Alberta has some of Canada’s highest auto insurance rates, yet insurers are pulling out of the market -why? Higher insurance rates typically mean good business for companies, especially within a free enterprise system. Still, providers like Sonnet Insurance Company and the ever-popular Aviva are phasing out their Alberta branches.

If you’re an Alberta resident wondering what could become of your auto insurance, you’re not alone. Here’s what you and other drivers can expect next.

Why Insurance Carriers Are Leaving the Province

The short version of the Alberta auto insurance crisis is that the province’s rate cap of 3.7%, implemented in January 2023, is leading to underwriting losses for insurance companies.

In July 2024, Aviva Canada announced its departure from the Alberta market: “We had to make the difficult decision to exit as the current environment in Alberta doesn’t foster growth.” Aviva’s sudden exit came mere weeks after Sonnet Insurance pulled out of Alberta. In its statement, Sonnet claimed that its decision resulted from limited growth opportunities and the affordability crisis. According to the Insurance Bureau of Canada (IBC), Alberta has the second-highest claim size ($12,309) in the country, second only to Ontario.

How Does Car Insurance Work in Alberta?

Auto insurance in Alberta is nearly identical to that in other Canadian provinces. The government requires that all Albertan drivers have auto insurance, which covers accident benefits and third-party liabilities.

Insurance companies calculate claims coverage according to who was at fault. Injured parties who aren’t at fault can sue those who are for compensation. Drivers can get extra protection by purchasing add-ons, such as comprehensive insurance.

What’s Wrong With the Alberta Auto Insurance System?

While there is nothing inherently wrong with the auto insurance system in Alberta, insurers become unprofitable due to rate caps, and consumers more than likely can’t afford the drastic increase in premiums. Rising repair costs, car theft, environmental loss, and high claim values are factors causing these issues for the insurance market in Alberta.

The rate freeze is a superficial solution, as it can’t compete with the rising costs of everything else. Plus, unlike neighbouring provinces, Alberta doesn’t have a public auto insurance system. Instead, it’s a privately delivered for-profit model that is often too expensive even for the most established insurance providers in the country.

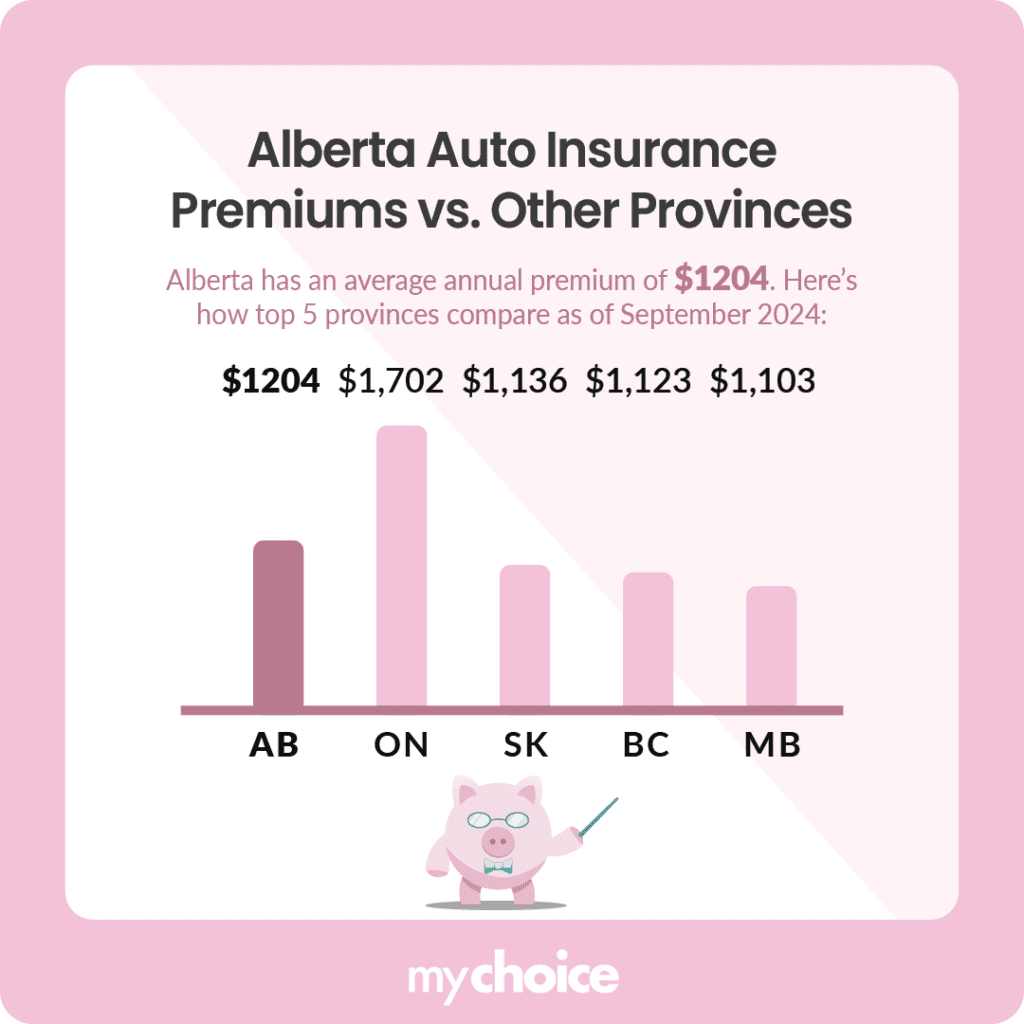

Alberta Auto Insurance Premiums vs. Other Provinces

Alberta has the second-highest auto insurance premiums in the country because of the higher number of accidents, a less competitive regulatory framework, and now the departure of many insurance companies.

Based on MyChoice’s internal data, Alberta has an average annual premium of $1204. Here’s how other provinces compare as of September 2024:

- Ontario: $1,702

- Saskatchewan: $1,136

- British Columbia: $1,123

- Manitoba: $1,103

- Newfoundland/Labrador: $1,075

- Nova Scotia: $820

- Prince Edward Island: $814

- New Brunswick: $763

- Quebec: $718

Source: Quote data from MyChoice.ca, September 2024

Looking Ahead: Proposed Solutions and Alternatives

While the Alberta auto insurance premiums crisis seems unlikely to improve significantly in 2024, these solutions and alternatives can prompt gradual positive change.

Key Advice From MyChoice

- Shop around before you choose an Alberta insurance company. Compare quotes and list the pros and cons of each option.

- Understand your coverage needs in relation to Alberta’s conditions. For instance, since Alberta has a high rate of car theft, it might make sense to purchase comprehensive coverage, which can provide a financial cushion if your car is stolen.

- Always be prepared to make a claim. Maintain full records of accidents, medical bills, and any necessary evidence. File your claim immediately and review the claims process in your area.