A common question that many vehicle owners ask when seeking car insurance for the first time is whether or not other drivers are covered when using your vehicle. It is not at all uncommon to let a friend or relative who is not named on the vehicle, borrow your car, for example they may need to run a quick errand with your vehicle because they can’t fit their new mattress in the back of their sedan. Or, maybe their car is being serviced, and you have an extra vehicle that they can use for a temporary time to get back and forth to work.

Driving Someone Else’s Car

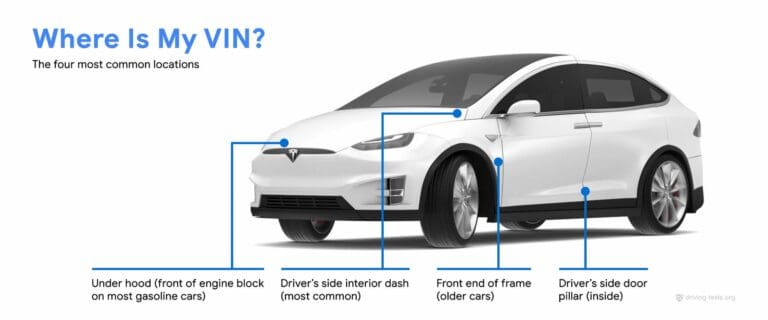

Whatever the situation is, are these other drivers covered or not? The answer is a bit complicated. In most cases, a policy is issued for a specific vehicle, and that vehicle is identified by its unique vehicle identification number (VIN). However, there are cases where coverage can extend to the driver when they use other vehicles.

The first thing to understand is that in most situations, it is lawful to drive someone else’s vehicle, provided that they have provided you with permission to do so. And, it is important that they have knowledge of when and where you will be driving. In these situations, the insurance will cover the car, as long as they are just borrowing the vehicle occasionally.

When you drive someone else’s vehicle regularly, even if they have given you permission to do so, then the insurance company needs to be informed and may require that the additional driver is added to the policy. Insurance companies view occasional use and regular use as two different scenarios, and in the latter scenario, the person needs to be added to the insurance policy.

Your rate can go up when adding another driver, especially if that driver is young with little to no driving history. You can also expect to see a hike in your rate if the driver has a poor driving record. In some cases, the insurance company may elect to decline coverage to that driver, and if that happens, you should cease allowing them to drive your vehicle.

Can I Drive a Car That is Not Tied To an Auto Insurance Policy?

As mentioned previously, car insurance is tied to a specific vehicle through the VIN, and a specific driver(s). So, it is unlawful to drive a vehicle that is not tied to an insurance policy, even if you are insured on your own vehicle. An easy way to remember this is that the insurance follows the car, not the driver. If you are pulled over for driving a vehicle that is not insured, you will be subject to fines, impounding of the vehicle, and a suspension of your license.

Before driving someone else’s car, always ask for a copy of their insurance card before taking the car on the road. The policyholder is legally obligated to ensure lawful and responsible use of their vehicle. If they are unwilling to show you insurance, this is an indicator that you should not drive the vehicle.