Alberta’s shift from an at-fault to a no-fault insurance model will take effect on January 1, 2027. This major reform aims to reduce insurance costs and simplify the claims process, but it also significantly affects Albertans’ rights and protections.

Under the new system, crash victims will file claims with their insurers and face restrictions on suing at-fault drivers. Albertans may see it as a one-way deal for drivers and individuals injured in collisions, but some say it’s fairer. What else should you take into account? Keep reading to learn about the changes, benefits, what this means for car insurance in Alberta and how to adapt to the new system.

Overview Of No-Fault Insurance in Alberta

With no-fault insurance, you don’t have to worry about proving who caused the accident to get coverage. Instead of filing a claim against the other driver, your own insurance policy takes care of your medical expenses and other benefits – no matter who was responsible.

The idea is to make the claims process quicker and cut down on legal battles, but it also means you have fewer options to sue for additional compensation. The no-fault insurance system isn’t new – it’s already in place in other parts of Canada, such as Ontario and internationally, where it has helped reduce lawsuits and speed up claim settlements.

The government is rolling it out gradually, with pilot programs already in motion. At the same time, new regulations are being introduced to ensure the system meets both driver expectations and industry standards.

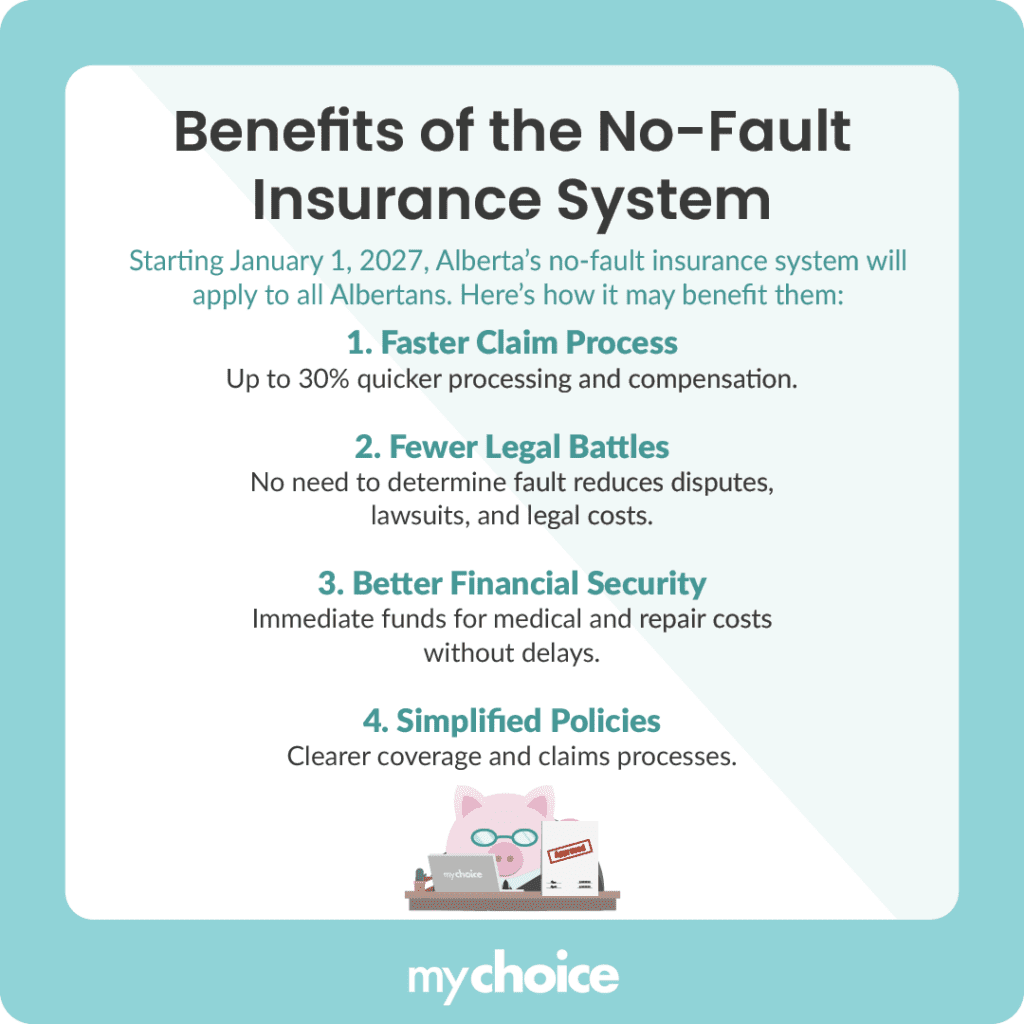

What Are The Benefits Of The No-Fault Insurance System?

A survey conducted by Janet Brown Opinion Research in January 2024 revealed that 63% of Albertans prefer to maintain the current at-fault insurance system, while only 25% support transitioning to a no-fault model.

Even though many Albertans have concerns about the shift, it does come with some potential benefits worth considering:

How Will No-Fault Insurance Impact Albertans?

The shift to no-fault insurance will bring several changes for Alberta drivers, both legally and financially, but it’s designed to simplify the process. Here are some key changes:

Insurance Claim Process In The New System

The no-fault model will change how claims are processed, aiming to streamline the system and reduce delays. Here’s what drivers can expect under the new approach:

How To Prepare For The Transition

Drivers and stakeholders can take a few proactive steps to get ready for the shift to no-fault insurance:

Key Advice From MyChoice

- You have to review your policy thoroughly. Understand what’s covered and how your benefits might change.

- Consider whether additional coverage, like income replacement or extended medical benefits, would better protect you.

- Keep up with updates from your insurer and the Alberta government to know what to expect when the transition happens.