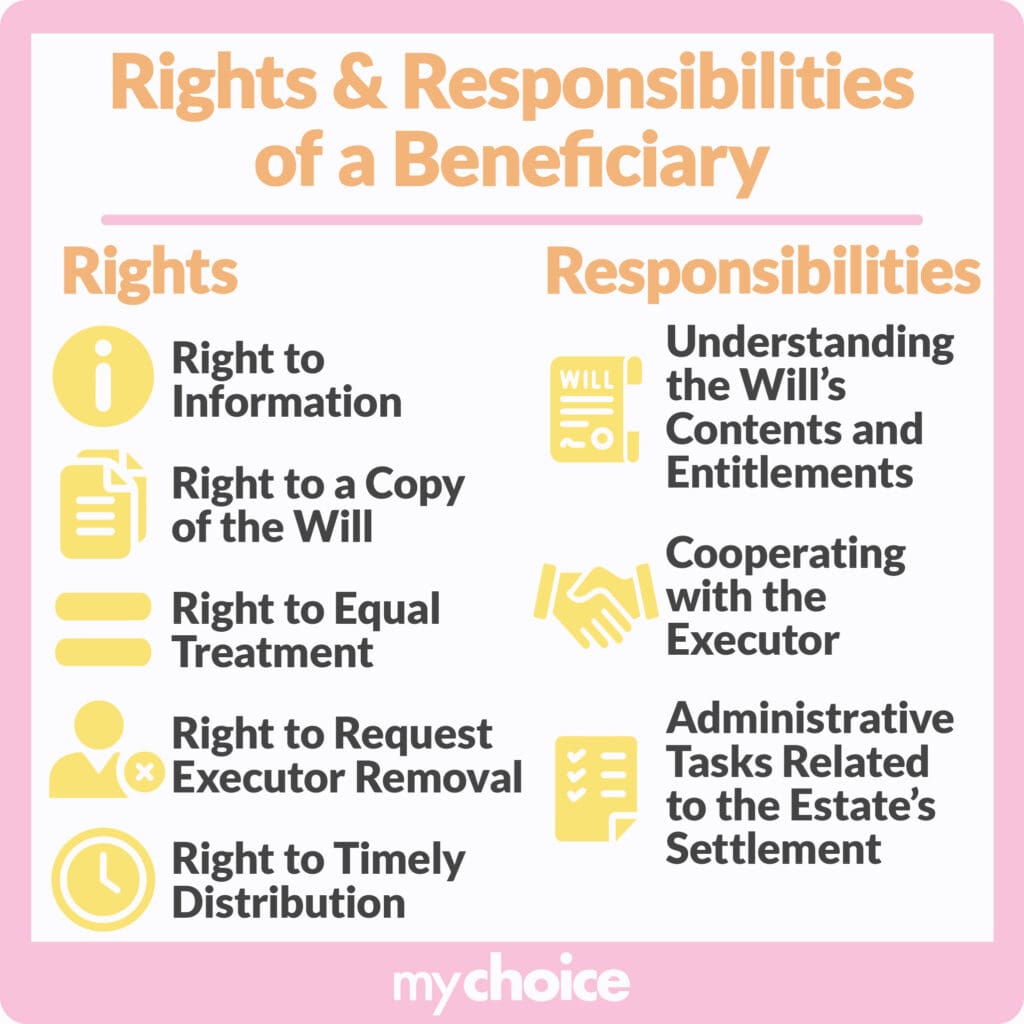

The term “beneficiary rights” is a bit of a misnomer. In Ontario, a beneficiary does not have legal rights to an estate per se. Instead, they are entitled to:

- Be notified of their inclusion in the will and the estate’s proceedings.

- Receive a copy of the will or see the parts that concern them.

- Be treated fairly alongside other beneficiaries.

- Receive their inheritance within about a year, depending on the complexity of the estate.

Beneficiary Responsibilities

While beneficiaries don’t have any legal expectations, certain beneficiaries, such as those assigned to be executors or estate trustees, must carry out certain duties. If an executor cannot fulfill their duties, other beneficiaries can petition to have them removed or sue for causing financial harm.

Some of the responsibilities of beneficiaries include:

- Knowing what assets they inherit and the attached conditions

- Cooperating with the executor and other beneficiaries

- Handling administrative tasks as the executor, such as paying debts, taxes, and distributing assets

- Applying for probate (as the executor)

The Probate Process in Ontario

Probate is a court procedure that gives a person the authority to act as the estate trustee of a deceased’s estate. The process formally approves that the deceased’s will is their valid last will and gives the trustee authority to see over the estate proceedings.

