Increasing claims, parts shortages, and higher costs of repairs have driven up the cost of car insurance in every Canadian province in recent years. However, auto insurance rates have consistently been highest in Alberta for one reason: personal injury claims. To make car insurance more affordable for Albertan drivers, the provincial government enacted the 2024 Alberta Auto Insurance Reform.

How do you get the cheapest auto insurance rates in Alberta under these updates, and how does the reform affect the powers of the Auto Insurance Rate Board? Read on to find out what these legislative changes mean for you and your car insurance pricing.

Full Overview of the 2024 Alberta Auto Insurance Reform

These are the specific details of the 2024 Alberta Auto Insurance Reform to reduce high insurance costs and make coverage sustainable:

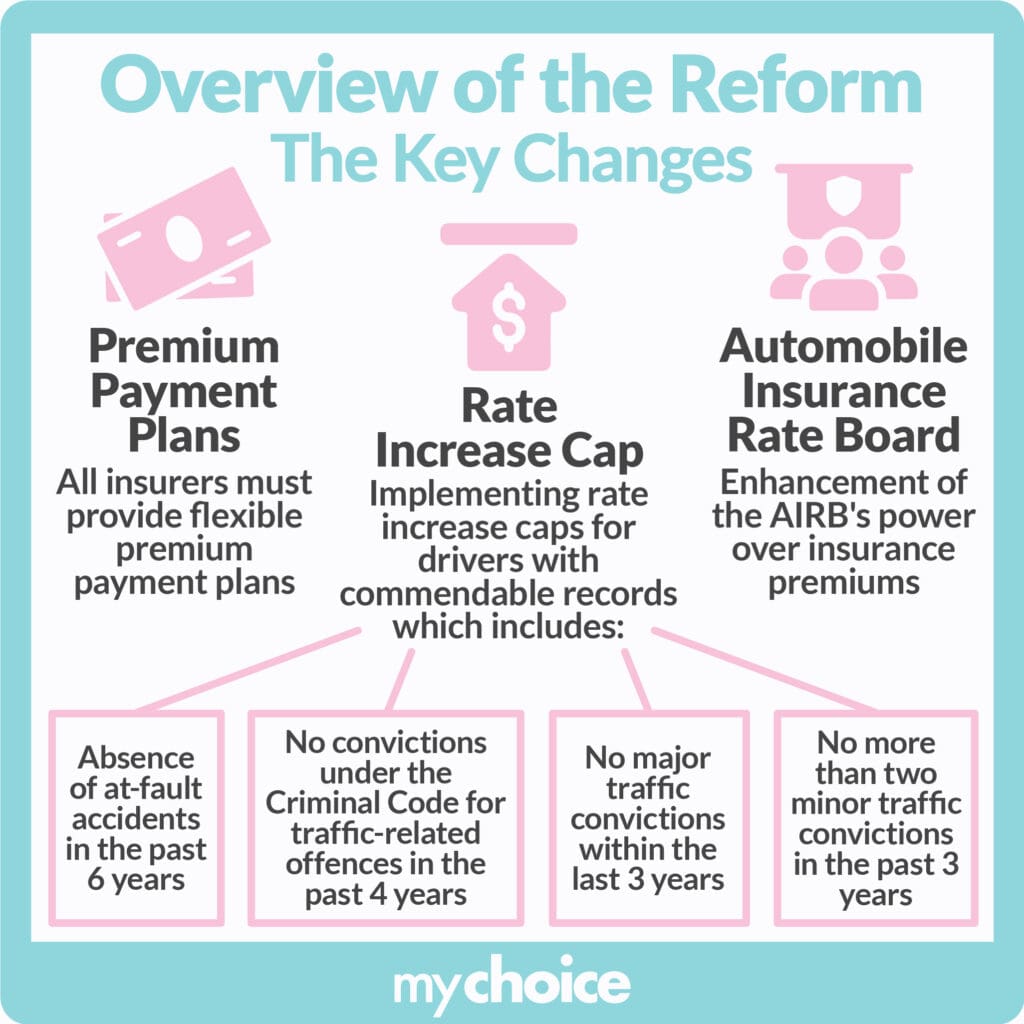

The below infographic should serve as a visual aid in case you want to understand the main aspects of the reform.

Why it Matters

Alberta’s auto insurance reforms emphasize fairness and greater accessibility to affordable insurance. Here’s why the current changes and proposed amendments matter:

- Greater payment flexibility: Now that it’s mandatory for auto insurance providers to offer premium payment plan options, they’re prevented from insisting on hefty upfront lump-sum payments. This helps Alberta drivers better manage their budgets.

- More affordable rates for drivers: If you fall under the reform’s definition of a good driver, congratulations – your rates can only be increased up to the previous year’s inflation rate. But even if you don’t, the proposed amendments will give the AIRB the power to review and lower rates.

- A stronger AIRB: By giving AIRB more oversight over the car insurance industry, they can strike a better balance between the profitability of private insurers and affordability for consumers. The proposed amendments allow the AIRB to mandate just rates, refund premiums during highly profitable years, and generally keep any increases at a justifiable amount.

But no matter how these reforms impact affordability and accessibility to car insurance, it’s important for Albertan drivers to still take all the necessary steps they can to lower their car insurance premiums. These steps include measures like shopping around to find the best price and bundling your auto insurance with other policies like home insurance.

Stay informed of any further changes to current regulations that may affect your car insurance premiums down the line. For more detailed explanations of changes to auto insurance regulations and how to keep your rates low, head on over to MyChoice.ca to learn more.

Key Advice from MyChoice

Now that you know how the 2024 Alberta Auto Insurance Reform affects your car insurance premiums and how you pay them, here’s some key advice from MyChoice:

- If you qualify as a “good driver” under the Alberta reforms, there’s a cap on any increase to your car insurance rates. Practice safe driving habits to improve your driving record and become eligible for this cap as well as future ones.

- Find the coverage you need at the best price by shopping around. With over 40 car insurers in Alberta, you can compare premiums, discounts, and other considerations before choosing the best car insurance policy for your needs. Use MyChoice to compare quotes between different providers and get the best deal for you.

- Talk to your Alberta car insurer to see if you can switch your existing policy’s payment plan to ease the financial burden. By switching from upfront payments for the year to payment in installments, you can better plan how to fit auto insurance into your budget.