Probate is not required except in certain circumstances, such as if the deceased owned real property or assets held by a financial institution. Other instances in which a trustee may apply for probate include:

- If the deceased died without a will

- If the deceased did not name an estate trustee in their will

- If a financial institution requires proof of a person’s legal authority to receive money or investments from the deceased

- If assets include real property, which cannot be passed to another person by right of survivorship

- If the deceased’s property must be sold

- If there are disputes about the appointed trustee

- If there are disputes about the will’s validity

- If beneficiaries cannot provide legal consent

To apply for probate, you must obtain a Certificate of Appointment of Estate Trust (for estates valued at more than $150,000) or a Small Estate Certificate (for estates valued at up to $150,000) from the Ontario Superior Court of Justice.

Tax Implications for Beneficiaries of Will

Beneficiaries don’t have to pay taxes on the assets they inherit from an estate — taxes are deducted from the estate before being transferred to beneficiaries. The death benefits received from a life insurance policy are not taxable either.

You will have to pay estate administration tax when you file for probate. This is charged on the value of the estate assets and is calculated on the total value (in Canadian dollars) of a deceased person’s estate at the time of their death.

In Ontario, estate trustees will also have to settle personal income taxes of the deceased that are due for the year of death and income taxes for any trusts, such as for interest earned in savings accounts by the estate from the day of death to the time of distribution.

Common Questions About Wills and Estate Proceedings

Given the complicated nature of estate law, it’s not uncommon to have questions — especially as an executor. Here are some questions that typically come up when settling an estate in Ontario:

Are Wills Public in Ontario?

In Ontario, there is no official registry for wills. If a person filed for probate, you can obtain a copy of the will from the registrar at the Superior Court of Justice in the jurisdiction where the deceased resided.

If you are or wish to be the trustee, you can find a will by:

– Searching the deceased person’s home, usually in a safe or filing cabinet

– Contacting the deceased’s bank for a will stored in a safety deposit box-

– Contacting the deceased’s lawyer

– Contacting the local court registrar

What Can You Do if There Is No Beneficiary Named In a Will?

If there is no beneficiary named in a will, the laws of intestacy dictate that a person’s estate go to their next of kin. The preferential share allotted to a surviving spouse in Ontario is $350,000. This means for persons with a surviving spouse and children, the spouse is entitled to the first $350,000, while the children and spouse divide the remainder equally.

Can You Challenge a Will?

f you have a financial interest in the estate, you can challenge a will. Financial interest means that you are:

– The spouse of the deceased

– A child, descendant, or dependant of the deceased

– Named in the will or a previous version of the will

– Someone with a share in the estate (for instances when there is no will)

– A creditor

Anyone with the legal right to contest a will in Ontario must do so within two years of notice of the will.

Does a Will Override a Beneficiary Designation in Canada?

No. Beneficiary designations override wills. A will is a legal document that provides instructions for the estate proceedings after your death, while a beneficiary designation contains the names of individuals who are set to receive assets upon your passing.

Can You Renounce Your Inheritance?

Think of an inheritance as a gift. If you do not wish to receive it, you can simply turn it down. To disclaim or waive an inheritance, prepare a signed waiver with a witness — ideally with a witness.

Who Inherits If a Beneficiary Dies in Canada?

If a beneficiary dies before the estate is settled or before the testator passes, their inheritance will be passed on to their legal successors or heirs.

Will an Inheritance Affect My Chances of Receiving Government Assistance?

Yes, an inheritance can affect your eligibility for income support from the Ontario Disability Support Program (ODSP). However, it is possible for all or part of your inheritance to be exempt from this.

For example, if you inherit money or an asset, some of it may be exempt under the rules for gifts and voluntary payments. Up to $10,000 of the total value of all gifts, voluntary payments, and payments from a life insurance policy or trust given within 12 months is exempt as income.

For inheritance money placed in a trust within six months of receiving it, up to $100,000 of your trust may be exempt. Properties and other possessions inherited will be treated as assets, except for a house you currently reside in and a car you use as your primary vehicle.

Key Advice From MyChoice

Now that we’ve learned about the beneficiary of will in Ontario let’s take a look at some top tips:

- Understanding your rights and responsibilities as a beneficiary is integral to minimizing conflicts and issues throughout the estate settlement process.

- Keep lines of communication open with the estate trustee, other beneficiaries, and legal professionals involved with the proceedings.

- Don’t be afraid to seek advice from experts on legal and financial concerns.